- LINK jumped to $26.70, its highest since January, after Powell’s speech.

- Whales elevated holdings by 27% in a month, whereas alternate balances preserve falling.

- Technicals level to a breakout sample concentrating on $51, backed by rising demand and robust fundamentals.

Chainlink ripped greater on August 22, hitting $26.70—its greatest stage since January. The rally adopted Jerome Powell’s dovish feedback at Jackson Gap, which gave the broader crypto market a lift. However for LINK particularly, it wasn’t simply macro chatter driving the transfer. Whales and so-called good cash buyers have been piling in, fueling momentum as a bullish technical setup begins to take form.

Whales and Good Cash Maintain Shopping for

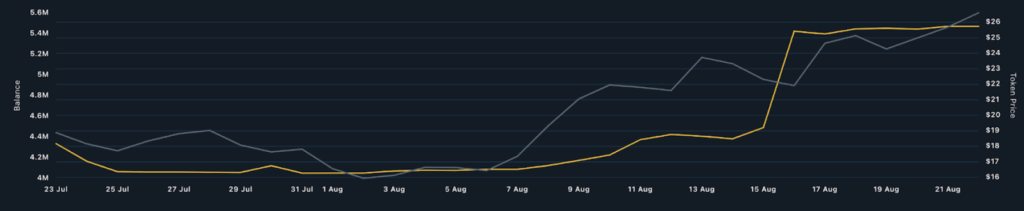

Information from Nansen reveals whales have grown their LINK holdings by 27% over the previous month, now sitting at 5.47 million tokens. That’s up from beneath 3 million final 12 months, exhibiting a gentle build-up of confidence. In the meantime, good cash wallets—these with a popularity for getting low and promoting excessive—have additionally been scooping up LINK. In truth, LINK was the highest token bought by these buyers within the final week.

On the similar time, alternate balances preserve dropping. Simply 270 million LINK stay on centralized platforms, down from 280 million earlier this month. That’s a wholesome signal: fewer tokens on exchanges means much less quick promoting stress. Mixed with rising pockets addresses, it suggests demand is outpacing provide.

Derivatives Gas Extra Upside

The derivatives market is backing the rally too. Funding charges for LINK have stayed optimistic since June, exhibiting that merchants are keen to pay to maintain lengthy positions open. Open curiosity has additionally hit a brand new all-time excessive of $1.58 billion, signaling extra demand and deeper liquidity in futures markets.

On the basics facet, Chainlink continues to guide the oracle sector, securing over $57 billion in worth—far forward of opponents like Band Protocol or Pyth. Partnerships with JPMorgan, SWIFT, ANZ Financial institution, UBS, and Coinbase preserve including weight to its RWA tokenization narrative. The launch of Strategic LINK Reserves, now above $3 million, additional reinforces long-term confidence.

Technical Image: Cup and Deal with Forming

Technically, LINK is shaping up properly. The each day chart reveals a creating cup-and-handle sample, with resistance round $30 and assist close to $10. The sample’s depth is about 67%, which initiatives a breakout goal near $51—the token’s all-time excessive.

If whales preserve shopping for, derivatives stay supportive, and Chainlink continues to strengthen its grip on real-world adoption, LINK might realistically be lining up for a run nicely past $30 and towards new highs.