Be a part of Our Telegram channel to remain updated on breaking information protection

Ethereum topped its 2021 all-time excessive (ATH) to succeed in $4,946 as Bitcoin suffered a flash-crash, pushing 24-hour liquidations previous $800 million and forcing the Crypto Concern and Greed Index under 50.

The crypto house fell over 2% within the final 24 hours to a market capitalization of $3.94 trillion.

ETH additionally traced from the brand new peak to commerce at $4,577 as of 4:16 a.m. EST, whereas Bitcoin fell greater than 2% within the final 24 hours to commerce at $111,768.

The most important 24-hour losers embody Mantle (MNT) (11%), Pudgy Penguins (PENGU) (9.85%), and OKB (OKB) (9.44%), in response to CoinMarketCap information.

In the meantime, the highest gainers have been Monero (XMR), VeChain (VET), and XDC Community (XDC), experiencing 2.67%, 2.50%, and 0.33% value will increase, respectively.

Ethereum Value Hits Report $4.9K, Breaking 2021 All-Time Excessive

After attaining a brand new ATH, the Ethereum value entered a correction section.

The latest surge is a part of a longer-term pattern that has seen the value of Ethereum soar 74% within the final 3 months.

August has been a major month for the Ethereum token, after spot ETH exchange-traded funds (ETFs) recorded a large $2.79 billion in web inflows, information from Coinglass exhibits.

In line with NovaDius Wealth Administration President Nate Geraci, there was a notable shift within the inflows between spot ETH ETFs and spot BTC ETFs.

Spot eth ETFs w/ $340mil inflows yesterday…

To this point in August:

Spot eth ETFs = $2.8bil inflows

Spot btc ETFs = $1.2bil *outflows*

Since starting of July:

Spot eth ETFs = $8.2bil inflows

Spot btc ETFs = $4.8bil inflows

Notable latest shift.

