The long-running authorized battle between Ripple Labs and the US Securities and Alternate Fee (SEC) has concluded, ending one of the vital intently watched courtroom battles in crypto historical past.

On August 22, the Second Circuit Courtroom dismissed all excellent appeals, confirming that transactions involving XRP on public exchanges don’t qualify as securities gross sales. The ruling ends a dispute that started in December 2020, when the SEC accused Ripple of elevating $1.3 billion by unregistered XRP choices.

Ripple Ends 5-Yr Struggle With $125 Million Superb

Ripple’s authorized protection spanned almost 5 years and value greater than $100 million, reflecting the uphill battle it confronted beneath the hostile regulatory surroundings formed by SEC Chair Gary Gensler and the Biden administration.

Nevertheless, the trajectory of the case shifted in July 2023 when Choose Analisa Torres dominated that retail gross sales of XRP had been lawful, whereas institutional gross sales violated securities legal guidelines.

Each Ripple and the SEC initially appealed that break up ruling, prolonging the uncertainty.

Nevertheless, the political local weather shifted with the return of Donald Trump and the appointment of a extra crypto-friendly SEC management. This growth opened the door to settlement talks.

By March, Ripple Chief Govt Brad Garlinghouse confirmed a tentative deal involving a $50 million penalty and mutual withdrawal of appeals. Choose Torres initially rejected that settlement, retaining the case unresolved.

However in early August, each side collectively requested dismissal, and the Second Circuit endorsed the proposal with a $125 million advantageous.

Crucially, Torres’ earlier opinion—emphasizing that “XRP itself just isn’t a safety”—stays intact.

Market observers consider this precedent will affect future product approvals and regulatory steering.

XRP ETF Momentum Accelerates

The readability from the ruling instantly sparked motion within the funding merchandise sector.

On August 22, seven asset managers, together with Grayscale, Franklin Templeton, Bitwise, CoinShares, WisdomTree, 21Shares, and Canary, up to date their filings for an XRP-focused spot exchange-traded fund (ETF).

Nate Geraci, president of funding advisory agency NovaDius Wealth, described the flurry of exercise as proof that issuers are aligning proposals and positioning for an eventual regulatory acceptance.

Notably, the SEC has not accepted a spot XRP ETF product within the US regardless of the presence of leverage funds.

In the meantime, pro-crypto lawyer John Deaton famous that October will likely be a vital month, because the SEC faces a collection of ETF software deadlines—starting with Grayscale on the 18th and ending with WisdomTree on the twenty fifth.

Deaton identified that buying and selling for these merchandise may start inside days if the SEC approvals mirror the method for Bitcoin spot ETFs.

Nevertheless, their launches may take a number of months if the SEC calls for further disclosures, because it did for Ethereum ETFs.

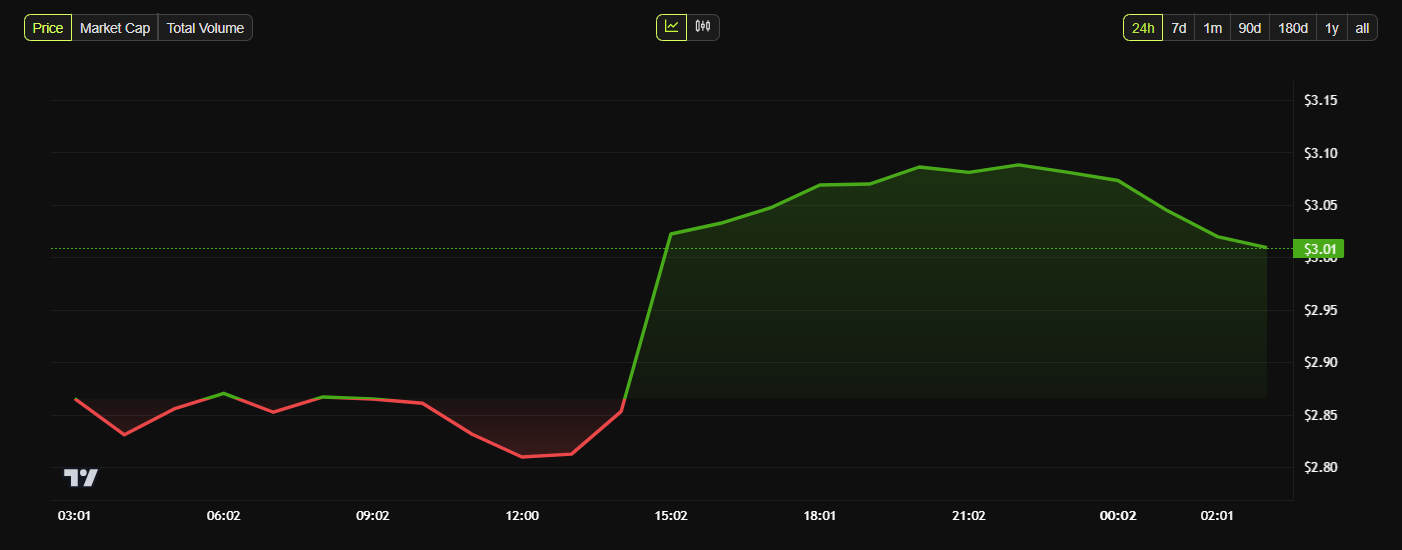

In the meantime, these developments sparked optimism within the XRP market.

In line with BeInCrypto information, the token gained 4% over the past 24 hours and traded at $3.01 as of press time.

The put up Ripple-SEC Case Closure Adopted by Rush of Up to date XRP ETF Filings appeared first on BeInCrypto.

(@FilanLaw)

(@FilanLaw)