Kanye West’s meme coin YZY got here crashing down barely hours after rocketing previous the $3 billion market cap threshold.

In an X put up on Thursday, the controversial American rapper promoted YZY as a “New Financial system, Constructed On Chain,” sharing each its contract deal with and web site.

The put up ignited the preliminary shopping for frenzy across the meme coin and pushed its market cap above $3 billion inside forty minutes of its launch.

Nonetheless, as a result of suspicious fund actions by insiders and the centralized management of its tokenomics, questions relating to the legitimacy of YZY started to realize floor.

Blockchain trackers, together with Lookonchain, raised insider buying and selling alerts, revealing that not lower than 95% of the availability is managed by 4 pockets addresses, as in opposition to the bigger inhabitants that West claimed the mission will serve.

And amid rising skepticism from followers and analysts, YZY suffered a brutal hit, shedding practically 74% of its worth in lower than 24 hours and leaving 1000’s of retail buyers with huge losses.

However the dramatic worth swings didn’t come as a shock to many, contemplating its launch adopted the identical controversial sample with different superstar rug pulls like LIBRA that harm many degens earlier this yr.

On the time of writing, the Solana meme coin is buying and selling round $0.7, down 74% from its all-time excessive of $3. The market cap? It’s at the moment hovering round $200 million, having misplaced over two-thirds of its peak worth.

Unsurprisingly, even the most recent broader market restoration, sparked by the Fed’s September charge reduce plan, has performed nothing to shift the bearish sentiment across the token. Is YZY lastly lifeless?

How Kanye West’s Meme Coin Turns Into A Pump-and-Dump Nightmare

YZY arrived on Solana on Thursday, August twenty first, 2025, and was instantly listed on Bitget. The discharge took the market by storm, with the worth formally breaking all market fundamentals to achieve a peak of $3 inside an hour. In reality, at one level, it reached a market capitalization of $3 billion.

In keeping with Ye, the entire thought behind the launch of this meme coin is to energy the Yeezy Cash system. Nonetheless, the YZY fever didn’t final lengthy, as insiders rushed to promote the tokens, leaving common buyers with devastating losses.

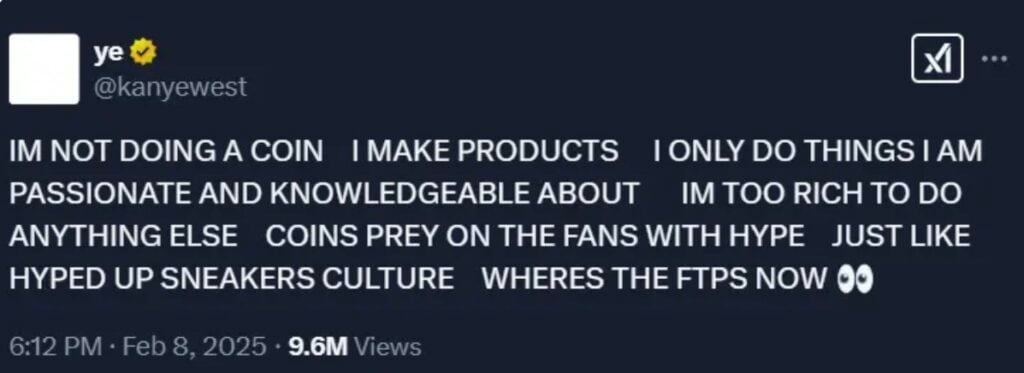

Ye himself drew large criticism for the mission, with many saying it embodied precisely what he as soon as warned about in his February 2025 “cash preying on followers” X put up.

YZY’s tokenomics can also be topic to main controversy. Coinbase director Conor Grogan famous that 94% of the availability was initially managed by insiders, with one multisig pockets holding 87% earlier than distribution. On-chain information additionally exhibits that 70% of the availability is allotted to Yeezy Investments LLC, with claims of a 24-month vesting interval.

