US-listed Ethereum exchange-traded funds (ETFs) have logged their first week of outflows in 15 weeks, marking a pause in what had been a gradual run of institutional inflows.

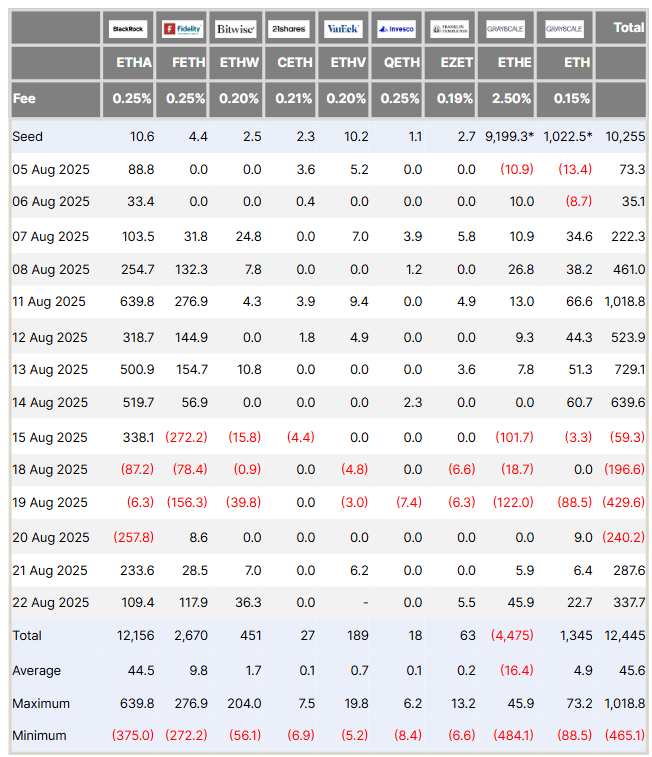

Information from Farside Traders reveals that buyers pulled $241 million from the merchandise in the course of the week of August 22, whilst a late-week rebound in demand softened the general influence.

Ethereum ETFs Endure Uncommon Setback of $241 Million Outflow

The week started with heavy promoting strain, with the 9 funds registering a mixed $866.4 million outflow between Monday and Wednesday.

Notably, Tuesday alone accounted for $429 million in redemptions, the second-largest every day outflow because the merchandise went stay.

By Thursday, nevertheless, sentiment started to shift. The funds recorded two consecutive days of inflows totaling $625.3 million.

Whereas this reversal diminished the dimensions of the withdrawals, it was not sufficient to erase the sooner harm. The consequence was a internet weekly outflow of roughly $241 million.

This shift tracked broader macro indicators and Ethereum’s market strikes. The early-week selloff stemmed from considerations about US inflation information, which heightened hypothesis over the Federal Reserve’s subsequent coverage choice and triggered expectations of a short-term value correction in ETH.

Later within the week, Fed Chair Jerome Powell delivered a extra dovish message, calming fears of extended tightening. Ethereum responded with a rally to a contemporary all-time excessive, which in flip spurred the late-week inflows.

Regardless of the setback, Ethereum ETFs proceed to point out stronger relative efficiency in contrast with their Bitcoin counterparts.

Final week, Bitcoin ETFs noticed greater than $1.1 billion in outflows, underlining the diverging investor urge for food for the 2 main crypto merchandise.

Nate Geraci, president of funding advisory agency The ETF Retailer, pointed to the broader development.

Because the begin of August, spot Ethereum ETFs have attracted $2.8 billion in inflows, whereas spot Bitcoin ETFs have registered $1.2 billion in outflows. Wanting again to July, Ethereum has pulled in $8.2 billion, in contrast with $4.8 billion for Bitcoin.

This sample displays a notable shift in institutional positioning. Traders seem more and more keen to rotate into Ethereum merchandise, whilst broader market volatility continues to affect weekly flows.

The submit Ethereum ETFs Submit First Weekly Outflows After 3 Months appeared first on BeInCrypto.