SharpLink, typically dubbed the “ETH MicroStrategy,” is now buying and selling beneath the worth of the Ethereum it holds on its books.

This turnout fuels hypothesis of a significant market turning level, delivering a kind of uncommon indicators merchants wait years to see.

SharpLink’s NAV Low cost Sparks Debate Over Ethereum’s True Backside

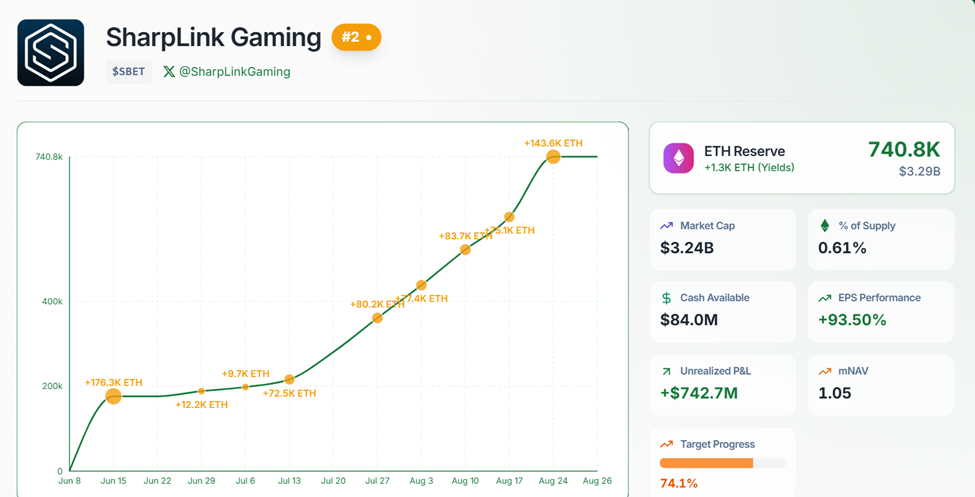

As of this writing, SharpLink’s whole market capitalization is $3.24 billion, barely beneath its Ethereum holdings, that are price $3.29 billion.

Notably, this marks a uncommon low cost, displaying traders worth the corporate at lower than the belongings it owns.

Crypto analyst AB Kuai Dong highlighted this anomalous situation. He defined that when Web Asset Worth (NAV) falls beneath 1, it indicators that the corporate’s fairness trades at a reduction to the ETH it controls.

“This additionally signifies that the general market worth of ETH MicroStrategy is decrease than the worth of the ETH belongings on its books. The underside-fishing reference line predicted by legendary merchants has lastly appeared this time,” Kuai Dong wrote on X.

For seasoned merchants, such NAV reductions are uncommon and infrequently interpreted as contrarian purchase indicators, suggesting capitulation could also be close to.

Analysts Eye Upside Targets Amid SharpLink’s Buyback Buzz and Retail Indicators

Final week, SharpLink introduced a $1.5 billion buyback program when its market cap hovered round $3.2 billion. This implies a buyback intervention to rake in almost half its excellent worth.

This information triggered a slight climb for its inventory, SBET, which moved from $18 to $21 earlier than slipping again to $19.17 as of this publication. At a structural stage, the NAV ratio has turn into a buying and selling compass.

“When mNAV > 1: swap shares for cash. When mNAV < 1: purchase again shares…comply with the treasury firm’s strikes,” an X consumer defined.

Nevertheless, traders ought to conduct their very own analysis, as sentiment additionally hinges on the Ethereum value motion.

Elsewhere, Donald Dean highlighted SharpLink’s positioning as a compelling threat/reward wager. The economist projected aggressive upside targets if ETH rises.

In his NAV-linked mannequin, SharpLink’s inventory might attain $37.22 at ETH $4,600, $40.37 at ETH $5,000, and $48.28 at ETH $6,000.

In the meantime, SharpLink itself doubled down on its ETH-first mission, revealing the pivot in a latest put up.

“At SharpLink, we’ve two main targets: Elevate capital to purchase ETH and put that ETH to work to generate yield on behalf of shareholders,” the corporate articulated.

Nevertheless, the technique faces criticism, with some, akin to crypto commentator Grubles, stating the chance price of ETH staking.

“T-Payments yield greater than ETH staking. So that you’re leaving cash on the desk by staking ETH,” Grubles challenged.

For a lot of in crypto, the SharpLink low cost is much less about company treasury mechanics and extra about Ethereum’s long-awaited backside.

Some merchants see the NAV < 1 phenomenon as a line within the sand, the place valuations disconnect from fundamentals earlier than snapping again in bull cycles.

As of this writing, Ethereum was buying and selling for $4,415, down by almost 5% within the final 24 hours.

If ETH turns upward from right here, the SharpLink NAV sign may very well be an early indicator, suggesting the beginning of a broader Ethereum-led market rebound.

The put up “ETH MicroStrategy” SharpLink Trades Under NAV — Is Ethereum Bottoming Out? appeared first on BeInCrypto.