— Nate Geraci (@NateGeraci) August 23, 2025

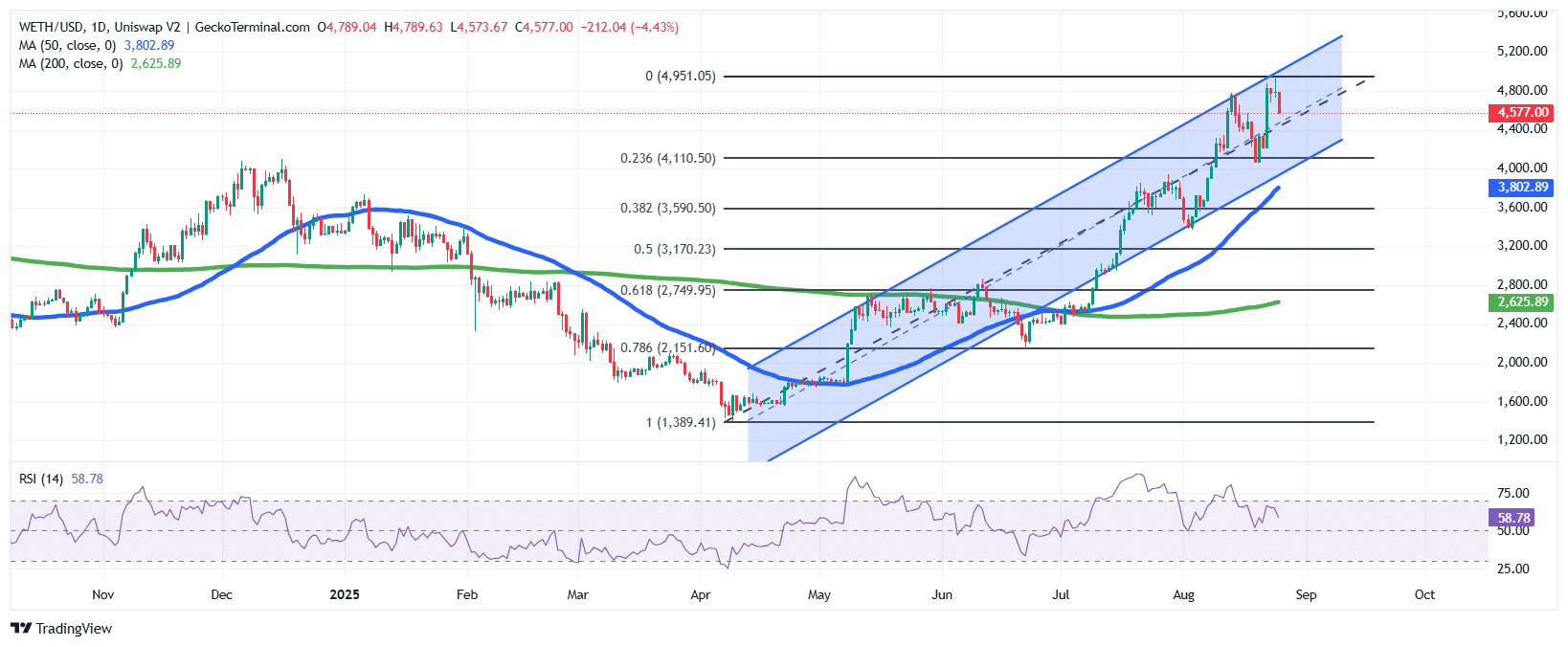

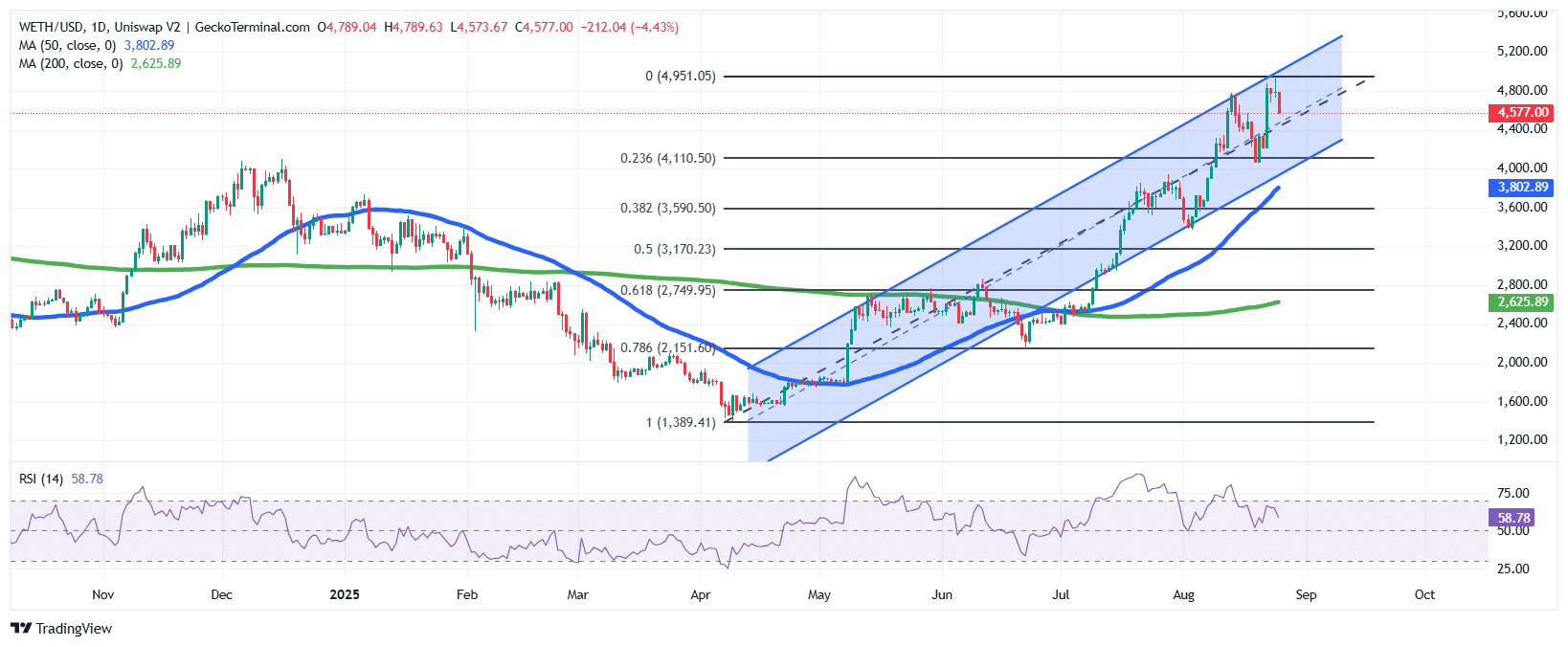

After bottoming out in April, ETH has climbed steadily, breaking by key Fibonacci retracement ranges and most not too long ago going through resistance close to $4,950 earlier than pulling again on the every day chart.

The worth of ETH stays effectively above each the 50-day and 200-day Easy Shifting Averages (SMAs), reinforcing the energy of the continued uptrend.

In the meantime, the Relative Power Index (RSI) is at 58, suggesting wholesome energy with out being in overbought territory, leaving room for additional upside.

ETH appears set to retest the $4,950 stage, and if it breaks decisively, a push past $5,200 is feasible.

Nevertheless, if the channel help is examined, the $4,100 (0.236 Fib stage) zone turns into the primary key stage to observe for a bounce.

In line with a crypto analyst on X, known as Crypto Stream, ETH might nonetheless soar on condition that the present drop from the ATH doesn’t present on the weekly chart.

Your portfolio is likely to be down after this predatory weekend value motion, the place you bought baited into longing the ATH breakout.

Whereas it is horrendous on the five-minute chart, I encourage you to zoom out slightly.

Ethereum is presently in a parabolic growth, and this little dip… pic.twitter.com/MbItvQw9GZ

— Crypto Stream (@CryptoStreamHub) August 25, 2025

ETH might lose steam in September, in response to crypto dealer CryptoGoos, who stated the altcoin’s value has traditionally corrected throughout post-halving years.

$ETH seasonality in September throughout post-halving years is usually adverse.

Will this time be completely different? pic.twitter.com/h9hJ40V3np

