- VanEck filed the first-ever JitoSOL ETF with the SEC, absolutely backed by staked SOL.

- Jito’s token (JTO) rallied 10% however faces heavy resistance round $2.

- ETF approval may mark a turning level for liquid staking adoption in conventional markets.

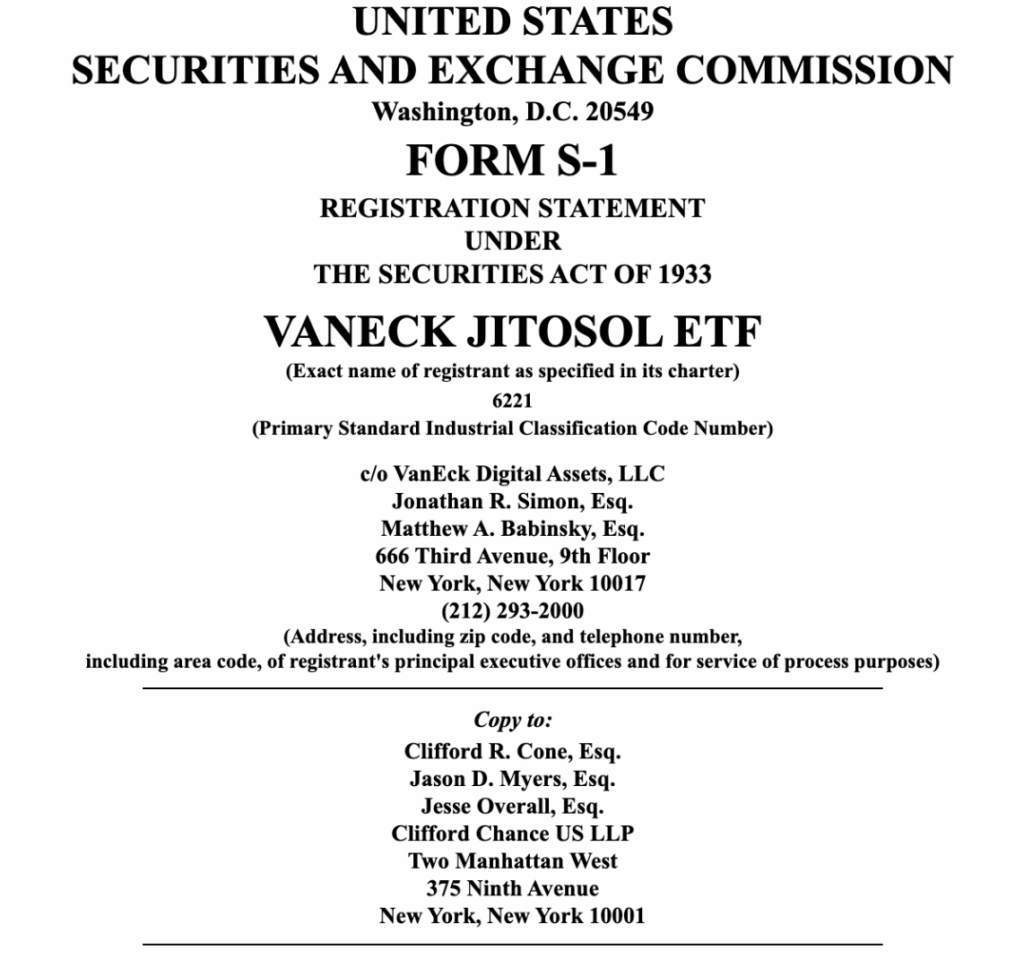

VanEck, the $133B asset supervisor, has formally stepped into new territory by submitting with the SEC for a JitoSOL ETF—the primary of its variety. What makes this historic isn’t simply that it’s a Solana-based product, however that it’s the very first software for a liquid staking token (LST) ETF. In brief, the ETF can be absolutely backed by JitoSOL, which represents staked SOL locked contained in the Jito protocol. A deposit receipt token turning right into a Wall Avenue product? That’s a milestone for each Solana and staking.

Massive Win for Jito and Solana Staking

The information was rapidly hailed as a breakthrough. Tushar Jain, co-founder of Multicoin Capital, referred to as it “an enormous win for Jito and Solana.” Based on Jito, this wasn’t some rushed submitting however the results of lengthy collaboration with SEC employees. The timing additionally strains up with latest regulatory readability: again in Might, the SEC mentioned protocol staking for proof-of-stake networks didn’t rely as securities. Then, in August, they described LSTs as “technical receipts” relatively than funding contracts. This opens the door for staking to be included in spot ETFs, which may assist enhance liquidity, compliance, and even tax therapy. Jito summed it up neatly of their assertion: “Jito will stay on the tip of the spear for institutional adoption.”

Market Response: Jito Token Rallies

The submitting despatched ripples throughout Solana DeFi and gave Jito’s native token (JTO) a noticeable bump. JTO gained about 10% on the weekly chart, breaking above its 100-day SMA, although it stalled across the $2 resistance stage. Until bulls handle to flip that mark into help, the rally may cool off quick time period. A push increased would doubtless goal $2.20 subsequent, however merchants are treading rigorously. Knowledge from Coinglass reveals prime Binance merchants trimmed lengthy positions from 62% to 49% over two days—traditional profit-taking close to a key resistance zone.

What’s Subsequent for Solana and LSTs

Even with near-term resistance at $2, the larger story is evident. A regulated ETF tied on to staked SOL would give establishments a compliant technique to faucet into Solana’s DeFi ecosystem. It additionally provides legitimacy to the liquid staking market at giant, which has been rising quick however typically lacked regulatory readability. If permitted, VanEck’s JitoSOL ETF may act as a key catalyst—not only for Solana, however for LSTs and staking in conventional finance. For now, eyes keep locked on the SEC’s response.

The publish VanEck Recordsdata First-Ever JitoSOL ETF, Marking Main Breakthrough for Solana Staking first appeared on BlockNews.