- XRP slipped beneath $3, however chart fractals recommend a possible 60%–85% rally into This fall, concentrating on $4.35–$4.85 if momentum sustains.

- Whale flows stay damaging, hinting at short-term weak spot, however knowledge exhibits distribution could also be nearing exhaustion.

- The $2.65–$2.33 zone might act as a key accumulation space earlier than XRP pushes larger.

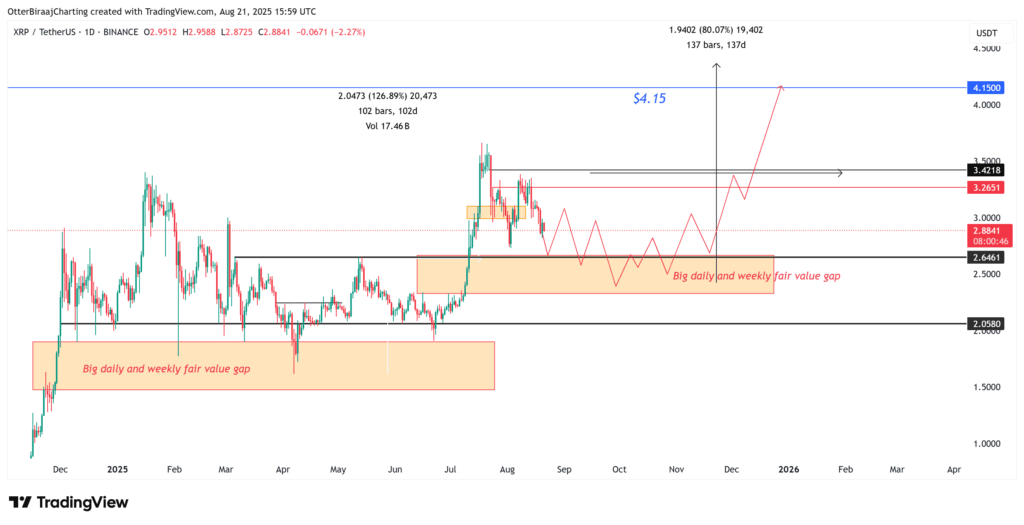

XRP closed Tuesday beneath the $3 psychological barrier, dipping to $2.87 as its two-week correction dragged on. Merchants eye the transfer with blended feelings—short-term sentiment leans bearish, however the broader setup is flashing one thing else solely. A repeating fractal sample on the charts is suggesting that XRP may be coiling for a bigger rally later this yr, one that might push it as excessive as $4.85 if momentum aligns.

Fractals, these repeating value constructions that echo throughout timeframes, usually carry weight after they seem at inflection factors. The present construction mirrors XRP’s January 2025 run, when the token hit $3.40 earlier than unwinding again to $1.60 in April. That pullback tapped into honest worth gaps (FVGs)—areas the place liquidity builds up—earlier than value ripped larger once more. Proper now, a recent FVG sits between $2.32 and $2.66, a zone merchants are watching intently. If XRP dips there and consumers step in, the case for one more enlargement section strengthens dramatically.

Technical Image and Potential Upside

Analysts be aware that diminishing returns might mood this subsequent transfer, however projections nonetheless present 60%–85% upside in This fall. If XRP can break decisively above $3.85, it enters what’s referred to as “value discovery,” the place resistance is skinny and rallies can speed up. From there, targets between $4.35 and $4.85 come into play.

Macro situations might add gas. With rising hypothesis round U.S. rate of interest cuts and broader liquidity inflows into danger property, XRP may gain advantage from a extra favorable setting. Nonetheless, short-term volatility is predicted—value might chop decrease earlier than reaccumulation units the stage for the larger transfer.

Whale Flows: Exhaustion or Extra Ache?

On-chain knowledge is displaying that whale flows—massive holders shifting tokens—are nonetheless internet damaging. That sometimes suggests promoting strain within the close to time period. However zooming out, the sample seems acquainted. The same distribution wave hit in Q2, proper earlier than XRP carved out its April backside.

Now, the 90-day common of whale netflows is hinting that distribution could also be peaking once more. If that flips to accumulation, historical past suggests whales might begin rebuilding positions across the $2.65–$2.33 zone. That’s the very same vary aligning with the present honest worth hole, creating a possible confluence for the subsequent leg up.

The Greater Image

XRP’s short-term destiny will doubtless hinge on whether or not $2.93 help holds or cracks decrease into the FVG. However the broader setup, mixed with historic fractal conduct and whale move exhaustion, leans towards bullish continuation into This fall. Merchants simply want endurance—the fireworks might not kick off till that liquidity zone will get examined.