— CryptoGoos (@crypto_goos) August 22, 2025

In line with one other X person, Satoshi Stacker, any time ETH has gained in August up to now, it has skilled a correction in September.

Bitcoin Flash Crash Causes $800 Million Liquidations

Bitcoin suffered a sudden flash crash on Sunday evening, shedding over 3% inside minutes. The sudden crash was triggered by a single whale who unloaded 24,000 BTC to purchase ETH.

JUST IN: #Bitcoin flash crash at present, which worn out $310M in lengthy positions, has been traced to a SINGLE Bitcoin whale dumping BTC for ETH.

The whale offered 24,000+ BTC, together with cash that hadn’t moved in 5+ years, sending 12,000+ #BTC at present alone to the Hyperunite buying and selling… pic.twitter.com/h5jEt92Sys

— Jacob King (@JacobKinge) August 24, 2025

That precipitated BTC to drop from $114,790 to $110,680 in a matter of minutes, catching merchants off guard.

The crypto market chief has since recovered to commerce above the $111,000 stage.

In line with Coinglass liquidation information, the sudden value swings erased $811 million in positions. In complete, 164,316 merchants have been liquidated inside hours of the drop. The biggest single liquidation order was for BTC/USDT on OKX, valued at $12.49 million.

Bitcoin lengthy positions confronted the heaviest losses, with $254.17 million worn out from these bullish bets, whereas Ethereum longs misplaced $248.78 million. Smaller altcoins additionally noticed liquidations, although to a lesser diploma.

In the meantime, the Crypto Concern and Greed Index dropped under 50 to 47, however nonetheless signifies that investor sentiment out there stays “Impartial.”

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection