Pi Coin worth has slipped practically 1% prior to now 24 hours and is down 6.5% over the previous week, underperforming the broader market.

Whereas most tokens are inclined to stage short-lived rebounds throughout corrections, technical and on-chain alerts recommend PI’s downtrend is way from over.

Consumers Fail to Regain Management as Promoting Stress Persists

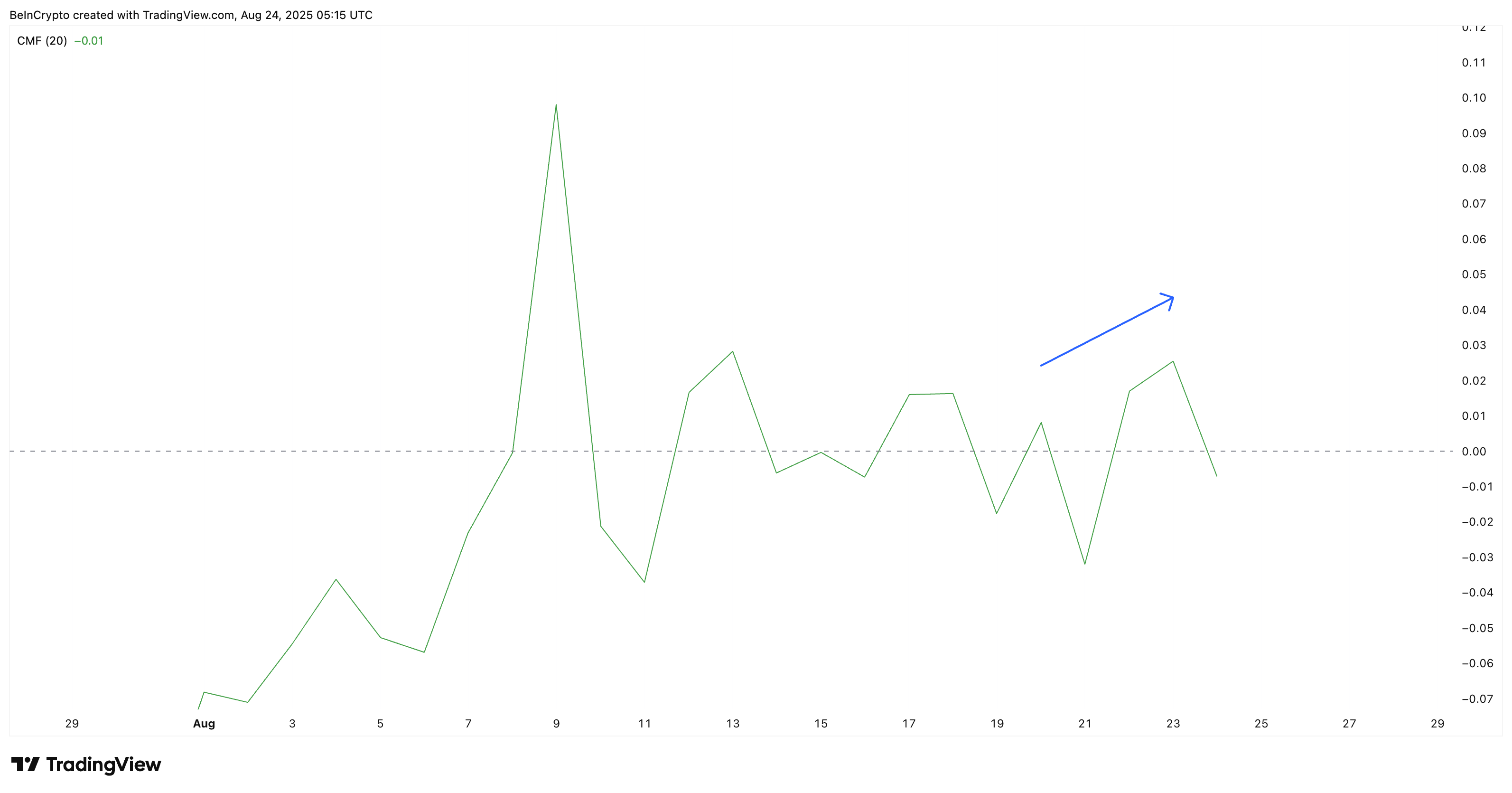

The Chaikin Cash Movement (CMF), which tracks capital inflows and outflows, briefly moved increased earlier in August, hinting at rising demand. However the newest studying has dropped again beneath zero, confirming that promoting stress nonetheless outweighs capital inflows.

For PI, this shift suggests patrons tried to regain management however did not maintain it.

