High Tales of The Week

Coinbase predicts trillion-dollar stablecoin period by 2028

The whole US dollar-pegged stablecoin market is projected to swell to $1.2 trillion by 2028, spurred on by complete crypto laws in the US, in accordance with crypto trade Coinbase.

Coinbase mentioned the projections imply the US Treasury issuance must be $5.3 billion per week over the subsequent three years to fulfill demand from stablecoin issuers, who use short-term US Treasury payments as backing collateral for his or her digital fiat tokens.

This issuance schedule would trigger a minor and non permanent drop in three-month Treasury yields of about 4.5 foundation factors, opposite to analyst predictions that demand from stablecoin issuers will considerably scale back the curiosity on US authorities debt. Coinbase wrote in a market report:

“We expect the forecast doesn’t require unrealistically massive or everlasting charge dislocations to materialize; as an alternative, it depends on incremental, policy-enabled adoption compounding over time.”

Kanye West YZY sniper pockets linked to $21M LIBRA extraction scheme: Analysts

An onchain investigation by pseudonymous analyst Dethective linked a pockets that sniped the Kanye West-themed token YZY to a different set of wallets behind the LIBRA token, suggesting that the identical operator extracted tens of tens of millions of {dollars} utilizing insider information.

In a sequence of X posts on Thursday, Dethective revealed {that a} YZY sniper pockets managed to purchase $250,000 price of tokens at simply $0.20, far under the worth most merchants paid. Inside minutes, the pockets secured over $1 million in revenue, which was later funneled right into a treasury pockets.

The identical treasury pockets had additionally obtained massive sums from wallets tied to LIBRA’s launch six months in the past. Two “Libra sniper” wallets extracted a mixed $21 million. In complete, practically $23 million was pulled throughout the YZY and LIBRA launches, with funds later moved to Kamino or Binance.

“We will be certain that is somebody with clear inside data,” Dethective wrote. “The proof is that he didn’t snipe any coin moreover $YZY and $LIBRA and he was ready with enormous dimension.”

Bitcoin’s 4-year cycle might not be lifeless in spite of everything: Glassnode

Bitcoin’s current value motion should still be monitoring its historic four-year halving cycle, regardless of some market predictions that growing institutional curiosity will break the sample, in accordance with onchain analytics agency Glassnode.

“From a cyclical perspective, Bitcoin’s value motion additionally echoes prior patterns,” Glassnode mentioned in a markets report on Wednesday.

Glassnode mentioned a number of components counsel that the Bitcoin cycle could also be additional alongside than the market assumes.

Revenue-taking amongst long-term holders — these holding Bitcoin for greater than 155 days — is now “similar to previous euphoric phases, reinforcing the impression of a market late in its cycle,” it mentioned.

Glassnode additionally pointed to weakening demand, with capital inflows into Bitcoin “exhibiting indicators of fatigue.” Spot Bitcoin exchange-traded funds have posted outflows of about $975 million over the previous 4 buying and selling days, in accordance with Farside Traders.

Harvard economist admits he was incorrect about Bitcoin crashing to $100

Harvard economist Kenneth Rogoff, who as soon as predicted Bitcoin would extra doubtless crash to $100 earlier than it hit $100,000, admitted that quite a bit has modified since his feedback seven years in the past, although he seemingly nonetheless hasn’t come round to Bitcoin.

“Nearly a decade in the past, I used to be the Harvard economist that mentioned Bitcoin was extra more likely to be price $100 than 100K. What did I miss?” Rogoff wrote on X on Wednesday, referring to a section on CNBC’s “Squawk Field” in March 2018.

Rogoff is a former chief economist of the Worldwide Financial Fund and likewise creator of Our Greenback, Your Downside, a guide printed in Might.

In 2018, Rogoff mentioned that authorities regulation would set off a drop in Bitcoin costs.

Philippine invoice charts path to strategic reserve with 10,000 Bitcoin

The Congress of the Philippines is weighing a proposal that would see the nation’s central financial institution set up a strategic reserve of 10,000 Bitcoin, positioning the nation among the many first in Southeast Asia to undertake Bitcoin as a strategic asset.

A Home of Representatives invoice filed by Camarines Sur Consultant Migz Villafuerte in June made headlines on Thursday, because it goals to mandate the Banko Sentral ng Pilipinas (BSP), the nation’s central financial institution, to buy 2,000 Bitcoin yearly over a five-year interval.

