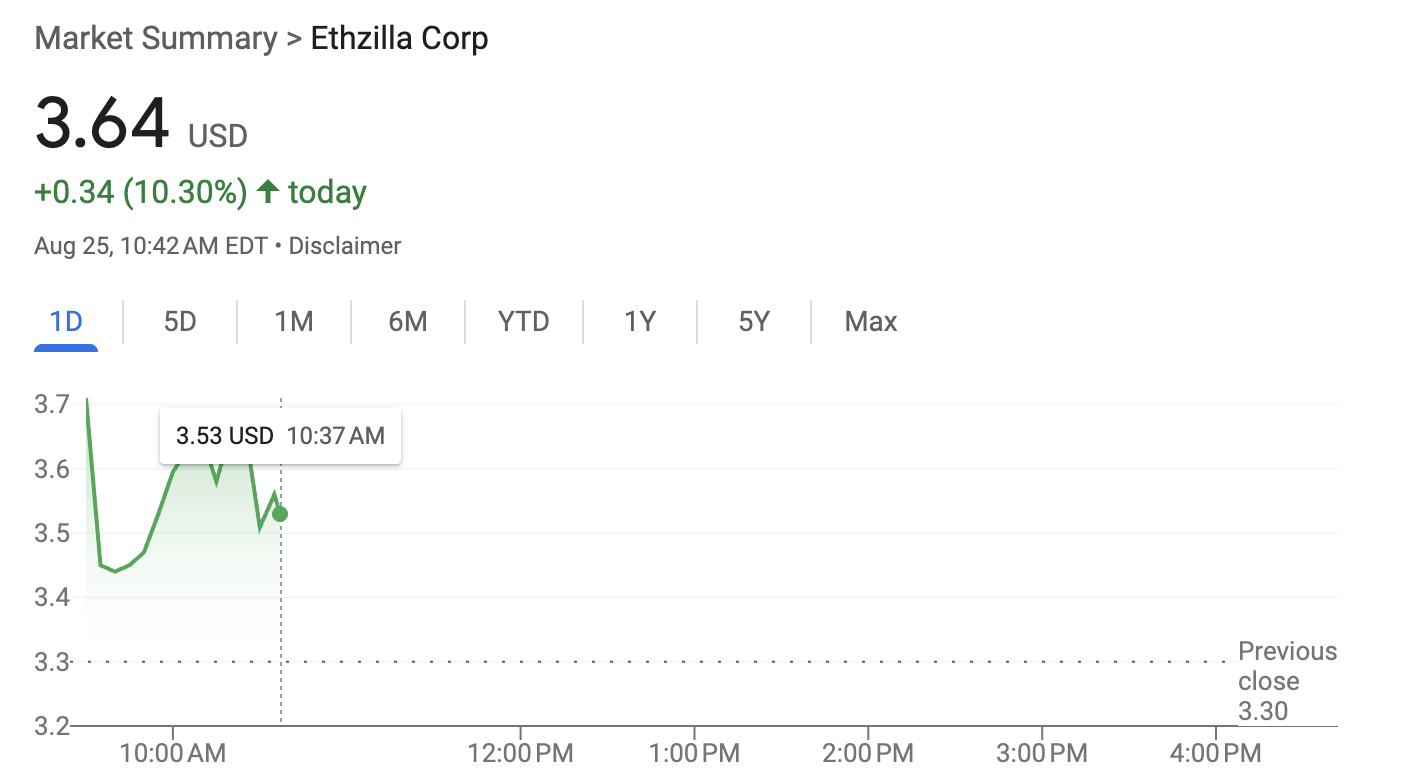

ETHZilla, an Ethereum treasury agency, introduced a $250 million inventory buyback after firm shares fell practically 30% final week. This precipitated a quick bounce, relieving inventory dilution issues.

Nonetheless, this sort of transfer gained’t instantly allow the following Ethereum buy. ETHZilla holds round $489 million in ETH, representing a current acquisition, nevertheless it must maintain constructing this stockpile.

ETHZilla’s Ethereum Plan

Ethereum has been doing effectively these days, reaching an all-time excessive final Friday, and company funding is doing quite a bit to energy the development. The token is receiving a number of institutional confidence, and one current growth illustrates this.

Though ETHZilla’s shares tanked after its final Ethereum buy, it’s making ready to do it once more:

“At ETHZilla, we proceed to deploy capital to speed up our Ethereum treasury technique with self-discipline and report pace. As we proceed to scale our ETH reserves and pursue differentiated yield alternatives, we consider an aggressive inventory repurchase program on the present inventory value underscores our dedication to maximizing worth,” claimed McAndrew Rudisill, Govt Chairman.

Particularly, the agency is conducting a $250 million inventory buyback to stabilize its valuation. Regardless of Ethereum’s strong efficiency, issues of share dilution sapped ETHZilla buyers’ confidence.

Final week, the corporate deliberate to supply 74.8 million shares to fund ETH purchases, representing a 46% within the complete variety of shares.

In different phrases, share dilution signifies that ETHZilla stockholders may lose cash, even when Ethereum continues rising.

To treatment this, the agency’s $250 million inventory buyback plan has helped momentarily stabilize issues, opening the door to future acquisitions:

A Temporary Reprieve

SEC paperwork associated to this buyback reveal that ETHZilla presently holds round $489 million value of Ethereum, making it a considerable personal holder.

That is considerably larger than the agency’s reported holdings final week, so it has made a strong buy not too long ago.

Nonetheless, a $250 million inventory buyback may even minimize into its buying capabilities. ETHZilla has attracted company funding, however inventory gross sales are its important automobile for ETH purchases.

These purchases, in flip, are the one manner it could promise future worth to potential buyers.

There’s an inherent contradiction right here. If this commerce collapses attributable to diminishing returns, it may trigger critical issues.

Inventory buybacks could carry short-term stability, however they will’t energy actual progress.

ETH staking its large treasury may present passive revenue, however Vitalik Buterin warned that this may not be sustainable both.

In different phrases, ETHZIlla could now be caught in an analogous pickle to Technique.

Final week, Saylor’s firm claimed it will begin promoting shares for different causes than BTC acquisition. This prompted somewhat backlash and fears that the agency is dropping its momentum.

ETHZilla’s new buyback program is equally untethered from Ethereum, though unverified social media rumors declare it purchased $35.2 million in ETH at this time.

Between this alleged acquisition and final week’s buy, the agency has some endurance. Nonetheless, it all the time must maintain transferring.

In any other case, the inherent dangers of a DAT technique may blow up in ETHZilla’s face.

The publish NASDAQ Listed ETHZilla Is Shopping for Extra Ethereum Regardless of Inventory Value Crash appeared first on BeInCrypto.