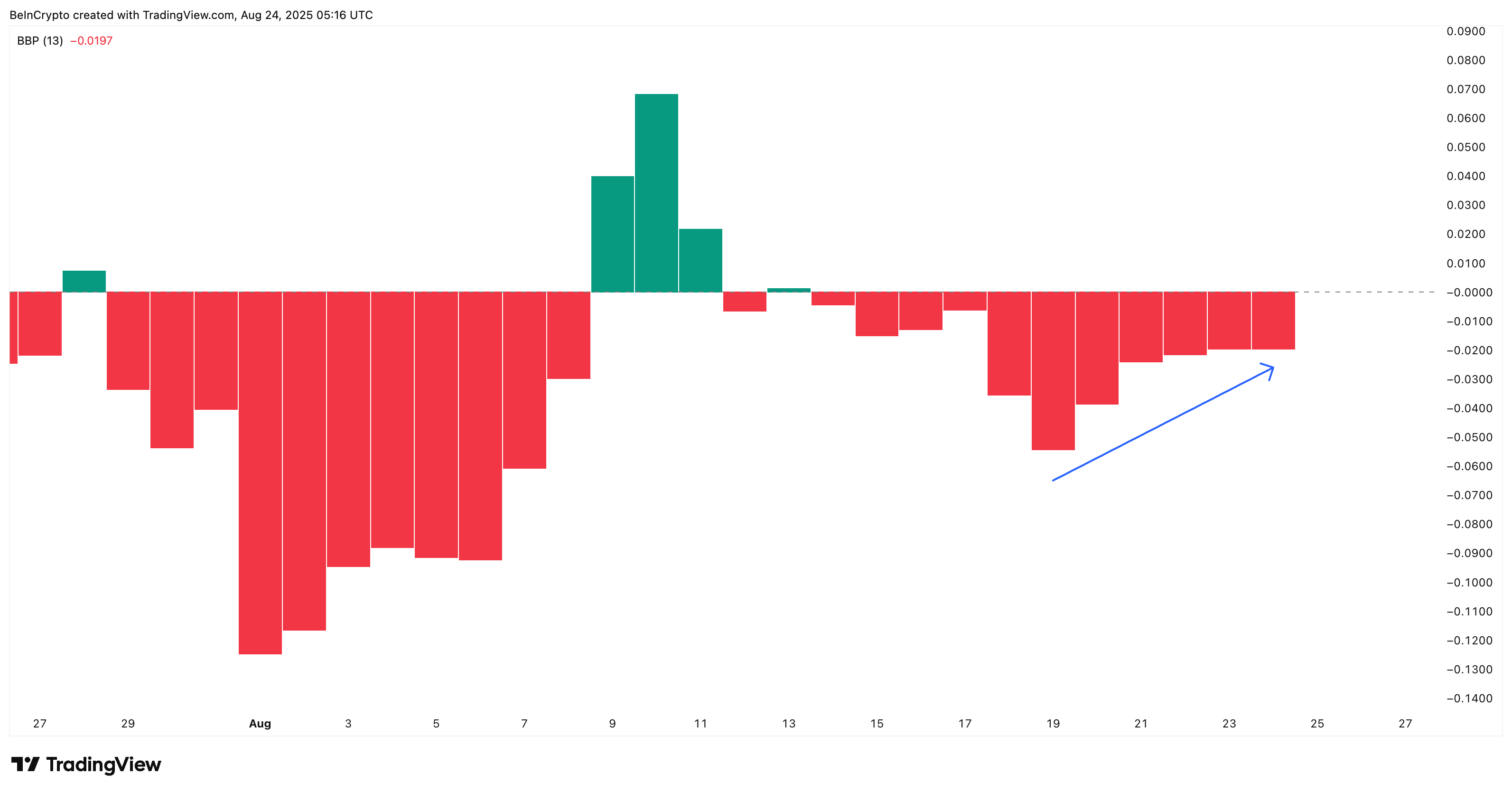

The Bull Bear Energy (BBP) reinforces the bearish image. It’s an indicator that gauges whether or not patrons (bulls) or sellers (bears) management the market.

Whereas the indicator reveals that bearish energy has eased barely, the final two classes have remained flat. This implies that bulls tried a push however did not overpower sellers.

When paired with CMF’s detrimental studying, the information means that promoting stress continues to be firmly in management regardless of patrons making an attempt to undo the bearish momentum.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Hidden Divergence Confirms Bearish Bias As Key PI Value Ranges Come In Focus

