Bitcoin value rose 2.5% over the previous 24 hours, buying and selling close to $115,700, nevertheless it nonetheless trails Ethereum and others which have already pushed to new highs.

Regardless of being nearly 7% beneath its peak, a number of key on-chain and technical indicators recommend the setup for a breakout is forming, very similar to the rally seen earlier this month.

Whale Promoting Strain Is Weakening

For weeks, the Bitcoin value lagged behind as whales rotated capital into different property, leaving retail patrons to drive a lot of the transfer.

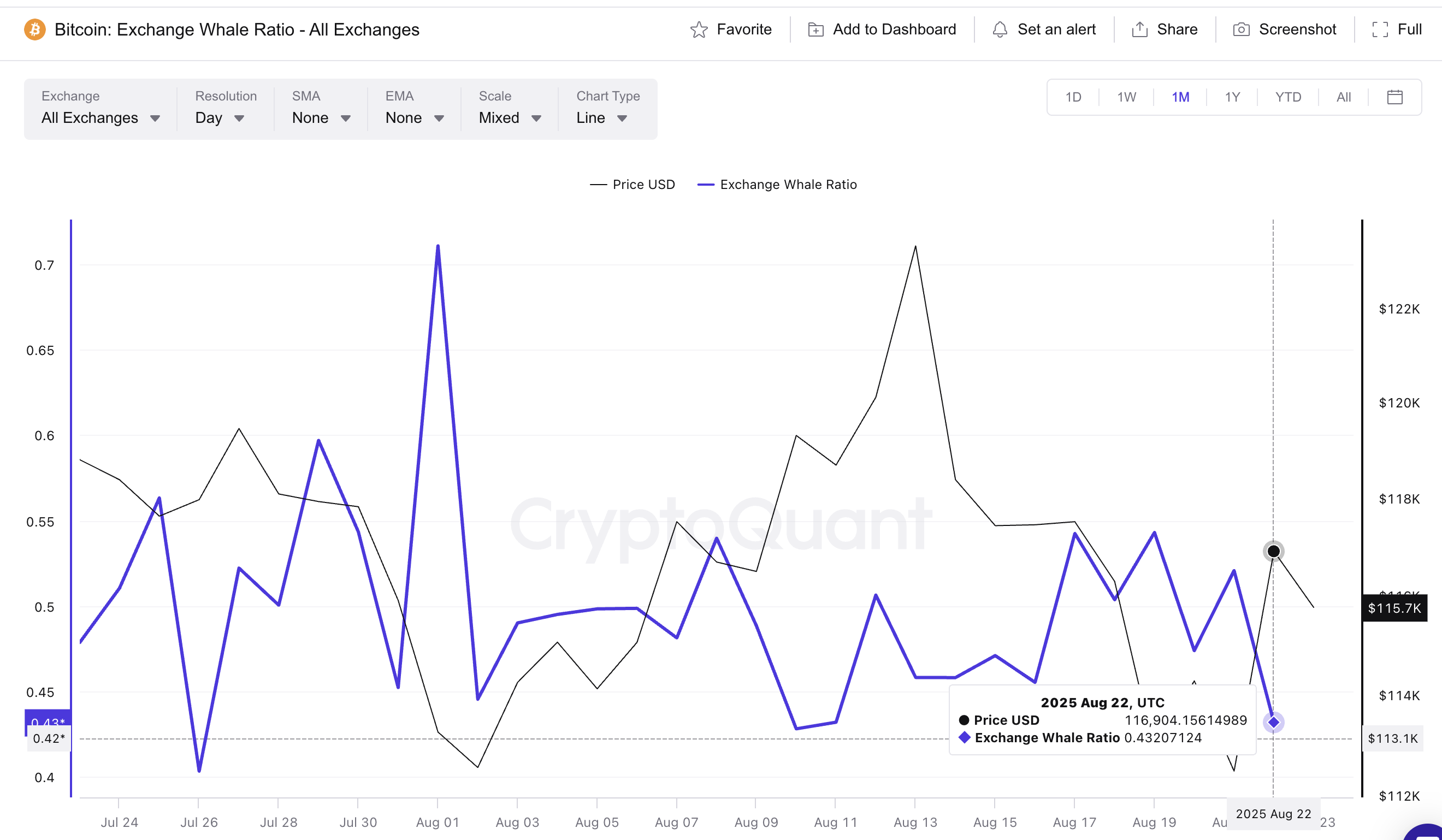

That made it vital to trace whether or not whales had been lastly slowing their promoting. The Alternate Whale Ratio, which measures the share of the highest 10 inflows in comparison with all inflows to exchanges, gives that sign.

This ratio has fallen from 0.54 on August 19 to 0.43 on August 22, its lowest in practically two weeks. The same drop occurred on August 10, when the ratio fell to 0.42. That transfer preceded a pointy rally in Bitcoin from $119,305 to $124,000 — a achieve of roughly 3.9%.

