The cryptocurrency market fell practically 4% Monday, intensifying issues over a surge in Ethereum (ETH) unstaking. On-chain knowledge exhibits 1.18 million ETH are queued for withdrawal, the most important backlog in months.

The delays spotlight stress on the Ethereum community. Usually, unstaking takes three to 5 days. Present candidates resist 40 days.

ETH Unstaking Surge ≠ Promoting Strain

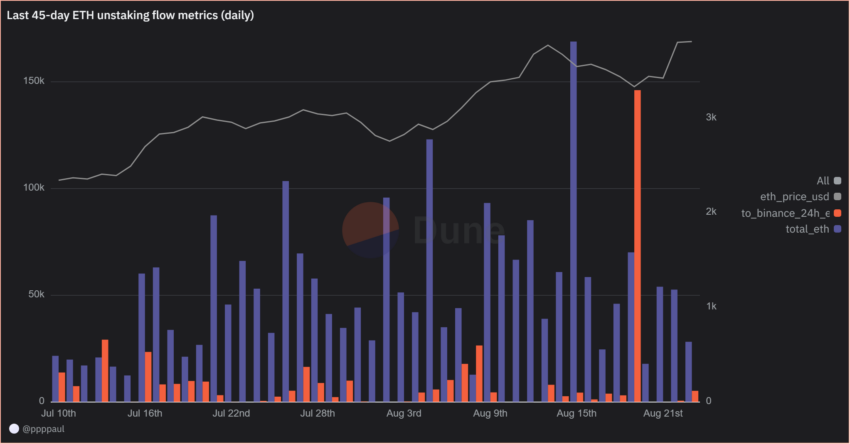

Unstaking doesn’t mechanically imply promoting. Many holders could maintain their ETH, ready for increased costs or DeFi alternatives. Information from Dune Analytics signifies no robust hyperlink between unstaking quantity and ETH value over the previous 45 days.

Nevertheless, when withdrawn, ETH strikes to exchanges, and value drops usually comply with.

On August 19, massive inflows to Binance coincided with a 5% ETH decline. That very same day, the Nasdaq fell 1.46% on fears of delayed Federal Reserve price cuts.

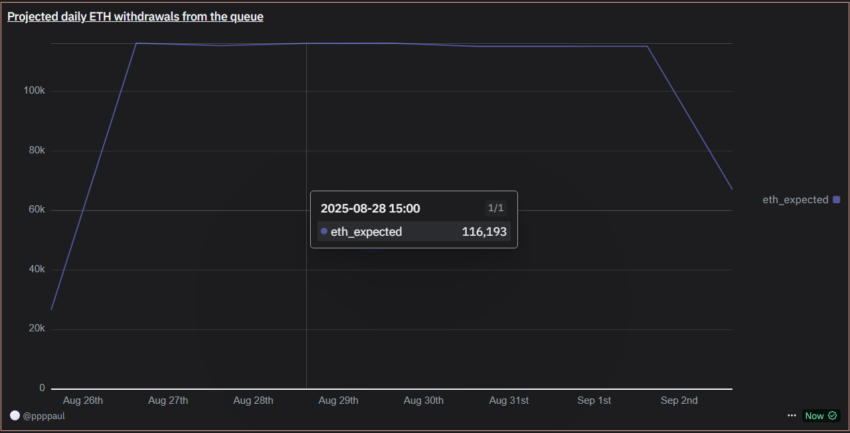

In response to on-chain knowledge, roughly 115,000 ETH will exit staking every day this week. At present costs, it’s practically $4,600, which equals $529 million in circulation every day.

The amount provides uncertainty as markets stay delicate to macroeconomic shifts. A mixture of heavy unstaking and unfavorable information may drive sharp value swings.

. Source: Dune Analytics]

A number of market voices argue that the fears are overstated. Some traders in contrast the state of affairs to Solana, which confronted related fears after FTX-related unstaking.

In the meantime, CryptoQuant knowledge highlighted that ETH provide on centralized exchanges has fallen to file lows. Solely 18.3 million ETH stay, lowering rapid promote stress.

Unstaking flows stay massive, however the influence is dependent upon trade transfers and broader financial circumstances. Analysts warning that ETH withdrawals alone are unlikely to set off sustained sell-offs with out exterior market shocks.

Total, the file Ethereum unstaking backlog underscores rising investor exercise, however its market influence stays unsure.

Whereas billions in ETH are set for launch, trade flows and international financial tendencies will in the end decide whether or not the surge interprets into promoting stress or just displays a maturing community.

The publish Issues Mount Over Ethereum Unstaking as Crypto Market Cap Takes a Tumble appeared first on BeInCrypto.