Bitcoin has lately climbed again to round $116,000 after falling to $111,000 from its all-time excessive of $124,000, partly pushed by indicators that the Federal Reserve might reduce rates of interest in September, boosting each crypto and inventory markets.

Including to optimism, Bitwise tasks that Bitcoin might develop by a median of 30% yearly over the following decade, sparking renewed discussions within the crypto neighborhood. This confidence can be mirrored within the Bitcoin Hyper presale, which has now raised over $11 million.

Supply – 99Bitcoins YouTube Channel

Why Bitcoin Stays a Wealth-Constructing Asset

A latest submit on Bitcoin Archive supplied a optimistic long-term outlook for Bitcoin, projecting it might exceed $1.4 million by 2035.

Key elements driving this development embrace spot Bitcoin ETFs, rising institutional curiosity, favorable insurance policies, and potential government-mandated dollar-cost averaging by retirement accounts.

Including to this bullish sentiment, Coinbase CEO Brian Armstrong has steered that Bitcoin might hit $1 million as early as 2030.

Whereas bold, these forecasts replicate rising confidence in Bitcoin’s potential. Traditionally, Bitcoin has outpaced conventional monetary markets, strengthening its position as each a retailer of worth and a wealth-building asset that may rival shares, bonds, and even gold.

Key Drivers of Lengthy-Time period Progress

A number of macroeconomic and structural elements might assist sustained Bitcoin growth:

The Nice Wealth Switch

The upcoming intergenerational switch of wealth is predicted to be one of many largest in historical past. As trillions of {dollars} transfer from child boomers to youthful generations, a good portion is more likely to circulation into digital property.

Youthful traders are typically extra snug with cryptocurrency, viewing it as a pure a part of a diversified portfolio.

Estimates counsel this shift alone might inject $200 billion into Bitcoin, probably creating $20–28 million in each day demand and sustaining upward momentum over the long run.

Institutional and Company Adoption

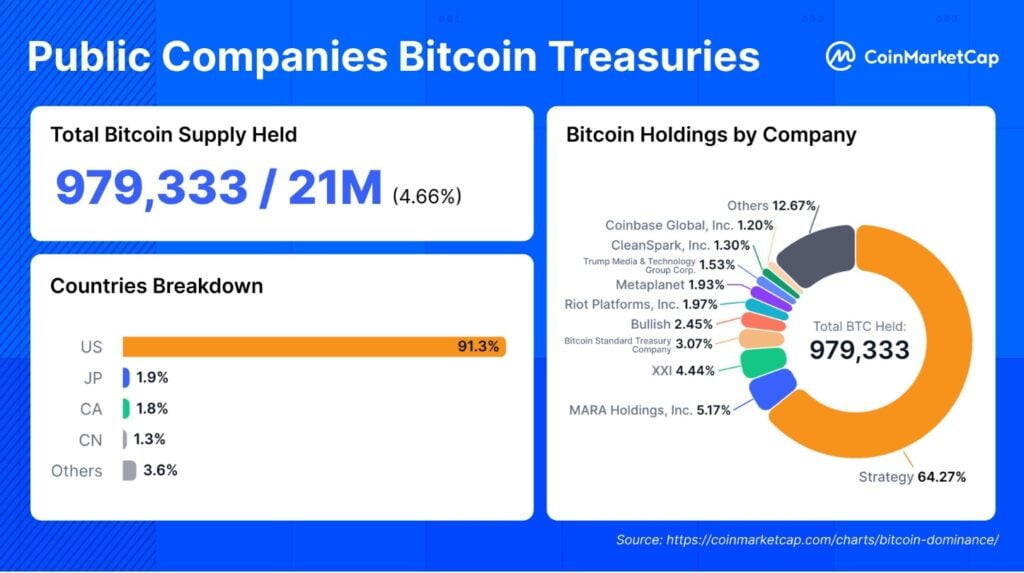

Institutional curiosity in Bitcoin continues to develop. Public firms at present maintain practically 980,000 Bitcoin, valued at round $111 billion-roughly 4.66% of the entire provide.

