- SUI gained 11% in 24 hours, buying and selling round $3.74 with quantity up 12%.

- Analysts warn of a attainable pullback to $3.10–$2.50 earlier than affirmation.

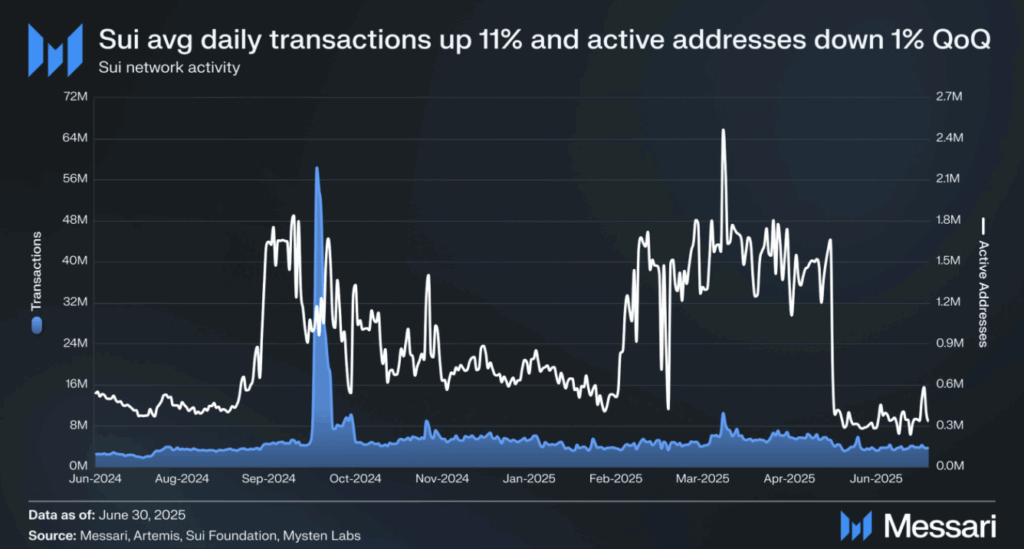

- Community fundamentals are robust, with TVL over $2B and day by day transactions up 11% QoQ.

SUI’s value spiked practically 11% in a single day, snapping again after heavy profit-taking dragged it down earlier within the week. The rebound got here because the broader crypto market rallied, with merchants dashing again in, pushing quantity increased. Now, the query hangs—can SUI preserve this momentum alive or will sellers return to tug it again to key assist?

Breakout or One other Pullback?

The token not too long ago broke above a macro triangle sample, however the transfer wasn’t clear. In response to analyst Rekt Capital, SUI remains to be within the “post-breakout retest” section, that means it hasn’t absolutely confirmed the breakout but. If bears regain management, value might slide again towards $3.10, or in a sharper downturn, all the way in which to $2.50. On the bullish facet, Robinhood’s itemizing of SUI is being seen as a significant catalyst, giving U.S. buyers new entry and serving to validate the breakout setup.

Institutional Curiosity and Community Progress

Past value charts, Sui’s fundamentals look more and more robust. Institutional adoption has been increasing shortly, with Messari highlighting development in gaming initiatives and infrastructure rollouts on the community. DeFi TVL has now surpassed $2B, whereas market cap climbed above $11.9B. Each day transactions additionally rose 11% quarter-over-quarter to five million, at the same time as energetic pockets addresses dipped barely. The crew can be engaged on bringing “robots on-chain,” constructing automation instruments designed to deal with real-time IoT duties. That form of enlargement might give the community endurance past short-term hypothesis.

Market Construction and Technical Outlook

On the time of writing, SUI trades close to $3.74, after ranging between $3.39 and $3.80 over the previous 24 hours. Quantity rose 12%, exhibiting stronger curiosity from merchants. On the day by day chart, value sits underneath the 50 and 100-day SMAs however above the 200-SMA, protecting the construction neutral-bullish. RSI at 51.8 displays stability, although leaning barely optimistic. Analysts like Ali Martinez and Crypto Tony had flagged a attainable pullback to $3.17 earlier than one other leg increased, and that also stays a situation to look at. In the meantime, futures markets present rising curiosity—open curiosity climbed 9% to $1.92B, suggesting derivatives merchants are positioning for extra volatility.

What’s Subsequent for SUI?

SUI’s bounce has merchants break up. Bulls see the breakout and Robinhood itemizing as proof of extra upside, with potential targets above $4. Bears level to profit-taking danger and the still-untested assist ranges round $3.10. As at all times, the approaching days might be essential—if quantity retains flowing in, SUI would possibly verify its breakout and intention increased. If not, one other dip into assist seems seemingly earlier than the following rally try.