Be part of Our Telegram channel to remain updated on breaking information protection

US crypto change Coinbase predicts the stablecoin market may greater than quadruple by 2028 to succeed in $1.2 trillion.

In an Aug. 21 report known as ”New Framework for Stablecoin Progress,” Coinbase stated the sector’s development will likely be ”underpinned by an bettering coverage panorama and accelerating adoption developments.” The sector’s market capitalization stands at $288.39 billion now, according to CoinMarketCap.

Coinbase stated the stablecoin market has grown at a compound annual development price of roughly 65% since 2021. The common adjusted transaction volumes have additionally surged to $15.8 trillion for the seven months by July 31, up from $10.3 trillion over the identical interval in 2024, the report stated.

Surging Stablecoin Demand Will Not Push US Treasury Yields Down A lot

As stablecoins develop, issuers’ demand for US Treasury payments will soar as nicely. Coinbase tasks that the Treasury might want to problem round $5.3 billion of recent short-term debt each week for 3 years straight simply to cater to the demand.

Non-public stablecoin issuers like Tether and Circle have already develop into the highest patrons of US authorities debt, even eclipsing nations like South Korea, the United Arab Emirates (UAE), and Germany, the report famous.

Stablecoins already maintain extra U.S. Treasuries than Germany—the third-largest nationwide financial system on the planet. pic.twitter.com/th1WryeKch

— Bitwise (@BitwiseInvest) August 22, 2025

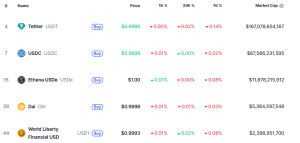

Tether’s USDT and Circle’s USDC are at present the most important stablecoins by market cap, and the 2 of them alone “have been the seventh largest patrons of US treasuries in 2025 YTD by June 30,” Coinbase wrote.

Largest stablecoins by market cap (Supply: CoinMarketCap)

Some analysts have expressed issues that the demand from stablecoins will push Treasury yields down a lot decrease, primarily making authorities borrowing low cost.

However Coinbase argues that whereas the stablecoin demand will push yields down, it should solely decrease 3-month Treasury yields by round 4.5 foundation factors (0.045%).

“Our baseline estimates recommend the affect on 3-month T-bill yields is small in week 1 and grows by weeks 2-3 earlier than really fizzling out,” Coinbase wrote.

“We expect the forecast doesn’t require unrealistically giant or everlasting price dislocations to materialize; as an alternative, it depends on incremental, policy-enabled adoption compounding over time,” the change added.

Coinbase additionally talked about the July signing of the GENIUS Act, which the change believes “may scale back the danger that enormous redemptions will flip right into a cascade of pressured T-bill promoting.”

Different Nations Compelled To Take into account Legalizing Their Personal Stablecoins

USD-pegged stablecoins have dominated the market up to now, however the signing of the GENIUS Act has pressured different nations to contemplate legalizing their very own stablecoins to stay aggressive with the US within the digital forex race.

As such, South Korea’s Monetary Providers Fee (FSC), a authorities regulator, introduced {that a} complete stablecoin regulatory invoice will likely be submitted to the nation’s legislature in October.

China has additionally pivoted from its lengthy historical past of opposing cryptocurrencies and privately issued cash when it reportedly signaled that it could enable stablecoins backed by the Yuan to start circulating available in the market.

Nevertheless, the rollout of any yuan-backed stablecoins would doubtless be restricted to particular financial zones, analysts say.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection