- Bitcoin bounced from $111K to $115.6K as promoting strain eased.

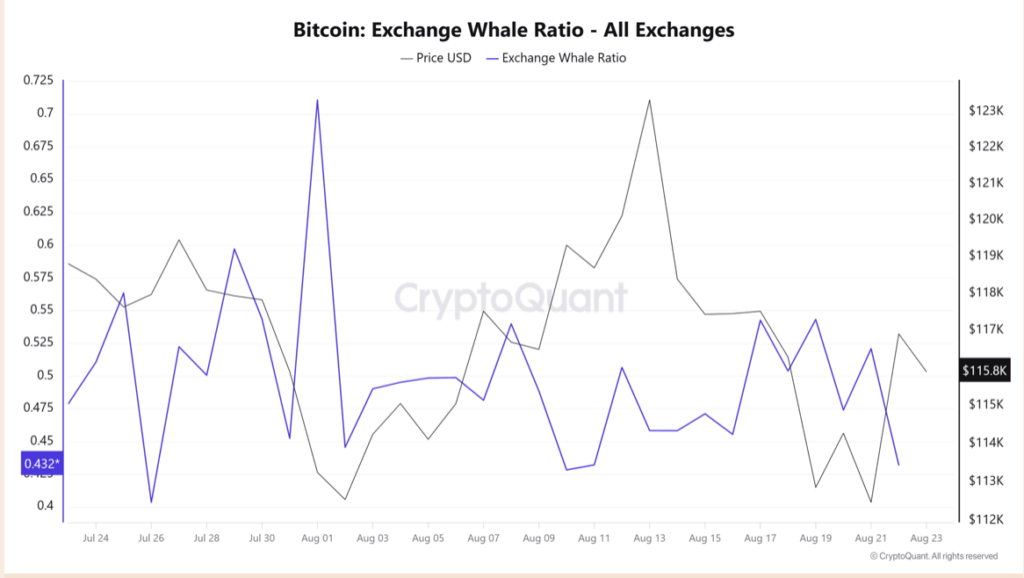

- Whale accumulation hit excessive ranges, with trade ratios dropping to 0.43.

- If shopping for continues, BTC might check $119.6K, however a vendor comeback dangers a retest of $112K.

Bitcoin’s newest dip appears to have run its course, with promoting strain drying up and whales quietly taking cash off exchanges. After sliding to an area low of $111K, BTC bounced again towards $117,421 earlier than cooling off close to $115,600, up round 2.4% on the day. The large query now—can $112K maintain if sellers determine to return?

Sellers Again Off, Revenue-Taking Slows

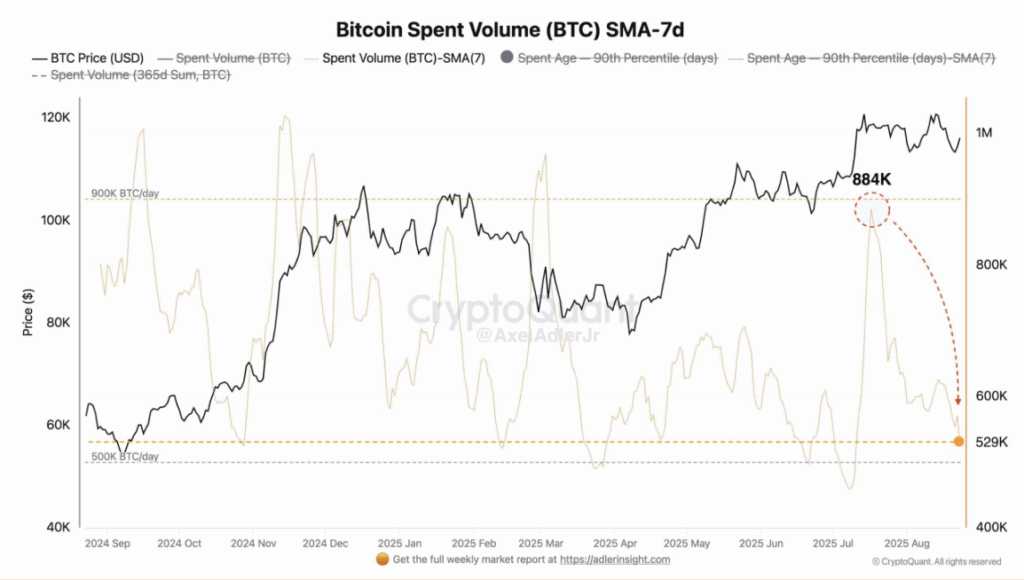

Information from CryptoQuant analyst Axel Adler reveals Bitcoin’s Spent Quantity (7-day SMA) plunged to 529K BTC per day. That’s a pointy decline, suggesting the massive wave of promoting has eased. With worth motion stagnant in latest weeks, the inducement to dump cash has dropped. Even realized earnings had been muted: long-term holders booked simply 7.2K BTC, whereas short-term merchants managed 1.8K BTC. For each teams, the urge for food to promote into power simply isn’t there proper now.

Whales Pull Cash Off Exchanges

Whereas retail hesitates, whales have been busy stacking. The Change Whale Ratio dropped to 0.43, its lowest in practically two weeks. Decrease readings right here sometimes imply whales are shifting BTC into non-public wallets relatively than exchanges—much less prep to promote, extra indicators of accumulation. Checkonchain information backs this up: mega holders and exchanges with over 10K BTC noticed balances shrink by greater than 20,000 cash, displaying withdrawals far outweighed deposits.

Traditionally, this sort of shift—whales pulling cash off exchanges—has preceded stronger upward strain on worth. It doesn’t assure a breakout, nevertheless it suggestions the steadiness towards accumulation relatively than distribution.

Can BTC Push Greater?

Netflow information paints the identical image. Bitcoin’s netflow turned unfavorable, dropping to -$128M, one other signal of heavy accumulation. If this pattern continues, BTC might retest $117K and presumably stretch towards $119,600 within the quick time period. Nonetheless, merchants stay cautious. A sudden return of sellers might put strain again on the $112K assist, a stage Bitcoin must defend to keep away from one other leg down.

For now, the market appears to be like prefer it’s leaning bullish—however as all the time with Bitcoin, one wave of promoting might flip the script right away.