For Cardano’s ADA, ninety cents isn’t only a quantity; it’s a warzone. This particular value has constantly been a psychological line within the sand the place bulls and bears conflict, defining the path of the market’s greatest strikes.

In case you dig into ADA’s value chart from the start, you’ll see that the battle round this degree tells a narrative about market confidence and what’s probably coming subsequent.

You’ll be able to inform how vital this degree is by wanting on the buying and selling quantity and open curiosity in futures—each have spiked. It feels just like the market is coiling for an enormous transfer, and each side are inserting their bets.

The historical past of ADA’s dance with $0.90 has burned its significance into the market’s reminiscence for a number of causes –

- Reminiscence of previous cycles – Merchants who’ve been round bear in mind the drama at this degree. That reminiscence turns into a self-fulfilling prophecy, as individuals place purchase and promote orders anticipating one thing to occur proper there.

- Key pivot level – Repeatedly, what ADA does at $0.90 has predicted the market’s subsequent huge swing. Breaking by means of has meant good instances forward; getting rejected has meant extra draw back.

- Spherical quantity psychology – It’s not a greenback, however it’s shut. Holding sturdy above $0.90 seems like the ultimate step earlier than making a critical run on the huge $1.00 milestone.

So, ninety cents is rather more than a random value for Cardano. It’s a battle-scarred landmark that measures investor guts and factors to the place the worth is headed. As this cycle continues, the battle for management of the $0.90 degree will probably be a key chapter in ADA’s story.

On-chain metrics – A yr of fluctuating progress, a resilient DeFi ecosystem

A have a look at Cardano’s on-chain important indicators over the past yr revealed a blended bag – Each day customers and transactions ebbed and flowed, however the cash locked in its DeFi world proved surprisingly powerful. Even when the market cooled off, community upgrades and new tasks stored constructing a stronger basis for the long run.

Each day lively customers – A shifting panorama of engagement

The variety of individuals utilizing Cardano every day has bounced round, mirroring what’s occurring within the wider market. After hitting a excessive of over 50,800 lively addresses day by day in January 2025, issues quieted down. By the center of the yr, nonetheless, exercise was choosing again up, climbing in the direction of 30,900 day by day customers.

What’s actually attention-grabbing is the soar in dApp utilization, which hit a peak in April 2025 with a mean of over 150,000 individuals interacting with apps on the community every day. This indicators that extra individuals are really doing issues on Cardano, not simply holding the coin.

Transaction quantity – A story of two metrics

The story of Cardano’s transaction quantity is difficult, however encouraging. By mid-2025, the community was buzzing alongside, dealing with about 2.6 million transactions a day. This can be a huge leap, displaying extra individuals are utilizing the chain, and so they’re doing it cheaply—the typical payment has stayed below 1 / 4.

It’s vital to separate these on-chain transactions, which present precise use, from the buying and selling quantity on exchanges, which is all about hypothesis and market temper.

