Ethereum’s rally this month has been sharp, however merchants are being warned to look at September carefully.

Associated Studying

Ether climbed about 20% for the reason that begin of August, buying and selling at $4,745 on the time of publication. Costs even pierced $4,860 after dovish remarks from US Federal Reserve Chair Jerome Powell on the Jackson Gap symposium, a transfer that many in crypto see as a attainable spark for extra positive factors.

Historic September Pullbacks

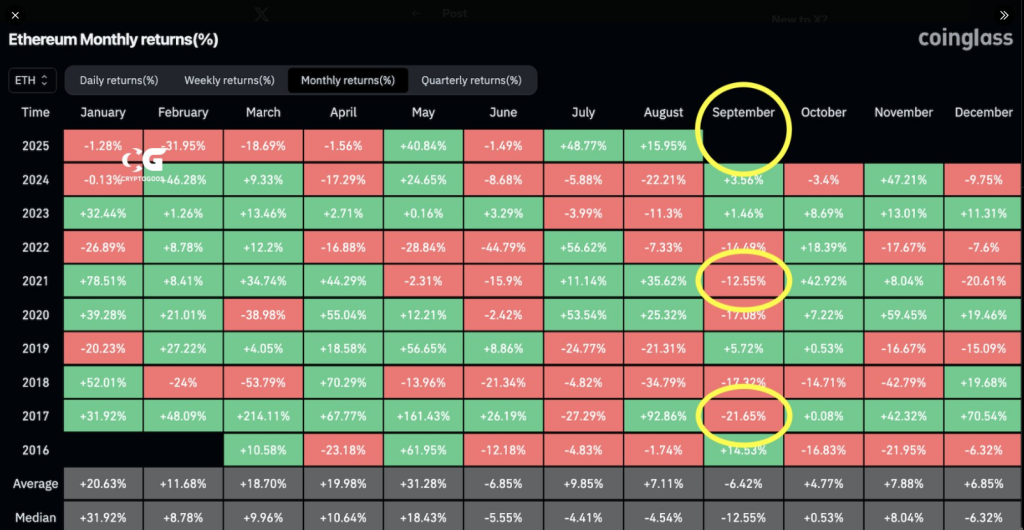

Based on CoinGlass, historical past gives a cautionary observe: there have been solely three instances since 2016 the place Ether rose in August after which slid in September.

In 2017, Ether jumped 92% in August after which dropped 20% the next month. In 2020, August positive factors of 25% had been adopted by a 17% pullback in September.

And in 2021, a 35% climb in August gave approach to a 12% slip in September. CryptoGoos, a dealer on X, summed it up bluntly: seasonality in September throughout post-halving years tends to be unfavourable.

$ETH seasonality in September throughout post-halving years is often unfavourable.

Will this time be completely different? pic.twitter.com/h9hJ40V3np

— CryptoGoos (@crypto_goos) August 22, 2025

That sample doesn’t imply a repeat is assured. Studies have disclosed that each market construction and investor profiles are completely different now than in these earlier years.

In 2016 and 2020, short-term losses in September had been adopted by multi-month recoveries, with Ether posting upside within the remaining three months of these years. So whereas historical past issues, it doesn’t determine outcomes by itself.

New Cash, New Dynamics

Flows into spot Ether ETFs this month have been massive sufficient to seize consideration. Based mostly on studies from Farside, spot Ether ETFs noticed roughly $2.70 billion web inflows in August, whereas spot Bitcoin ETFs skilled about $1.2 billion in web outflows over the identical interval.

On the similar time, corporations that maintain crypto on their steadiness sheets now management a large chunk of Ether. Studies present complete Ether held by treasury corporations topped $13 billion in worth on Aug. 11.

Arkham reported that BitMine chairman Tom Lee purchased one other $45 million of Ether, lifting BitMine’s stack to $7 billion.

These numbers change the mathematics. Huge institutional stacks and ETF demand could make sharp, short-term strikes extra persistent than in prior cycles.

Capital seems to be rotating; Bitcoin dominance has fallen 5% over the previous 30 days to 55%, which market individuals largely attribute to funds shifting into belongings past Bitcoin.

Associated Studying

What Merchants May Do Subsequent

Merchants and portfolio managers will doubtless control macro alerts and move information. A softer rate of interest outlook from Powell is a bullish issue for threat belongings, however seasonality and former post-August declines are causes to remain cautious.

Featured picture from Unsplash, chart from TradingView