The invoice, known as the “Strategic Bitcoin Reserve Act,” goals to mandate the BSP to purchase 10,000 Bitcoin price $1.1 billion at present market costs. The invoice states that the asset could be locked in a belief for a minimum of 20 years. This may imply that the cash couldn’t be offered, swapped or disposed of, aside from when retiring authorities debt.

Winners and Losers

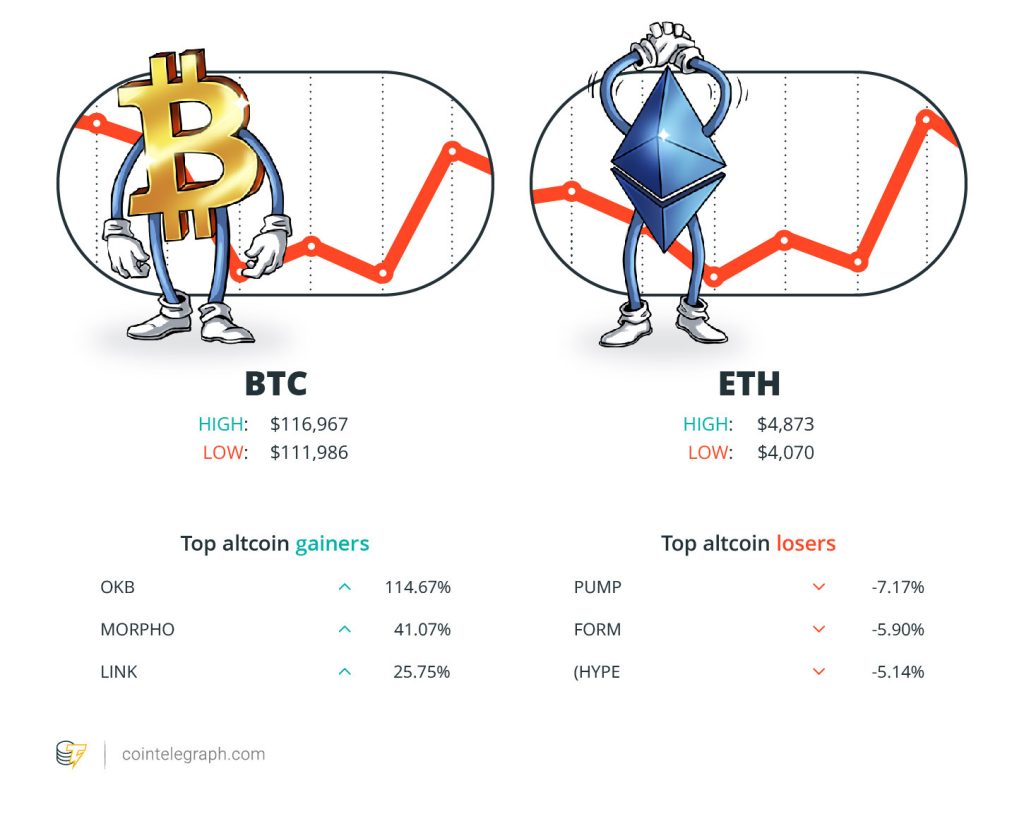

On the finish of the week, Bitcoin (BTC) is at $116,967, Ether (ETH) at $4,873 and XRP at $3.09. The whole market cap is at $4.05 trillion, in accordance with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are OKB (OKB) at 114.67%, Morpho (MORPHO) at 41.07% and Chainlink (LINK) at 25.75%.

The highest three altcoin losers of the week are Pump.enjoyable (PUMP) at 7.17%, 4 (FORM) at 5.90% and Hyperliquid (HYPE) at 5.14%.

For more information on crypto costs, be certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“From the SEC’s perspective, we’ll plow ahead and on this concept that simply the token itself is just not essentially the safety, and possibly not. There are only a few, in my thoughts, tokens which can be securities, but it surely depends upon what’s the bundle round it and the way that’s being offered.”

Paul Atkins, chair of the US Securities and Alternate Fee

“Retail merchants have executed a whole 180 after Bitcoin didn’t rally and dipped under $113,000.”

Santiment analysts

“This isn’t an indication of power for $BTC. The downward stress is palpable, however bulls are looking for their footing.”

Keith Alan, co-founder of Materials Indicators

“The tough thought I’ve in my head is that we’ll see a million-dollar Bitcoin by 2030.”

Brian Armstrong, CEO of Coinbase

“If we don’t get the market construction proper and the change flips again to a extra hostile coverage or regulatory setting, I believe there’s a very credible threat that we are going to lose out to the EU, to APAC, or perhaps even to the Center East.”

