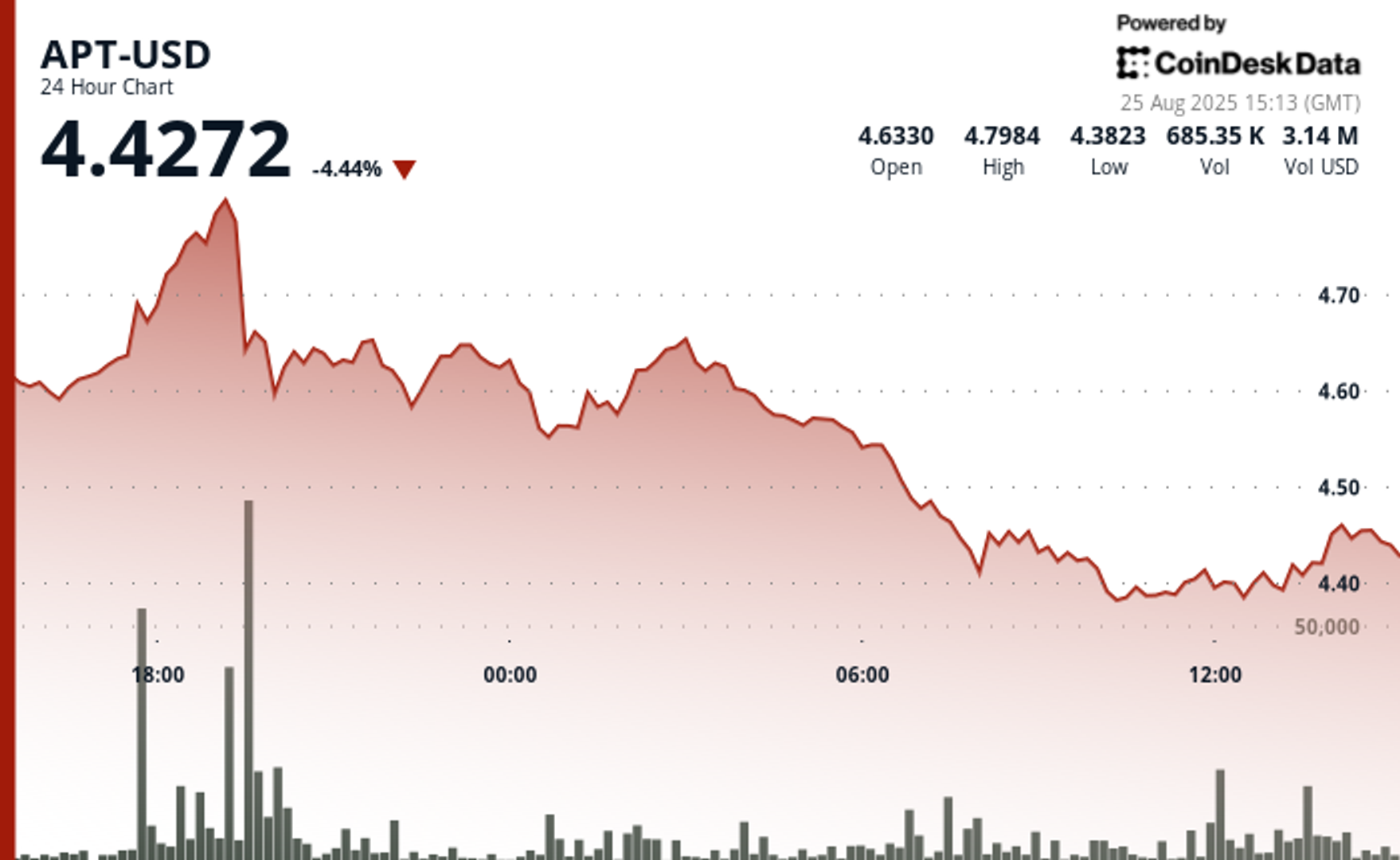

Aptos’ APT fell 4% over the 24-hour buying and selling interval, fluctuating inside a ten% vary, in response to CoinDesk Analysis’s technical evaluation mannequin.

The token made a session excessive of $4.80 and a low of $4.38, initially advancing to $4.80 earlier than declining sharply to $4.43 by morning hours, then consolidating round $4.45 with modest restoration indicators within the last buying and selling hour, the mannequin confirmed.

Important volume-backed help materialized across the $4.38-$4.41 worth zone, the place institutional shopping for emerged, with the ultimate hour demonstrating restoration momentum towards $4.45, suggesting potential market stabilization following the 9% decline from peak to trough, in response to the mannequin.

The drop in APT got here as the broader crypto market additionally fell, with the broader market gauge, the Coindesk 20, down 3.2%.

In current buying and selling, Aptos was 3.7% decrease over 24 hours, buying and selling round $4.43.

On the information entrance, the EXPO2025 digital pockets, powered by Aptos, had half 1,000,000 new accounts and 4.4 million transactions, in response to a current submit on X. In the meantime, DeFi lending protocol Aave lately launched on Aptos. This marked Aave’s first-ever deployment on a non-EVM (Ethereum Digital Machine) appropriate blockchain.

Technical Evaluation:

- Distinctive buying and selling quantity of 6.6 million throughout 19:00 hour supported preliminary rally, adopted by sustained quantity help round $4.38-$4.41 worth zone.

- Clear ascending channel formation with successive larger lows at $4.39, $4.42, and $4.45 ranges throughout the restoration section.

- Three distinct volume-driven rallies throughout the last hour breakout above $4.41 resistance degree.

- Robust institutional shopping for curiosity emerged at $4.38-$4.41 zone, establishing key help following 9% decline from peak.

- The following psychological resistance degree was recognized at $4.50 following a profitable breakout above $4.41.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.