- XRP hit a 7-year excessive of $3.65 earlier than correcting over 20%.

- A doable September fee reduce may increase threat belongings like XRP, although odds are slipping.

- With the SEC case over and ETF filings pending, XRP’s larger breakout may solely simply be getting began.

Ripple’s XRP just lately printed a contemporary all-time excessive at $3.65 on July 18 — its first peak in over seven years. However the celebrations didn’t final lengthy. The token has since dropped greater than 20% from these highs, buying and selling close to $2.87 at press time. In keeping with CoinGecko, XRP remains to be down 11% on the week, 2.8% throughout the final 14 days, and 16% for the month. That mentioned, zooming out exhibits it’s up an eye-popping 387.7% since August 2024. Quick-term ache, long-term power.

Might a Fed Price Lower Mild the Fuse?

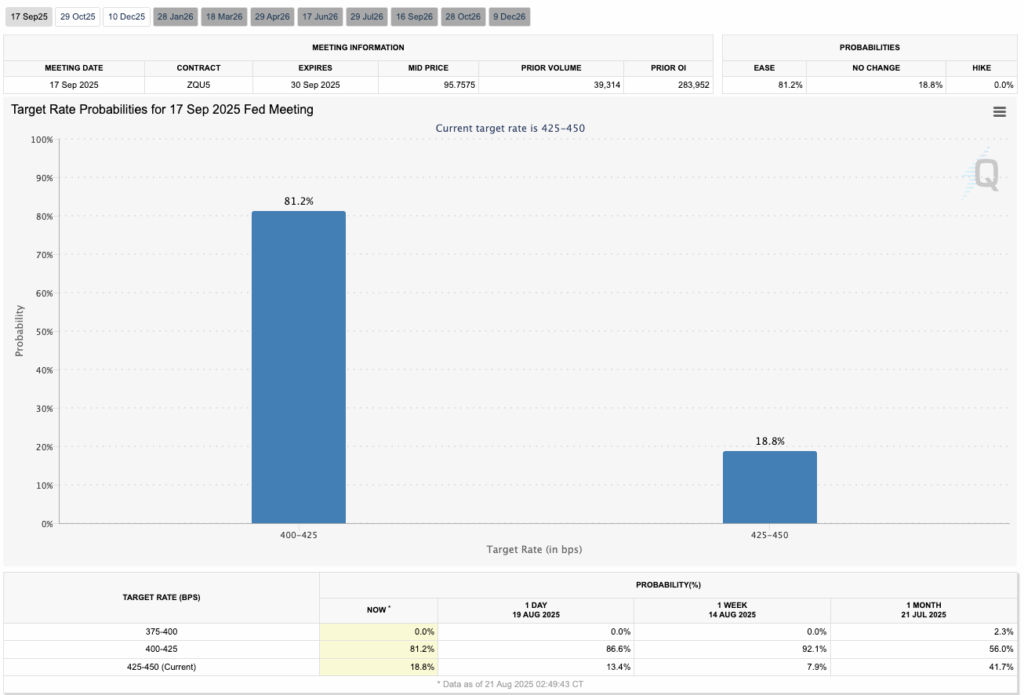

The dialog now shifts towards macro occasions. The CME FedWatch device at present exhibits an 81.2% chance that the U.S. Federal Reserve will trim charges by 25 foundation factors in September. A reduce like that tends to juice demand for threat belongings, and XRP might be one of many beneficiaries.

However right here’s the catch — these odds are slipping. Simply days in the past the identical mannequin gave a 96% likelihood, then it fell to 84%, and now sits at 81%. As we get nearer to the Jackson Gap gathering, expectations might wobble additional. If confidence continues to fade, risk-on belongings like XRP might stall till stronger indicators arrive.

Ripple’s SEC Cloud Is Gone, ETFs Might Be Subsequent

XRP spent years struggling beneath the shadow of the SEC lawsuit, which many argue stunted its adoption. With that case now closed, the token lastly has a clear runway. That alone may hold patrons even throughout market dips.

Including extra gasoline, a number of XRP spot ETF purposes are ready on SEC desks. If approval comes, the influence may mirror what we’ve seen with Bitcoin — main institutional inflows, new credibility, and doubtlessly new highs. Bitcoin’s run to report costs after its ETF nod remains to be contemporary in buyers’ minds, and XRP holders are hoping historical past rhymes.

Remaining Ideas

XRP is at a crossroads. On one aspect, a Fed fee reduce and doable ETF approval may ship the token ripping by previous resistance. On the opposite, shifting macro sentiment and technical corrections may hold it pinned beneath $3 for some time longer. For now, the long-term outlook stays stronger than the short-term chop, however as at all times with crypto, timing will likely be the whole lot.