Native token of oracle community Chainlink declined in tandem with the broader crypto market regardless of a contemporary partnership with Japanese monetary large SBI Group.

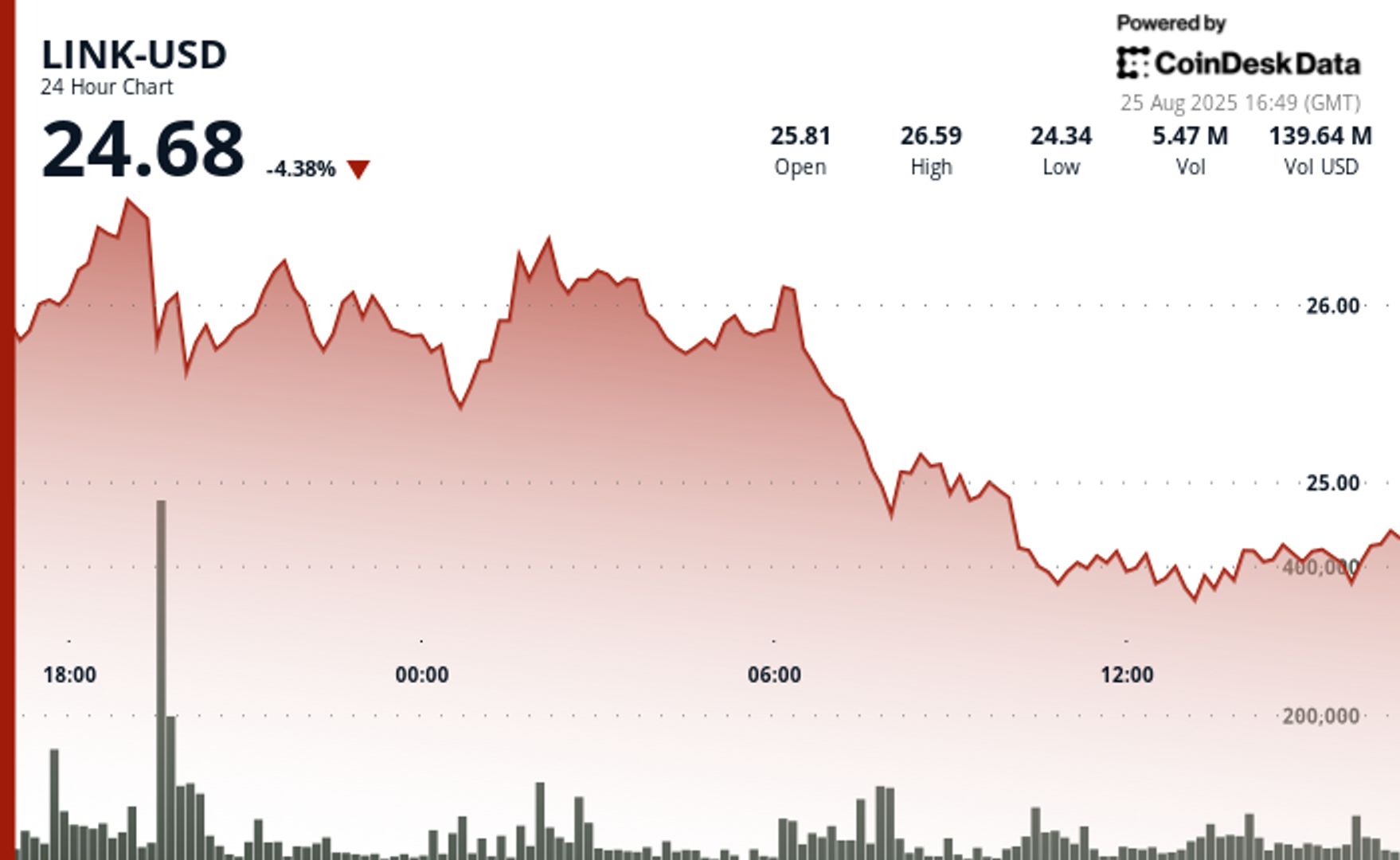

LINK declined to $24.4, down greater than 6% over the previous 24 hours, CoinDesk information reveals. That is a pointy reversal from the Friday’s year-to-date peak over $27.

The downward trajectory accelerated by way of successive buying and selling classes with persistent decrease peaks, while the concluding hour exhibited stagnation with negligible quantity, suggesting potential consolidation, in line with CoinDesk Analysis’s technical evaluation mannequin.

On the information facet, SBI Group, one among Japan’s largest monetary conglomerates, mentioned on Monday it has teamed up with Chainlink to develop tokenized belongings and stablecoin options in Japan, with future plans to develop into different Asia-Pacific markets.

SBI will use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to assist transactions throughout completely different blockchains whereas sustaining compliance. The companies will even check tokenized funds by bringing web asset worth information on-chain and discover payment-versus-payment settlement for overseas trade and cross-border transactions. Chainlink’s Proof of Reserve shall be used to confirm stablecoin reserves.

SBI and Chainlink have beforehand collaborated beneath Singapore’s Mission Guardian, a Financial Authority of Singapore (MAS) initiative exploring blockchain use in finance.

Technical Indicators Evaluation

- Resistance established at $26.61 with sharp reversal upon elevated quantity exercise.

- Crucial assist emerged at $24.37 with buying curiosity.

- Extraordinary quantity of seven,850,571 models throughout peak volatility, considerably exceeding 24-hour common of two,687,393.

- Systematic decrease peak formations indicating bearish momentum acceleration.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.