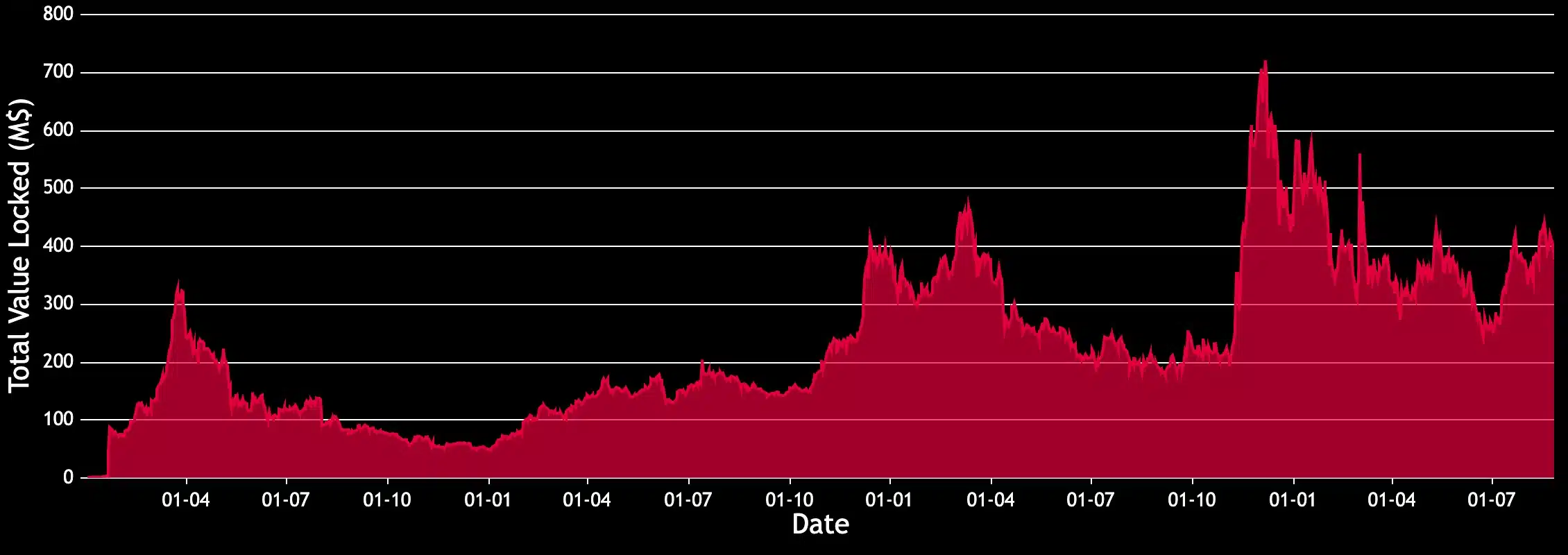

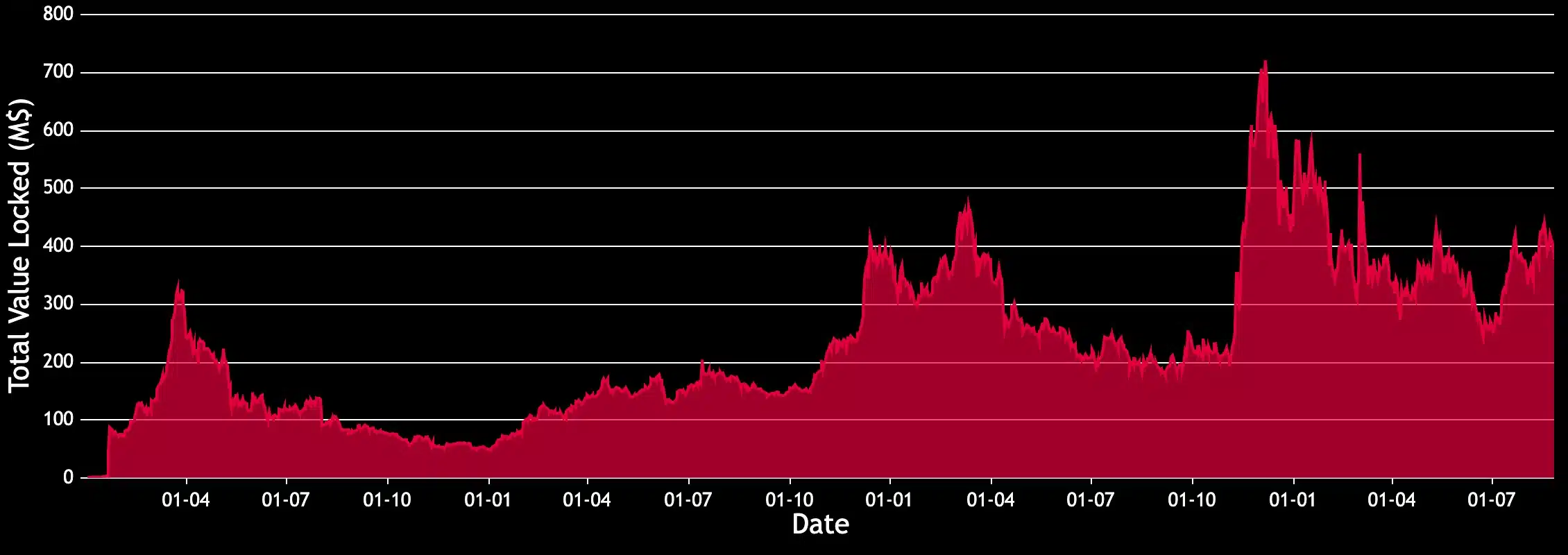

Whole Worth Locked (TVL) – A resilient and rising DeFi ecosystem

Cardano’s DeFi scene has proven actual grit. After the market took a dive early in 2025, it bounced again quick.

In June, the whole worth locked (TVL) shot as much as $431 million after an integration with Base. By mid-August, the DeFi TVL stood at a wholesome $349 million, with protocols like Liqwid Finance main the cost. This sort of progress reveals that actual cash and confidence are flowing into Cardano’s monetary apps.

