As Bitcoin (BTC) stalls close to the $113,000 stage, Ethereum (ETH) continues to point out power, highlighting a transparent divergence in worth motion between the highest two cryptocurrencies by market cap. This distinction has some traders contemplating a rotation from BTC into ETH to seize the latter’s bullish momentum.

Bitcoin Exhibits Correction Dangers – Is ETH Secure?

In response to a CryptoQuant Quicktake publish by contributor XWIN Analysis Japan, on-chain knowledge reveals underlying weak point in BTC worth motion. Against this, ETH is displaying notable resilience at the same time as broader crypto market momentum fades.

Associated Studying

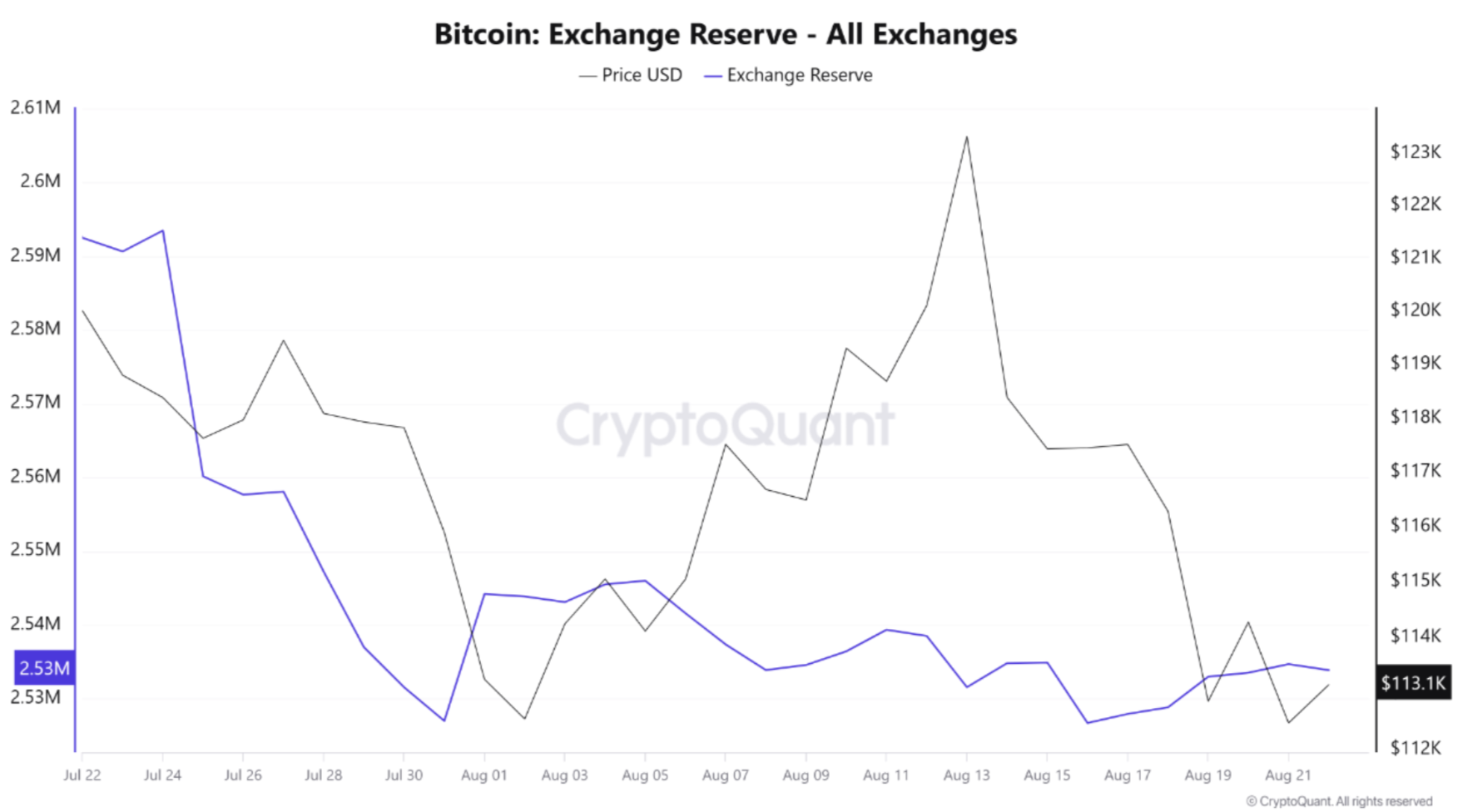

At present, Bitcoin’s alternate reserves are hovering round 2.53 million BTC, exhibiting little signal of declining regardless of latest volatility. For context, BTC has fallen 5.4% over the previous week.

Traditionally, shrinking alternate reserves have indicated BTC transferring off exchanges for long-term holding, which reduces near-term promote strain. This time, nonetheless, reserves stay flat, suggesting that a good portion of BTC provide continues to be liquid and out there for promoting.

Flat alternate reserves – mixed with BTC’s latest drop from $123,000 to $113,000 – have raised purple flags for a doable short-term correction. In the meantime, ETH’s on-chain dynamics inform a really totally different story.

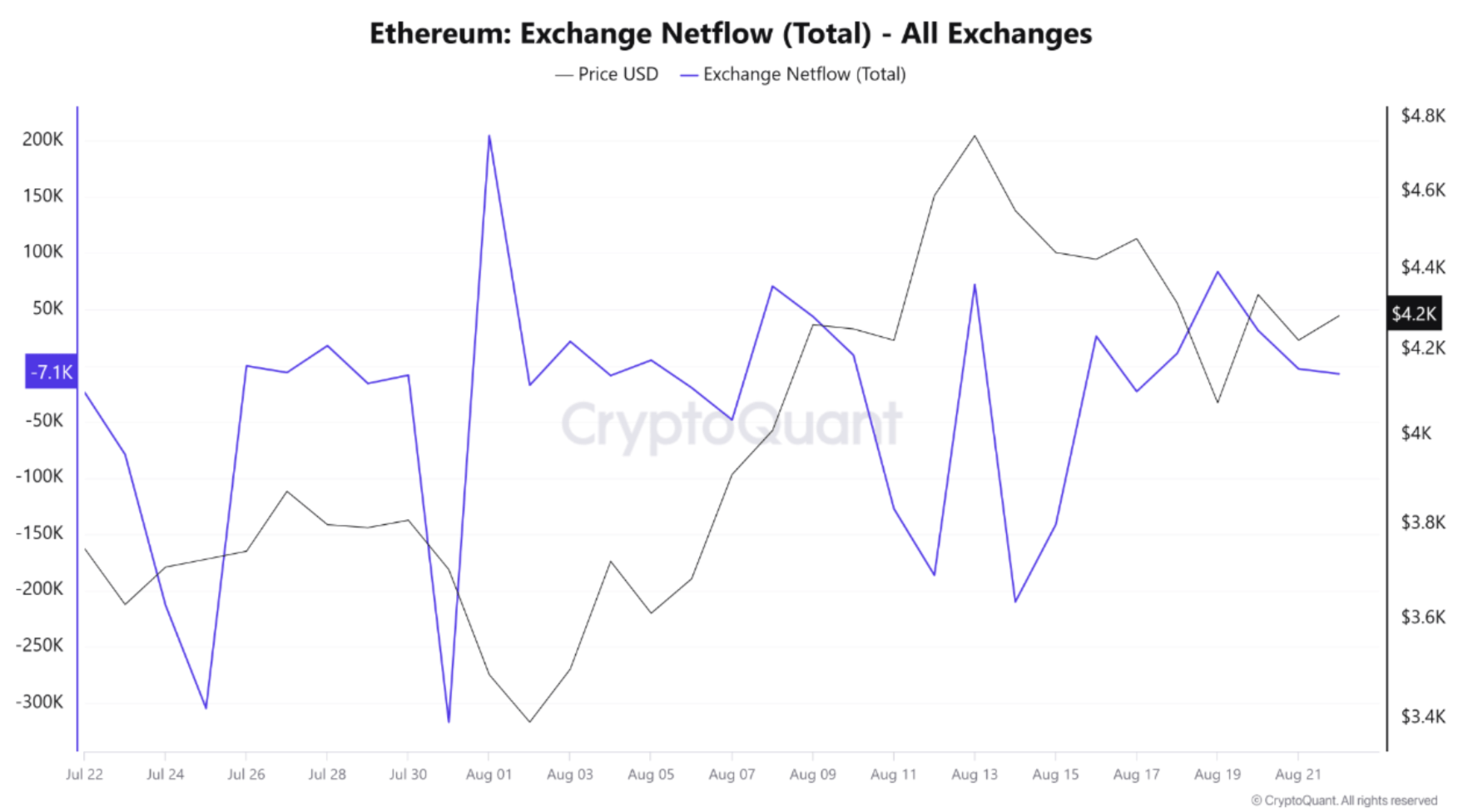

In contrast to BTC, ETH has persistently recorded massive internet outflows from exchanges, with a number of spikes exceeding 300,000 ETH in late July and mid-August. XWIN Analysis Japan defined:

Outflows normally mirror cash transferring into chilly storage, staking, or institutional custody, tightening the out there provide on the open market. ETH’s worth has been between $4.150 to $4,400, aligning with the outflow pattern and reinforcing a bullish narrative of a possible provide shock.

In brief, whereas BTC is consolidating with lingering sell-side liquidity, ETH’s declining alternate balances sign rising institutional demand. These opposing dynamics recommend capital could also be rotating from BTC to ETH.

Totally different Dynamics Between BTC And ETH

Past alternate reserves, different indicators additionally spotlight additional draw back danger for BTC and rising institutional curiosity in ETH, reinforcing the market’s choice for Ethereum over Bitcoin.

Associated Studying

As an example, famous crypto analyst Xanrox not too long ago provided a dramatic worth prediction for BTC, stating that it could crash all the way in which all the way down to $60,000 – nearly a 50% fall from its present market worth.

In the meantime, whales proceed to extend their publicity to ETH, rising their holdings at a fast tempo as ETH’s relative power in comparison with BTC improves. Yesterday, an Ethereum whale went lengthy on $300 million price of ETH on-chain.

From a technical perspective as nicely, issues look optimistic for ETH, with a possible restoration to $4,788 on the playing cards. At press time, BTC trades at $112,283, down 0.7% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com