- Solana broke above $210 whereas surpassing Ethereum in DEX volumes for 10 consecutive months.

- Wormhole bridge knowledge reveals $222M inflows to Solana, outpacing Ethereum’s $183M.

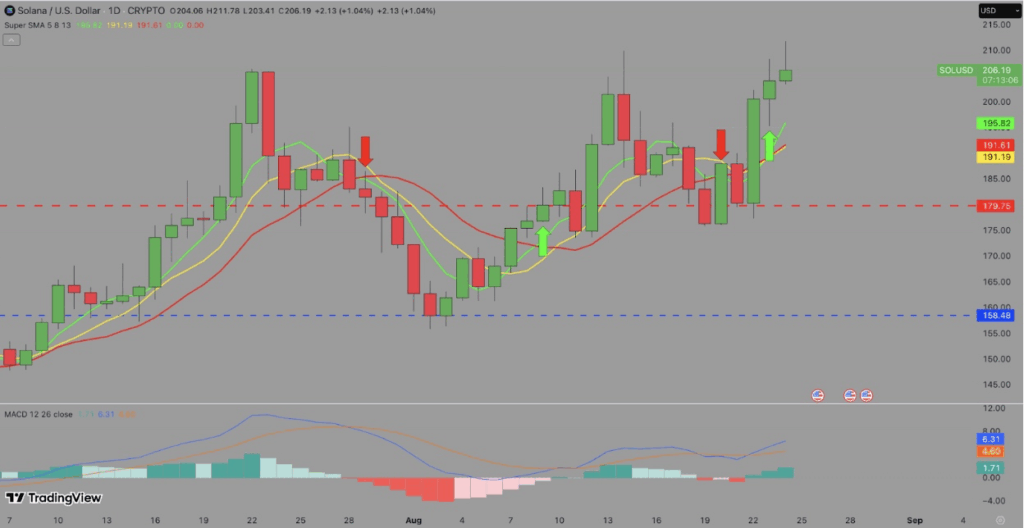

- SOL targets $215–$240 if $200 assist holds, with $191 and $179 as key draw back ranges.

Solana simply pushed previous $210 once more, clocking its highest degree since February, whereas a lot of the market cooled off over the weekend. Bitcoin, Ethereum, and XRP all gave again some features, however Solana’s rally stored grinding increased. What’s fueling it? Not simply Fed rate-cut hype—on-chain numbers present one thing greater at play. Solana has now crushed Ethereum in decentralized trade (DEX) volumes for 10 months straight, dealing with over $124 billion in trades in July alone, a 42% lead over ETH.

Liquidity Shifts Into Solana

Knowledge from Wormhole bridge highlights why this streak isn’t only a fluke. Solana captured 42.71% of all cross-chain transfers within the final 30 days, edging out Ethereum’s 42.53%. Capital flows are following too—$222 million got here into Solana via bridged inflows, in comparison with Ethereum’s $183 million. That’s not a small hole, and it suggests Solana is more and more the popular liquidity hub for DeFi transactions. In different phrases, it’s not simply hypothesis; actual demand helps carry SOL increased whereas different majors stall.

Technical Outlook: Holding the $200 Line

Worth-wise, SOL is consolidating above $205 with the 20-day SMA sitting close to $191 as a security internet. The MACD is flashing bullish momentum and RSI stays regular, supporting the case for continuation. Speedy resistance sits at $215, which traces up with March highs. A clear breakout there may arrange assessments at $228 and even $240 if momentum holds. The important thing, nevertheless, is defending the $200 degree. If that breaks, draw back strain may drag SOL again to $191, with a deeper slip concentrating on $179.

What’s Subsequent for SOL?

Proper now, Solana’s edge in DEX exercise and rising liquidity flows are performing as sturdy tailwinds. The truth that energetic customers preserve fueling demand in DeFi transactions provides to the bullish case. However as all the time, it comes with a warning—if broader crypto momentum stays weak, sustaining demand above $200 may show difficult. Nonetheless, so long as Solana holds that assist, the setup stays one of many extra compelling bullish tales available in the market.