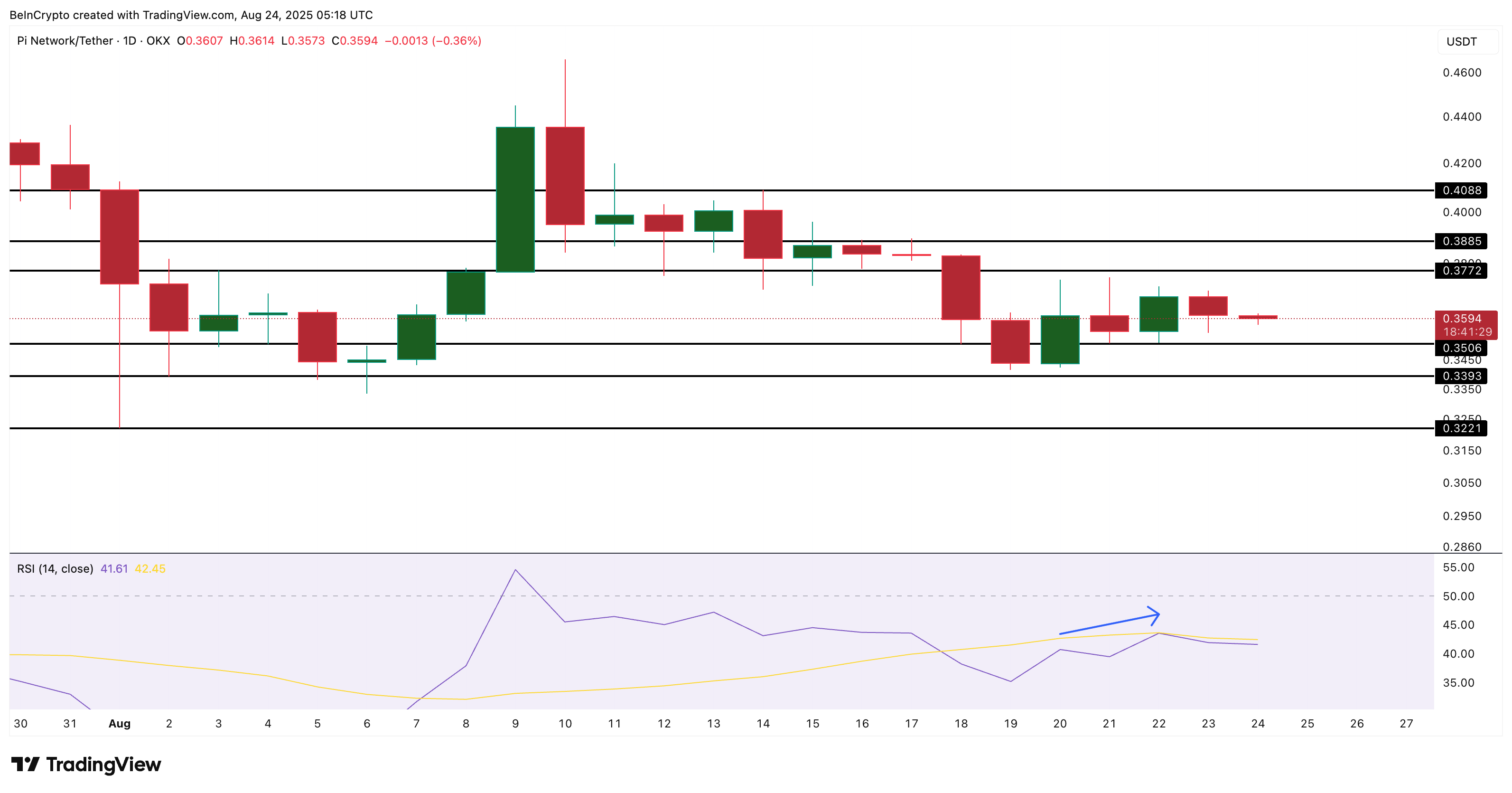

The weak point seen in CMF and BBP is echoed by momentum alerts. The Relative Energy Index (RSI) has fashioned a hidden bearish divergence.

This implies whereas PI’s worth chart reveals decrease highs, the RSI posted increased highs close to the mid-40s. This disconnect signifies momentum isn’t translating into upward worth motion, reinforcing the bearish bias.

The Relative Energy Index (RSI) measures the pace and energy of worth strikes, exhibiting whether or not an asset is overbought or oversold. A hidden bearish divergence happens when the worth makes decrease highs whereas the RSI makes increased highs.

This alerts that though momentum appears stronger, sellers nonetheless management the development, and the downtrend is more likely to proceed.

This type of hidden bearish divergence emphasises the continuation of the downtrend for the Pi Coin worth. The sample flashing on the each day chart (longer timeframe) is likely to be the important thing purpose why a brand new Pi Coin worth low is imminent.

At the moment buying and selling close to $0.359, the PI worth faces robust help at $0.350. A breakdown beneath this degree might speed up losses towards $0.339 and $0.322, with recent all-time lows seemingly if $0.322 is breached.

On the upside, bulls would want to reclaim $0.377 after which $0.408 to reverse the construction; a transfer that appears unlikely until inflows return decisively.

The publish Pi Coin Value May Document One other All-Time Low As Key Indicators Flip Bearish appeared first on BeInCrypto.