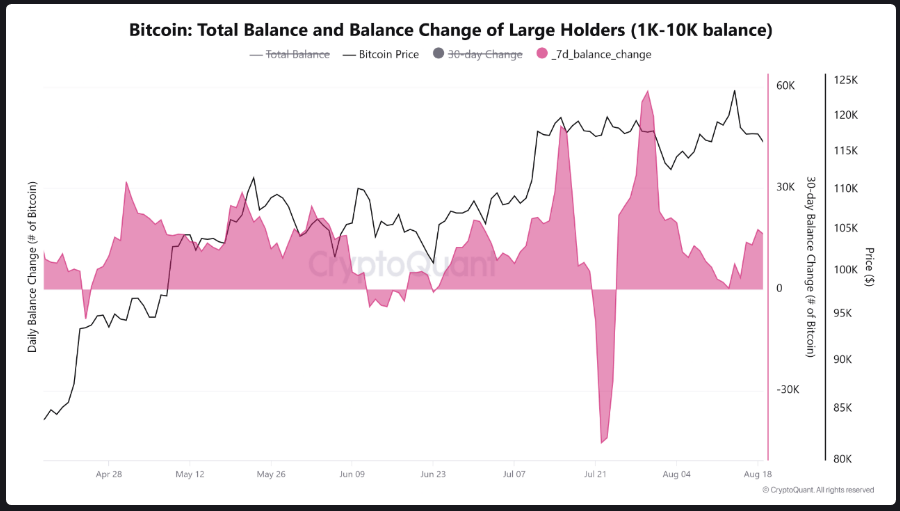

Reviews from CryptoQuant counsel that enormous holders are shifting aggressively whereas smaller gamers are bailing out.

Associated Studying

Over the previous week, wallets linked to key Bitcoin members grabbed greater than 16,000 BTC throughout a worth decline.

On the similar time, retail traders have been promoting into weak point, taking losses and widening the hole between whales and small merchants.

Analysts see this as a potential clue that the market could possibly be forming an area backside.

Seasonal Stress And Fed Expectations

The timing of those strikes provides extra complexity. September isn’t form to markets. Information during the last 35 years exhibits the S&P 500 slipping a median of 1% throughout this month, and Bitcoin has typically mirrored that seasonal drag.

Now, throw in a Federal Reserve assembly on September 15-16, the place merchants assign an 80% probability to a 0.25% price reduce, and you’ve got a cocktail of uncertainty.

For some, a reduce alerts potential aid for threat belongings. For others, the historic sample overshadows any short-term optimism. Both manner, volatility appears unavoidable.

BlackRock Switch Triggers Concern Of Promoting

Amid this macro backdrop, a single transaction set off alarms. BlackRock shifted over 10,584 BTC—valued near $1.20 billion—to Coinbase in sooner or later.

That sort of transfer not often goes unnoticed. Transfers to exchanges typically indicate a readiness to promote, and the market responded instantly.

Bitcoin slid to just a little over $112,000, a degree that beforehand acted because the launchpad for the rally that pushed costs to the all-time excessive of $124,000 this August.

Merchants at the moment are watching that quantity like hawks, questioning if it could actually act as a security web as soon as extra.

Technical alerts, nevertheless, don’t inform a unified story. The relative energy index sits at 32.90, scraping the oversold zone, which may generally trace at an exhausted sell-off.

However the MACD remains to be weak, with its line staying underneath the sign mark, suggesting adverse momentum. This cut up in indicators retains merchants guessing whether or not the subsequent huge transfer will likely be up or down.

Associated Studying

Crypto Market At A Crossroads

If $112,000 holds, a rebound is on the desk. Break it, and the draw back may speed up, particularly if establishments begin unloading extra Bitcoin.

Add whale accumulation, seasonal weak point, and a looming Fed resolution, and the short-term outlook appears to be like much less like a straight line and extra like a curve with surprises ready across the bend.

For now, the battle is evident. It’s between confidence and concern, and the end result could rely upon what occurs earlier than this month closes.

Featured picture from Unsplash, chart from TradingView