Supply: Cexplorer.io

Evolution of Cardano’s on-chain metrics

The earlier yr was a time for Cardano to mature. Whereas day by day person counts and transactions went on a rollercoaster trip, the general image is certainly one of a rising ecosystem. The surge in dApp utilization and the sturdy comeback of its DeFi TVL are particularly good indicators for the long run.

Massive software program updates and new integrations have been key to protecting the community busy. The actual fact that there have been over 1,300 tasks actively constructing on Cardano in mid-2025 speaks volumes about its increasing utility.

Because the blockchain continues to get higher at dealing with extra customers and connecting with different chains, these on-chain numbers will inform us if it’s succeeding. The toughness it has proven over the previous yr suggests it’s constructed on stable floor.

Community upgrades shake up blockchain panorama

When Cardano and Ethereum rolled out main upgrades, they took wildly totally different routes to unravel their issues. Cardano’s Vasil onerous fork gave customers an instantaneous increase in velocity and a drop in prices, whereas Ethereum’s well-known Merge was extra about taking part in the lengthy sport, organising future payment reductions that arrived a lot later with the Dencun improve.

Effectivity and price discount

The Cardano Vasil onerous fork, which went reside in September 2022, was all about making the community quicker and cheaper. It launched intelligent adjustments like diffusion pipelining to hurry up blocks and Plutus v2 scripts to make sensible contracts run leaner. The outcome was an instantaneous and noticeable enchancment: extra knowledge may match into every block, which shrank the scale and price of transactions.

Ethereum’s Merge, additionally in September 2022, had a distinct most important aim – To change from the energy-guzzling Proof-of-Work to the a lot greener Proof-of-Stake. It was a large win for the surroundings, slicing vitality use by a surprising 99.95%. Nonetheless, the Merge itself didn’t do something to repair the community’s notorious site visitors jams or excessive fuel charges.

The true aid for Ethereum customers got here later, in March 2024, with the Dencun improve. This replace introduced in one thing referred to as proto-danksharding, which gave Layer 2 networks a less expensive strategy to retailer knowledge on the principle chain, inflicting their transaction charges to plummet.

Assessing developer exercise

How these upgrades affected builders is a extra difficult story. After its Vasil onerous fork, Cardano noticed an actual spike in core growth. Stories in 2024 and 2025 confirmed that at instances, Cardano’s builders have been extra lively on GitHub than Ethereum’s – A key signal of programmer engagement.

Ethereum, nonetheless, continues to be the 800-pound gorilla within the room, with an enormous and well-established group of builders. Whereas its core growth exercise may fluctuate, the sheer variety of individuals and tasks constructing on Ethereum is gigantic, with over 1,500 builders engaged on tasks in a single week in June 2025.

Cardano and Ethereum have proven there’s a couple of strategy to construct a greater blockchain. Cardano’s Vasil improve delivered instantaneous gratification with higher efficiency and decrease prices. Ethereum’s path has been extra step-by-step – The Merge constructed a sustainable basis, and the later Dencun improve lastly tackled the payment downside for its ever-growing assortment of Layer 2s.

Each methods are working in their very own methods, creating stronger and extra usable networks. The fixed race to innovate between these giants is finally a win for the individuals who use and construct on them.

Cardano’s dApp ecosystem – A flourishing panorama with fierce competitors

Cardano’s world of decentralized apps is buzzing with exercise by means of 2024 and into 2025. Extra money, customers, and tasks are pouring in. Whereas it’s nonetheless taking part in catch-up to the enormous that’s Ethereum, Cardano is constructing a popularity for being rigorously constructed and safe, even because it fights for consideration in opposition to super-fast rivals like Solana.

By mid-2025, over 1,300 tasks have been actively constructing on Cardano, displaying that builders are taking it significantly. This progress is seen on-chain, with over 17,400 Plutus sensible contracts now reside. The community now holds over 4.8 million wallets and is dealing with greater than 2.6 million transactions day by day, a lot of it pushed by app interactions.

The cash flowing into Cardano’s DeFi house has additionally climbed, hitting round $680 million by mid-2025 – Up 42% from the yr earlier than.

A handful of standout tasks are main the cost on Cardano –

- Minswap – That is the highest canine amongst Cardano’s 42 decentralized exchanges, holding $230 million in locked worth as of mid-2025.

- Liqwid Finance – A key lending and borrowing platform that kinds one other pillar of Cardano’s DeFi.

- JPG Retailer – The undisputed king of Cardano NFTs, dealing with many of the buying and selling quantity.

- Indigo Protocol – This platform for artificial property has seen its worth and quantity develop impressively.