Stuart Alderoty, chief authorized officer at Ripple

“The way in which we purchase Bitcoin is we don’t transfer the worth of the Bitcoin.”

Shirish Jajodia, company treasurer and head of investor relations at Technique

High Prediction of The Week

ETH ‘god candle’ emerges amid Fed charge lower hopes: Is $6K Ether subsequent?

Ether’s value displayed power on the Wall Avenue open on Friday, rising 13% to $4,788 following Federal Reserve Chair Jerome Powell’s speech at Jackson Gap.

ETH value rallied from $4,200 inside minutes, reclaiming $4,600, a stage that has suppressed the worth over the past seven days, per information from Cointelegraph Markets Professional and TradingView.

That very same day, ETH set a brand new report excessive, crossing above $4,867 on Coinbase for the primary time since November 2021.

This efficiency follows Powell’s Jackson Gap speech, the place he hinted at a possible rate of interest lower in September, signaling a dovish stance that boosted market optimism.

Learn additionally

Options

Korea to carry company crypto ban, beware crypto mining HDs: Asia Categorical

Options

5 unbelievable use circumstances for Based mostly Brokers and Close to’s AI Assistant

Rate of interest lower odds for the Sept. 17 FOMC assembly have now jumped to 91.5% from 75% a day prior, in accordance with the CME Group Fedwatch device.

High FUD of The Week

Interpol coordinates crackdown on unlawful Angola-based crypto miners

The Worldwide Prison Police Group, or Interpol, introduced greater than a thousand arrests and the seizure of about $100 million as a part of a crackdown that included cryptocurrency miners and fraudsters.

In a Friday discover, Interpol mentioned it had coordinated with authorities in Angola to dismantle 25 crypto mining facilities being illegally run by 60 Chinese language nationals.

The group mentioned it had seized tools price greater than $37 million, which the Angolan authorities plans to distribute to “weak areas.”

Coinbase tightens workforce safety after North Korea remote-worker threats

Coinbase, the world’s third-largest cryptocurrency trade by quantity, has come below a wave of threats from North Korean hackers looking for distant employment with the corporate.

North Korean IT employees are more and more focusing on Coinbase’s distant employee coverage to realize entry to its delicate techniques.

Learn additionally

Options

Ethereum restaking: Blockchain innovation or harmful home of playing cards?

6 Questions for…

6 Questions for JW Verret — the blockchain professor who’s monitoring the cash

In response, Coinbase CEO Brian Armstrong is rethinking the crypto trade’s inner safety measures, together with requiring all employees to obtain in-person coaching within the US, whereas individuals with entry to delicate techniques might be required to carry US citizenship and undergo fingerprinting.

“DPRK could be very taken with stealing crypto,” Armstrong informed Cheeky Pint podcast host John Collins in a Thursday episode. “We are able to collaborate with regulation enforcement […] but it surely seems like there’s 500 new individuals graduating each quarter, from some form of faculty they’ve, and that’s their entire job.”

Taiwan costs suspects in report $72M crypto laundering scheme

Taiwanese prosecutors reportedly indicted 14 individuals in what they are saying is the nation’s biggest-ever cryptocurrency cash laundering case, involving greater than 1,500 victims and over $70 million in illicit funds.

The Shilin District Prosecutors Workplace indicted the 14 on costs associated to fraud, cash laundering and arranged crime, requesting the confiscation of 1.275 billion New Taiwan {dollars} ($39.8 million), which was allegedly obtained from victims by means of fraud, in accordance with a Friday report from native media outlet UDN.

Prosecutors additionally requested confiscation of one other 640,000 USDT, undisclosed Bitcoin and Tron holdings, over $1.8 million in money and two luxurious vehicles. They reportedly seized financial institution deposits totaling $3.13 million, with the remainder of the proceeds set to be recovered later.

The group was charged with laundering $71.9 million collected from unknowing victims in money, earlier than being transformed into international forex and transferred abroad to buy USDT by means of Taiwanese cryptocurrency trade BiXiang Expertise.

High Journal Tales of The Week

Can privateness survive in US crypto coverage after Roman Storm’s conviction?

Roman Storm’s Twister Money conviction displays the identical privacy-versus-security battle seen in earlier encryption battles, authorized consultants say.

Stablecoins in Japan and China, India mulls crypto tax modifications: Asia Categorical

Main Asian economies step on the stablecoin throttle, India’s reconsiders punitive crypto tax, and extra.

Bitcoin’s long-term safety price range downside: Impending disaster or FUD?

The declining block reward subsidy is a real concern for Bitcoin’s safety price range. However there are answers, too.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.