Ripple is making huge strikes once more – this time in Japan. The corporate’s making ready to roll out its RLUSD stablecoin with SBI VC Commerce, focusing on an early 2026 launch. It’s a sign that Japan’s regulators are warming as much as reserve-backed stablecoins.

Ripple and XRP will get a lot of the consideration following this information. However when a serious crypto firm breaks new floor like this, it typically drags smaller altcoins into the dialog as a result of merchants start taking a look at tokens tied to wallets or new Layer-2s.

That’s why many are avoiding the apparent names. Some various initiatives are constructing momentum with actual merchandise, sticky communities, or robust token utility – and people may very well be the very best altcoins to purchase proper now. So, let’s take a better take a look at the RLUSD information and which cash may gain advantage most.

Ripple’s RLUSD Heads to Japan in Early 2026

RLUSD is a dollar-pegged stablecoin totally backed by money and Treasuries, with third-party attestations to maintain it clear. In contrast to many different stablecoins, it’s constructed for each velocity and suppleness. On the XRP Ledger, you get low-cost, near-instant transfers; on Ethereum, you get ERC-20 compatibility and entry to DeFi.

The Japan angle makes this setup much more fascinating. Ripple has inked a cope with SBI VC Commerce to distribute RLUSD regionally, and if regulators log off, it may go dwell in Q1 2026.

🇯🇵 JUST IN: Ripple and Japan’s SBI Holdings via its subsidiary SBI VC Commerce announce partnership to distribute RLUSD stablecoin in Japan in Q1 2026. pic.twitter.com/7hHKgIdIFk

— Cointelegraph (@Cointelegraph) August 22, 2025

That’s noteworthy as a result of Japan’s new stablecoin framework was largely written with yen-pegged cash in thoughts – making RLUSD one of many first greenback stablecoins with a path to approval.

It’s additionally about utility. Japanese firms already use Ripple’s On-Demand Liquidity for cross-border funds. Including RLUSD offers them a dollar-denominated software for treasury and commerce finance, with out leaving Ripple’s ecosystem.

With discuss of upcoming change listings – and even hints of a future yen stablecoin – the launch may kick off a a lot greater stablecoin race throughout Asia. And if timelines maintain, Japan would possibly grow to be a testing floor for high-quality greenback tokens.

3 Greatest Cryptos to Purchase as Ripple Prepares to Launch RLUSD in Japan

Ripple’s push into Japan has redirected consideration onto smaller altcoins with robust fundamentals and near-term catalysts. Listed below are three that stand out proper now:

1. Greatest Pockets Token (BEST)

Greatest Pockets Token (BEST) has been producing severe curiosity – it’s raised greater than $15 million in presale funding, with tokens going for simply $0.025515. And in contrast to many “idea-stage” pockets tokens, Greatest Pockets is already dwell, boasting over half 1,000,000 downloads and a quarter-million month-to-month customers.

Proudly owning BEST supplies actual utility. Holders get payment reductions on swaps and transfers, boosted staking yields, early entry to new token launches via its built-in launchpad, and governance rights on the place the pockets goes subsequent. There’s even a debit card within the works to hyperlink your stability to on a regular basis spending.

Plus, with Fireblocks-powered safety and restoration baked in, the pockets is ready up for severe, scalable development. No surprise YouTuber Borch Crypto is so bullish. He even steered Greatest Pockets may steal vital market share from MetaMask and Belief Pockets by 2026.

Pockets-linked tokens like TWT have surged in previous bull runs – and BEST may comply with swimsuit. So, with presale demand skyrocketing forward of the upcoming DEX itemizing, BEST may very well be a prime altcoin to contemplate shopping for.

2. SKALE (SKL)

If Ethereum fuel charges have ever made you mad, SKALE’s (SKL) pitch can be refreshing: customers pay nothing. As a substitute, dApp groups subscribe to their very own “SKALE Chains” with SKL, and people chains include hundreds of TPS, sub-second finality, and pooled validator safety backed by Ethereum.

In apply, video games, dApps, and AI instruments can run quick and free for customers whereas builders foot the invoice. Unsurprisingly, this mannequin is catching on. SKALE now secures over 80 dwell chains with 3.9 million month-to-month wallets.

However it’s not nearly at present – its upcoming “Levitation” zk-rollup layer will permit trust-minimized bridging for ETH property, giving it a transparent path into the Layer-2 house. For builders chasing mass-market adoption, SKL may very well be among the best altcoins to purchase proper now.

3. Bitcoin Hyper (HYPER)

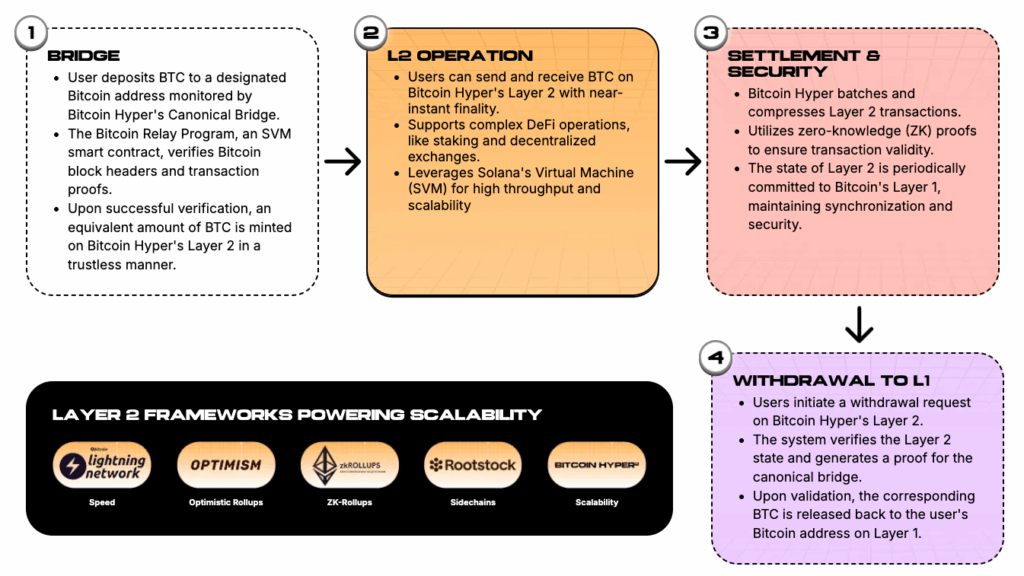

Bitcoin Hyper (HYPER) goals to attain one thing that has eluded the house for years: integrating DeFi into Bitcoin with out compromising the chain’s safety. It anchors to Bitcoin however runs the Solana Digital Machine (SVM), that means you get Solana-grade throughput – hundreds of TPS – and good contract flexibility.

In plain phrases, you’ll be able to commerce, lend, and even mint NFTs on the Bitcoin Hyper Layer-2 with native BTC as collateral. This opens up numerous potentialities – like BTC-collateralized lending markets, perpetual DEXs, and low-fee funds.

The HYPER token presale has already topped $11.2 million, with tokens priced at simply $0.012775. Early consumers can generate huge staking yields, at the moment estimated at 98%, designed to reward those that seed liquidity earlier than the official launch.

Hundreds of individuals at the moment are following Bitcoin Hyper on X and Telegram. If the group can proceed rising this group, Bitcoin Hyper may grow to be the Layer-2 that lastly turns idle Bitcoin into an actively used, yield-generating asset.