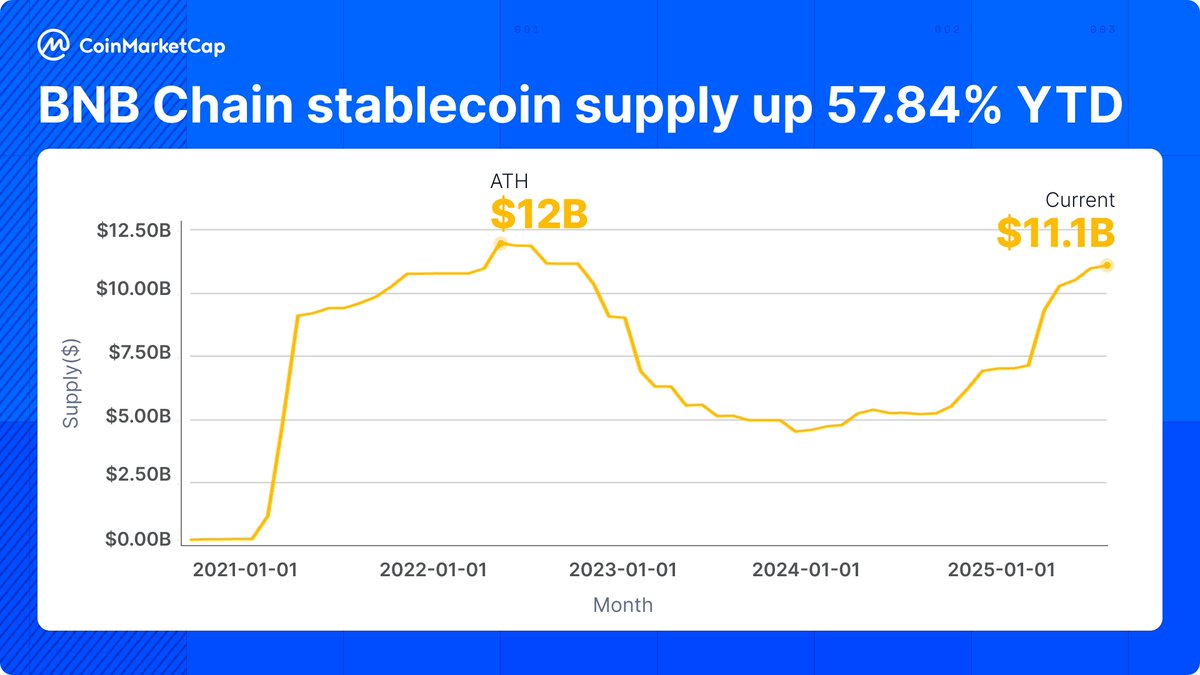

The BNB Chain is experiencing a pointy rebound in stablecoin exercise, with provide climbing 57.84% year-to-date and now sitting at $11.1 billion, in response to knowledge from CoinMarketCap.

That determine leaves the community simply $900 million away from its all-time excessive of $12 billion, reached in late 2022.

Resurgence After Market Downturn

Stablecoin provide on BNB Chain had fallen considerably throughout 2023 as broader crypto markets cooled and liquidity retreated. Nevertheless, 2025 has introduced a revival, with inflows accelerating over the previous six months. The renewed progress displays bettering sentiment throughout digital property, as merchants more and more park funds in stablecoins to place for market strikes.

Why It Issues

Stablecoins play a central function in crypto ecosystems by performing as the first base forex for buying and selling, lending, and DeFi functions. Rising provide on BNB Chain indicators:

- Elevated consumer exercise throughout exchanges and DeFi protocols constructed on the chain.

- Liquidity enlargement, making it simpler for merchants and builders to work together with decentralized functions.

- Renewed investor confidence, provided that stablecoin issuance usually grows throughout bullish phases of the market cycle.

Closing in on the Peak

At $11.1 billion, BNB Chain’s stablecoin provide is approaching the earlier excessive of $12 billion. If the development continues, the community may quickly surpass its document, setting a brand new milestone for liquidity on one of many largest good contract platforms within the business.

Outlook

With stablecoins persevering with to underpin market exercise, BNB Chain’s rising provide could also be a number one indicator of sustained demand in 2025. Ought to momentum persist, the chain couldn’t solely reclaim its earlier peak but in addition cement its place as one of many prime locations for DeFi and crypto buying and selling liquidity.