The crypto market is dealing with considered one of its most divided moments in current reminiscence. Whereas some merchants worry the cycle is topping, others level to alerts that the ultimate explosive part continues to be forward.

Analyst Atlas has mapped out Bitcoin’s trajectory and the broader path to altseason, drawing on historic patterns and present macro triggers.

Bitcoin’s present vary and assist

Atlas famous that Bitcoin is buying and selling between $102,000 and $115,000, with potential sweeps all the way down to $105,000 and even $102,000 earlier than continuation. The important thing threshold stays $100,000 assist – so long as this stage holds, the bull cycle stays intact. A breakdown beneath would shift the construction, however chances nonetheless favor additional upside.

Macro backdrop and liquidity triggers

The macroeconomic panorama explains why Bitcoin hasn’t but exploded to recent highs. Atlas highlighted tariffs feeding inflation and maintaining policymakers cautious. Nonetheless, Powell’s Jackson Gap affirmation of September charge cuts has restored confidence, with FedWatch odds for a minimize surging to 91%. This liquidity injection, he argues, is the inexperienced gentle markets have been ready for.

BTC dominance rolls over as ETH strengthens

Bitcoin dominance peaked earlier in the summertime and is now rolling over. Atlas pointed to Ethereum’s power via ETF inflows, staking demand, and real-world asset (RWA) hype. Altcoins are holding key helps as a substitute of collapsing, an indication of resilience in comparison with previous corrections. This rotation alerts that the ultimate progress part is underway.

Path to altseason

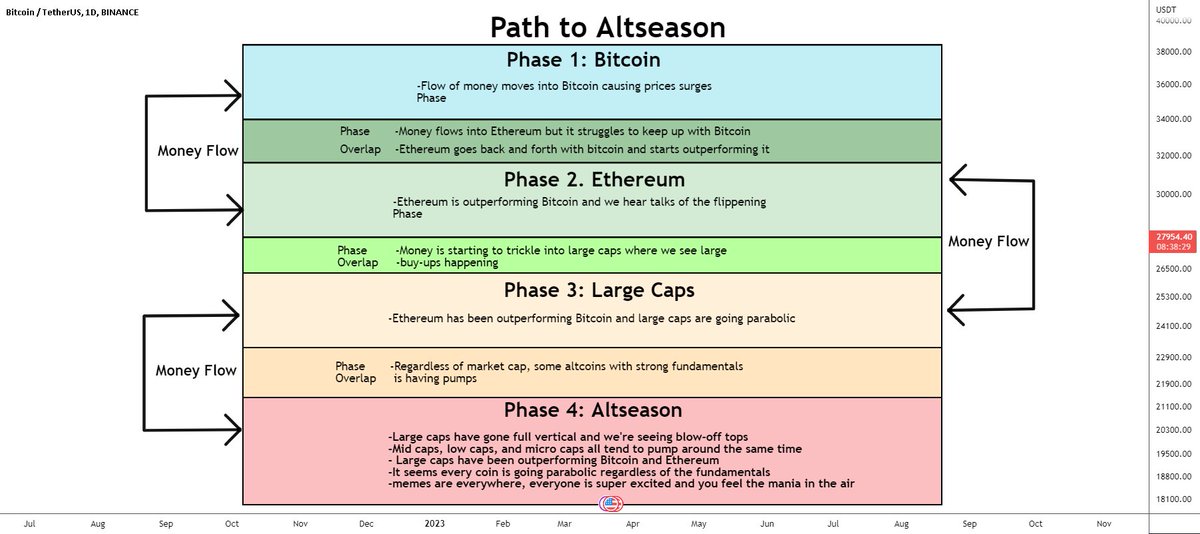

Atlas broke down the traditional movement of capital in bull markets:

- Part 1: Bitcoin leads.

- Part 2: Ethereum outperforms.

- Part 3: Giant-cap alts pump.

- Part 4: Full altseason with widespread parabolic strikes.

Traditionally, 2017 and 2021 each delivered 30–40 day altseasons after Bitcoin topped. The identical construction is now repeating virtually week by week, based on Atlas.

What comes subsequent?

Atlas cautioned that cycles don’t finish quietly. True tops often arrive with mania and euphoria, neither of which is seen but. Retail inflows stay muted, suggesting this rally has room left. He expects 2–3 sharp dips earlier than altseason’s blow-off, advising merchants to scale into worry and scale out into power.

With BTC nonetheless beneath its all-time excessive towards gold, ETH outperforming, and altcoins holding robust, Atlas concludes the bull run stays intact. The ultimate rotation into altseason could also be on deck heading into This fall 2025.