If historical past repeats, the present setup might open the door for the same upside extension, arguably in the direction of a brand new all-time excessive.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

HODL Waves Level to Accumulation

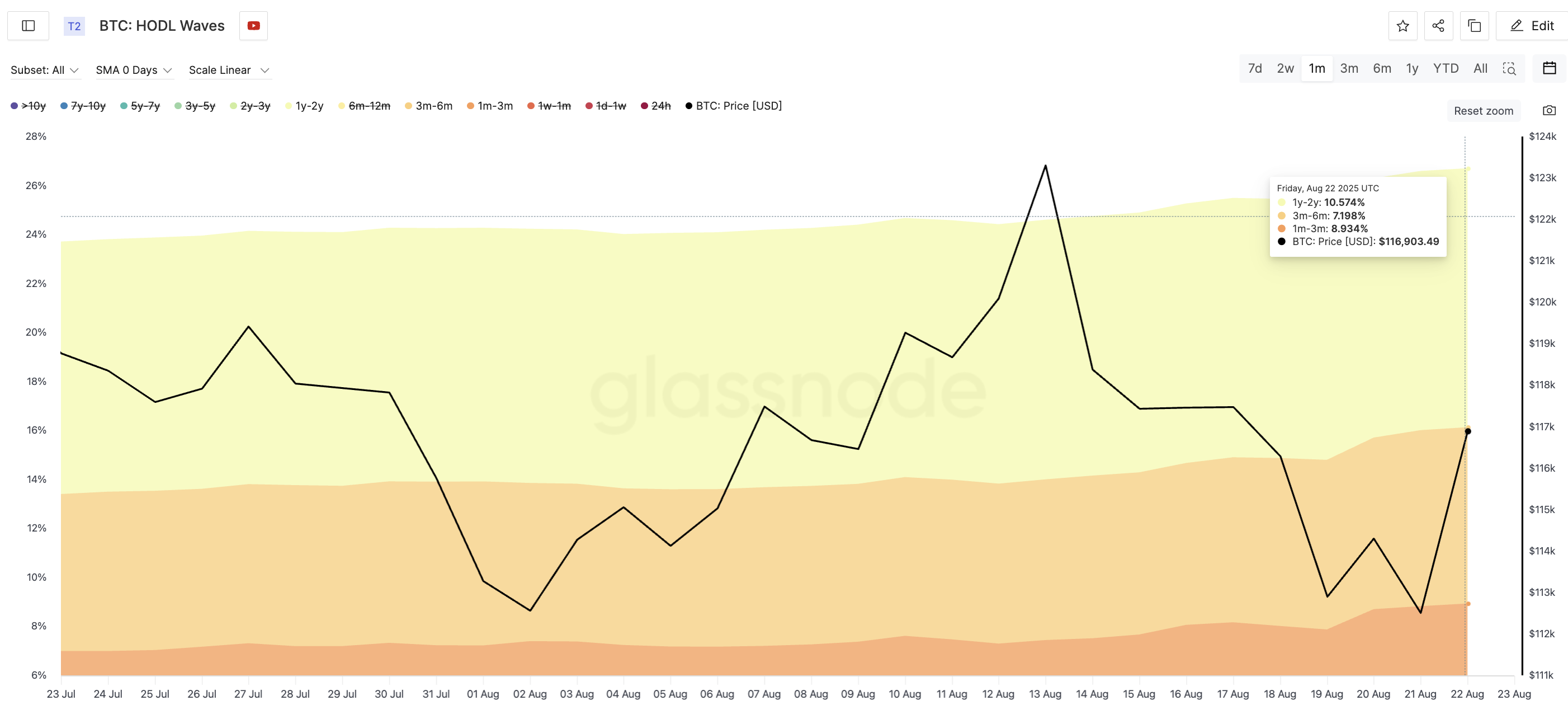

With BTC promoting stress easing, the following query is whether or not mid-term and long-term holders are accumulating. The HODL Waves metric tracks the share of Bitcoin provide held throughout age bands.

Over the previous month, key cohorts have expanded their positions:

- 1y–2y wallets rose from 10.31% to 10.57%

- 3m–6m wallets climbed from 6.40% to 7.19%

- 1m–3m wallets grew from 6.99% to eight.93%

This broad accumulation throughout volatility means that conviction is there. Mixed with decrease whale trade flows, the construction factors to a market that’s gearing up for a Bitcoin value breakout.

Bitcoin Value Ranges Outline the Breakout Path

The technical image ties these indicators collectively. Bitcoin presently trades simply above robust help at $115,400. A vital resistance lies at $117,600, with $119,700 appearing as the important thing breakout set off for the Bitcoin value to push in the direction of and even past its all-time excessive.

However, a slip beneath $114,100, and particularly $111,900, would shift the momentum bearish within the short-term

If the trade whale ratio repeats its August tenth sample, the Bitcoin value might climb practically 4% from present ranges. That may push the value previous $119,000, instantly into breakout territory.

From there, the stage can be set for a retest of the all-time excessive, validating the concept that this rally is delayed, not denied.

The publish Whale Indicators Present a New Value Route For Bitcoin appeared first on BeInCrypto.