Past finance, the NFT scene is prospering, with over 8.3 million NFTs minted and three.1 million distinctive house owners, proving the group is broad and engaged.

Street forward for Cardano

Cardano’s slow-and-steady, research-first philosophy has created a stable, safe blockchain that appeals to individuals who worth stability over hype. Its decrease charges make it a good various to Ethereum.

The problem, nonetheless, is that it strikes at a snail’s tempo in comparison with its rivals. To remain within the sport, Cardano must hold attracting builders and funky tasks whereas making its apps simpler to make use of. The Voltaire period, which palms governance over to the group, could possibly be a game-changer, probably dashing up progress by letting the customers name the pictures.

Cardano’s market sentiment – A blended, however evolving panorama

Making an attempt to get a learn on how individuals really feel about Cardano (ADA) is a sophisticated activity. On social media, you’ll discover a die-hard group, whereas information studies are extra cautiously hopeful. Nonetheless, the true story is perhaps with the large cash, the place institutional curiosity is clearly rising – An indication of a bullish long-term view.

In actual fact, current knowledge revealed a critical uptick in institutional curiosity. In 2025 alone, establishments have poured important money into Cardano, with ReserveOne knowledge displaying inflows of round $73 million, pushing complete institutional holdings previous the $900 million-mark.

“Whales” or large-scale buyers have been noticed shopping for up large quantities of ADA, a robust vote of confidence within the asset’s future. Analysts see this shopping for as a bullish signal, indicating a deal with long-term worth.

The truth that main asset managers like Grayscale are concerned provides much more weight to this development. The potential approval of a Spot Cardano ETF is the following huge domino to fall, which may open the floodgates to billions in new funding.

A wave of big-money curiosity is gathering round Cardano (ADA), setting the stage for what could possibly be a game-changing fourth quarter. A mixture of heavy shopping for by “whales,” sturdy odds of a U.S. spot ETF getting the inexperienced mild, and important community upgrades are all pointing in the direction of a possible flood of institutional money.

Technological developments as institutional magnets

This institutional curiosity isn’t nearly hypothesis; it’s additionally being pushed by main tech enhancements. The highly-awaited launch of the Hydra scaling answer on the principle community is ready to massively increase Cardano’s transaction velocity, probably as much as 1 million transactions per second. This improve will deal with scalability issues head-on, probably slicing down on community site visitors and costs.

One other key mission is the Midnight sidechain, a brand new blockchain centered on privateness that makes use of zero-knowledge proofs. Midnight is designed to fulfill the rising demand for knowledge safety within the crypto world.

The continuing Voltaire period, which is constructing out a totally decentralized governance system, additionally makes Cardano extra enticing to institutional buyers. The group just lately voted to approve a $71 million treasury allocation for protocol upgrades, proving that this governance mannequin is already working.

A have a look at Cardano’s staking ecosystem

Lastly, an evaluation of the identical tells us a really clear story – Holders have deep confidence within the mission’s future, and the community is extremely safe and decentralized. As of mid-2025, a large 67.3% of all Cardano in circulation was staked, totaling over 24 billion ADA. This participation seemed to be unfold out throughout greater than 3,200 lively stake swimming pools, proving that a large and engaged group is actively operating the community.

Supply: PoolTool.io

This excessive degree of staked capital is greater than only a quantity; it’s a large vote of confidence. By locking up their ADA, holders are usually not simply incomes rewards, they’re placing their cash the place their mouth is.

They’re betting on Cardano’s long-term success and making the community extra steady within the course of.

Top-of-the-line methods to guage a blockchain’s safety is to see how decentralized it’s. With hundreds of lively stake swimming pools, no single group has an excessive amount of energy to validate transactions. In actual fact, a current evaluation confirmed that the ten greatest swimming pools management lower than 11% of all staked ADA.

Cardano’s dedication to decentralization may also be measured by its excessive Nakamoto Coefficient. It tells you the minimal variety of impartial events it might take to compromise the community. For Cardano, that quantity is over 20 – Considerably greater than many different high blockchains.

Cardano made its staking system easy and open to everybody. Not like many different networks, you don’t need to lock up your ADA for any set period of time. Your staked cash are all the time liquid, which means you may transfer or spend them everytime you need. Plus, there’s no minimal quantity required to start out, so even somebody with a small quantity of ADA can assist safe the community and earn rewards.

This unimaginable safety offers holders much more confidence, which inspires them to maintain their property staked. This cycle of participation and safety is without doubt one of the elementary strengths that underpins your entire Cardano community.