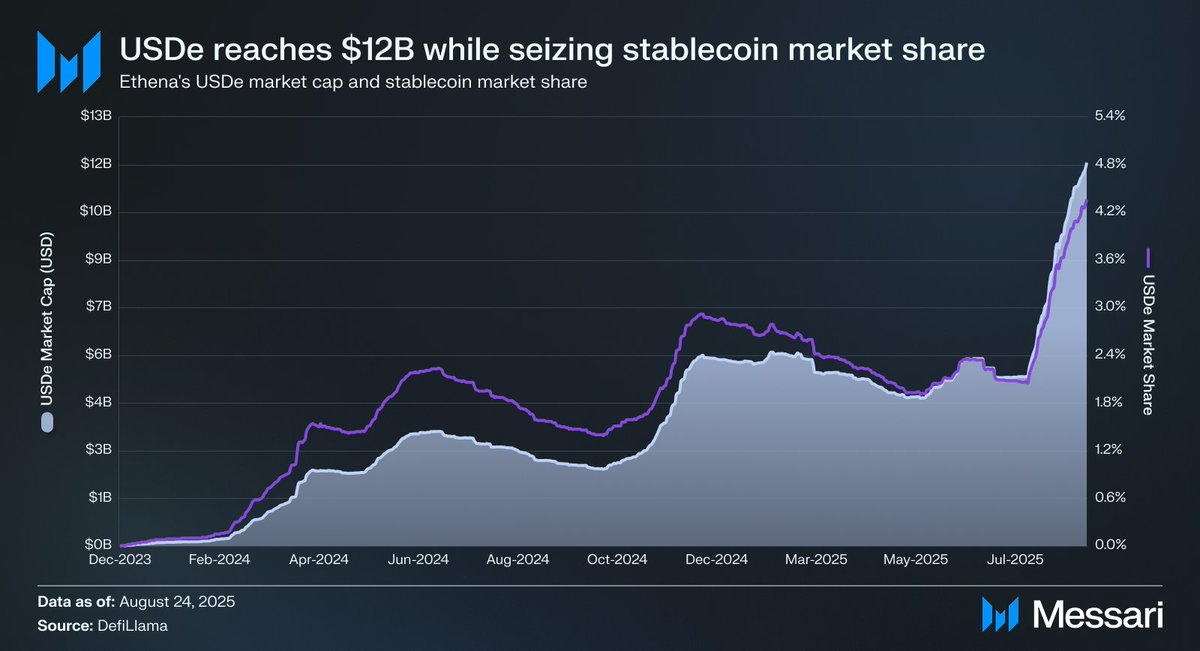

Ethena Labs’ artificial greenback, USDe, has crossed the $12 billion market cap milestone, securing greater than 4% of the worldwide stablecoin market, in accordance with Messari information.

The rise cements Ethena’s rising affect in a sector lengthy dominated by Tether and Circle.

Perpetual funding fuels momentum

A lot of USDe’s development has been fueled by rising perpetual funding charges, which have greater than doubled because the second quarter. Common charges climbed from 3.94% to 9.21%, creating a positive setting for Ethena’s mannequin, which thrives on arbitraging these funding flows in opposition to declining treasury yields.

A bullish setup for $ENA

Messari highlighted that this reflexive enterprise mannequin makes ENA, Ethena’s governance token, significantly engaging in bullish situations. Anticipation can be constructing across the venture’s Digital Asset Treasury (DAT) launch, which might deliver extra institutional inflows.

Macro backdrop provides weight

The timing of this development coincides with Jerome Powell’s latest hawkish Jackson Gap speech, which rattled conventional markets and pushed buyers to re-examine yield-bearing options like stablecoins.

With USDe’s fast ascent and ENA’s bullish setup, analysts counsel Ethena is positioning itself not simply as one other stablecoin issuer, however as a possible disruptor within the subsequent section of digital asset infrastructure.