- Ethereum surged 9% in hours, now closing in on its $5K all-time excessive.

- Some merchants anticipate a quick run to $6K as soon as $5K is damaged.

- Arthur Hayes says ETH may hit $20K this cycle, whereas its position in tokenization retains increasing.

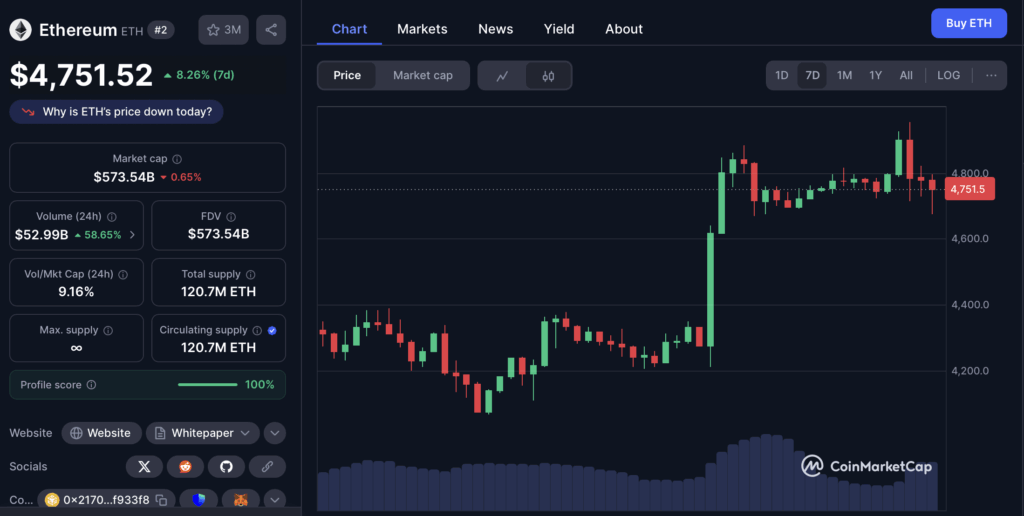

Ethereum is inching towards its all-time excessive close to $5,000, and merchants are buzzing about what comes subsequent. The second-largest crypto by market cap has been outpacing Bitcoin all summer season, pushed by robust institutional curiosity and fixed whale accumulation. After Jerome Powell’s Jackson Gap feedback hinted at potential charge cuts earlier than the top of 2025, danger property caught hearth—shares surged, Bitcoin jumped, and ETH ripped greater.

ETH Rockets Towards New Highs

On Friday alone, Ethereum soared from round $4,400 to $4,800 in underneath three hours, a close to 9% transfer that put it inside placing distance of latest highs. Bitcoin adopted, climbing again above $116K. On-chain information added one other bullish layer: Trump’s World Liberty entity scooped up 1,076 ETH for simply over $5M, an indication of deep-pocketed confidence. Large buys like that have a tendency to bolster upward momentum.

Efficiency and Lengthy-Time period Potential

Efficiency-wise, ETH is wanting stronger than ever. Over the previous month, it’s up 23%, and year-over-year it has gained 76%. Zoom out 5 years and also you’ll see a staggering 1,100% climb, cementing its place among the many world’s best-performing property. Many merchants now imagine that when Ethereum clears $5K, the subsequent leg greater may come shortly, with some calling for a transfer towards $6K within the close to time period.

Arthur Hayes Bets Large on ETH

In the meantime, some forecasts are even bolder. Former BitMEX CEO Arthur Hayes prompt ETH may mirror Bitcoin’s parabolic runs, probably reaching $20K earlier than this cycle ends. He revealed he’s “obese ETH” in comparison with Solana, reflecting his conviction in its long-term upside. Past hypothesis, Ethereum continues to solidify its position in real-world asset tokenization and stablecoin infrastructure. With the GENIUS Act boosting stablecoin readability within the U.S., ETH is more and more positioned because the spine for monetary tokenization and digital cash rails.