The largest crimson flag, nevertheless, lies in the best way just a few insider wallets, seemingly conscious of the right contract deal with, swooped within the second it went reside. However on the time of writing, simply 9 out of the primary 99 addresses that bought YZY are nonetheless holding, a transparent signal of a coordinated pump-and-dump scheme.

Information from Nansen paints a clearer image, exhibiting how the highest 10 wallets alone pocketed a mixed revenue of greater than $18 million from the scheme. One single entity, as an illustration, made a revenue of $8 million after initially investing about $2.28 million.

Whereas these insiders secured enormous returns, common buyers are left nursing steep losses. One dealer, for instance, misplaced practically $1.8 million.

Extra so, out of 56,050 wallets that touched the token, onchain information exhibits that 19,125 misplaced between $500 and $1 million, intensifying requires a full-fledged investigation.

For now, preliminary findings, particularly from Bubblemaps, linked the insiders to quite a few comparable releases previously. The token’s first purchaser “Naseem,” as an illustration, was among the many snipers that pulled tons of of tens of millions of {dollars} from TRUMP and LIBRA initiatives earlier this yr. The sample with which these wallets strike mirror a deep, well-scripted market manipulation.

Is the YZY Meme Coin Lifeless?

Provided that the YZY market cap continues to be hovering round $200 million at press time, it’s protected to say that it’s not fully lifeless.

Nonetheless, its worth motion has now stagnated, and even the broader market reduction rally has performed nothing to spark renewed momentum.

CoinMarketCap exhibits that the sentiment round this token is nowhere practically as bullish because it was a couple of minutes after it launched.

And contemplating the truth that just a few insiders related to failed superstar meme cash like LIBRA management round 90% of its complete provide, retail buyers will proceed to stay extraordinarily susceptible to extra dramatic dumps, identical to the one witnessed within the final 48 hours.

Subsequently, slightly than shopping for the dip, consideration ought to be placed on different Solana meme coin alternate options with distinctive branding, sensible utility, and immense progress potential.

This Utility Solana Meme Coin Might Be an Underrated Various

With insiders and snipers linked to LIBRA and TRUMP nonetheless dominating the YZY market and continually dumping their holdings, analysts anticipate additional downward swings within the coming days, doubtlessly leaving common degens with extra brutal losses.

It’s subsequently not with out that cause that an increasing number of good cash buyers are flocking to different Solana meme cash, resembling Wall Avenue Pepe.

Fortunately, Wall Avenue Pepe brings collectively the attraction of meme cash with a practical ecosystem constructed to combat in opposition to whales, cabals, and shady insiders who all the time appear to win whereas retail buyers lose out.

Launched in February 2025 after a spectacular presale outing, WEPE grew shortly on Ethereum, and its newest bounce to Solana is pushing it even additional. It’s no secret that Solana has been a hub for meme cash, owing to its lightning-fast pace, ultra-low charges, and extremely lively group.

By pegging its Solana token 1:1 with the Ethereum model, the mission eliminates the dilution and confusion that usually characterizes multichain expansions. Principally, each token buy on Solana reduces provide on Ethereum, balancing liquidity throughout each chains and boosting long-term sustainability.

In the meantime, the mission’s buying and selling alpha group, often known as the “WEPE Military,” has gained important traction, proving its affect with constant calls that assist members capitalize on alternatives they in any other case would have missed out on. In reality, a number of the calls returned between 500% to 1,000% on meme cash like Pudgy Penguins. This trading-focused utility offers it an edge over meme cash that rely solely on speculative hype.

Main names within the trade, together with Amira Blake have lined the mission’s multichain growth information, explaining how the transfer may appeal to a broader investor base and doubtlessly increase its worth.

Purchase Wall Avenue Pepe

This text has been offered by one among our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our industrial companions could use affiliate packages to generate revenues by means of the hyperlinks on this text.