Late Sunday night in Europe (August 24), Bitcoin abruptly slid from roughly $114,790 to $110,680 in about ten minutes — a drop of ~3.6% — earlier than stabilizing. On-chain watchers and derivatives dashboards level to a single giant vendor catalyzing the transfer and a cascade of lengthy liquidations ending the job.

Why Did Bitcoin Crash?

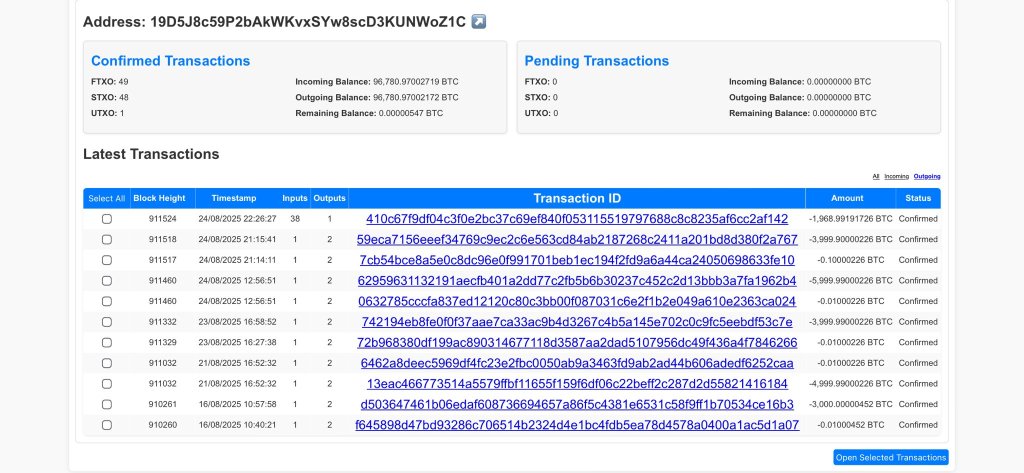

The primary thread of the story emerged on X from “Sani,” creator of TimechainIndex, who flagged a whale-scale cluster abruptly unloading stock by way of Hyperunite/Hyperliquid–linked pathways. In his phrases: “This entity liquidated their total 24k steadiness, sending all of it to Hyperunite. They transferred 12k simply right this moment and are nonetheless actively promoting, which is probably going contributing to the continued value drop.”

He adopted with the broader scope of the holdings and their provenance: This entity nonetheless holds a complete of 152,874 BTC throughout all related addresses, together with 5,266 BTC within the tackle proven beneath. The funds initially got here from HTX about six years in the past and had remained inactive till latest transactions involving one in every of their addresses containing roughly 24,000 BTC.”

Neighborhood replies captured the swirl of hypotheses round possession and intent. One person requested who these cash belong to. Sani ventured a guess, tying the origin again to historic Asian change flows: “Finest guess Justin Solar since they got here from HTX, most likely the cash bought by China 6 years in the past”

Some instructed an change pockets given the sheer measurement. Nevertheless, Sani cautioned that funds have been being routed from the cluster to Hyperunite/Hyperliquid after which on to Binance — indirectly from a Binance-owned pockets — arguing this sample made an in-house change pockets much less doubtless. “The funds are transferring from these addresses to Hyperunite to Binance so likely not Binance, in the event that they have been theirs they’ll transfer on to Binance,” Sani argued.

One other datapoint including warmth to the narrative: flows into Ether. An account often known as MLM (@mlmabc) tracked what it framed as an aggressive rotation: “This man is actually rotating the whole lot into ETH huh? Up to now he has bought 18.142K BTC value $2.04B at present costs. He’s now promoting the final 5.968K BTC ($670M), of which 4.968K BTC ($678M) continues to be exterior Hyperliquid.”

He added: “Up to now, the two entities have purchased 416.598K ETH mixed (at the moment valued at $1.98B) and longed 135.263K ETH ($642M) on perps, for a complete notional ETH publicity of 551.861K ETH value $2.62B. Out of the 416.598K ETH ($1.98B), 275.5K ETH ($1.3B) has been staked.”

These flows didn’t materialize out of nowhere. Final week, Sani had already flagged the primary motion from one of many dormant addresses: “An tackle holding 23,969 BTC has simply moved 3,000 BTC after remaining dormant for 5 years. These funds have been initially withdrawn from HTX, totaling 170,703 BTC throughout a number of addresses, and I believe them to be related to the cash bought by China on the time. Till yesterday, none of those funds had moved because the preliminary withdrawal.”

Futures positioning then turned a swift selloff right into a flush. Actual-time liquidation trackers confirmed a whole lot of hundreds of thousands of {dollars} in positions force-closed throughout the market into the downdraft, with BTC longs bearing the brunt. CoinGlass’ dashboards recorded $218.29 million in BTC lengthy liquidations on Sunday. Notably, this was the most important liquidation occasion since August 1 ($231.77 million) and June 12 ($299.41 million).

Technical context added tinder. Sunday’s slide arrange a contemporary CME Bitcoin futures “weekend hole” that many short-term merchants deal with as a magnet. As dealer Daan Crypto Trades cautioned on X: “If BTC have been to open up like this tomorrow, we’ll have a reasonably sizeable hole. You’ve most likely seen the observe report these gaps have been on the place we’ve closed just about all of them on Monday or didn’t even open up with a spot within the first place. Good stage to control. However as all the time, don’t solely base your evaluation on this single factor.”

At press time, Bitcoin traded at $112,511.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.