Supply – Bitcoin Archive Twitter

These company holdings show strategic allocation and growing institutional involvement within the crypto market.

Furthermore, integration of Bitcoin methods into conventional monetary indices, such because the S&P 500, might set off passive inflows exceeding $10 billion, additional cementing Bitcoin’s position as an institutional-grade asset.

Market Seasonality and Historic Patterns

Bitcoin’s value usually follows seasonal tendencies:

- August tends to be flat or stagnant.

- September normally sees declines.

- October usually marks a breakout.

- November traditionally delivers sturdy good points.

If these patterns proceed, Bitcoin might expertise short-term weak point in September however might stage a rally within the last months of the yr.

Macro Market Enhance: Powell Hints at September Price Reduce

Including to market optimism, Federal Reserve Chair Jerome Powell delivered a cautious message on the Jackson Gap symposium right now.

He famous that the “shifting steadiness of dangers might warrant adjusting Fed coverage,” hinting {that a} price reduce might come as quickly as September.

In keeping with Euronews, the announcement triggered a right away rally in each inventory and crypto markets, the S&P 500 surged 1.3%, the Dow rose 1.4%, and the Nasdaq jumped 1.3%.

Supply – The Kobeissi Letter Twitter

Powell emphasised that the Fed would proceed cautiously, balancing inflation towards employment stability, however his feedback had been sufficient to spice up investor sentiment.

For Bitcoin and associated tasks like Bitcoin Hyper, indicators of doubtless looser financial coverage might strengthen bullish momentum, as traditionally, decrease charges are likely to favor property, together with digital currencies.

Bitcoin Hyper Presale Surpasses $11 Million

Towards this backdrop, Bitcoin Hyper has emerged as a standout mission inside the Bitcoin ecosystem. Its presale lately exceeded $11 million, reflecting rising investor enthusiasm.

Timing performs a key position: as consideration turns to Bitcoin’s long-term development, traders are in search of tasks positioned to learn immediately from its rise. Bitcoin Hyper provides publicity to a mission designed round Bitcoin’s success whereas introducing distinctive options and use circumstances.

At its core, Bitcoin Hyper is the primary layer-2 resolution to combine the Solana Digital Machine (SVM) with Bitcoin, bringing quick, low cost transactions and sensible contract performance to the world’s largest cryptocurrency.

Supply – Bitcoin Hyper Twitter

BTC is bridged into wrapped BTC on HYPER, unlocking potential for DeFi, gaming, NFTs, and extra, all totally backed by actual Bitcoin.

The HYPER token powers transaction charges, decentralized purposes (DAPs), and governance, creating an entire ecosystem for customers and builders alike.

For traders in search of safe, multi-chain, non-custodial entry, platforms like Finest Pockets, out there on the App Retailer and Google Play, supply a handy method to handle investments throughout networks.

The presale demonstrates the ecosystem impact: as confidence in Bitcoin grows, so too does curiosity in associated alternatives.

Early traders seem desperate to get in, anticipating that related tasks might see amplified demand if Bitcoin achieves the projected 30% annual development.

Conclusion

Regardless of latest volatility, Bitcoin’s fundamentals stay sturdy. Lengthy-term forecasts point out potential exponential development, with generational wealth switch, increasing institutional adoption, and company holdings supporting a bullish trajectory.

Initiatives like Bitcoin Hyper are gaining momentum alongside Bitcoin itself, exemplifying how the cryptocurrency’s development can create new alternatives throughout the ecosystem.

The message is obvious: whereas short-term market fluctuations might trigger short-term concern, the broader outlook suggests Bitcoin and its related tasks are poised to play an more and more outstanding position in world finance.

Go to Bitcoin Hyper

This text has been supplied by one in all our business companions and doesn’t replicate Cryptonomist’s opinion. Please remember our business companions might use affiliate applications to generate revenues by the hyperlinks on this text.