- HBAR bounced almost 2% from $0.2288 help however faces blended technical indicators.

- Open curiosity fell under $400M, displaying capital outflows, but taker buys and lengthy/quick ratios trace at cautious optimism.

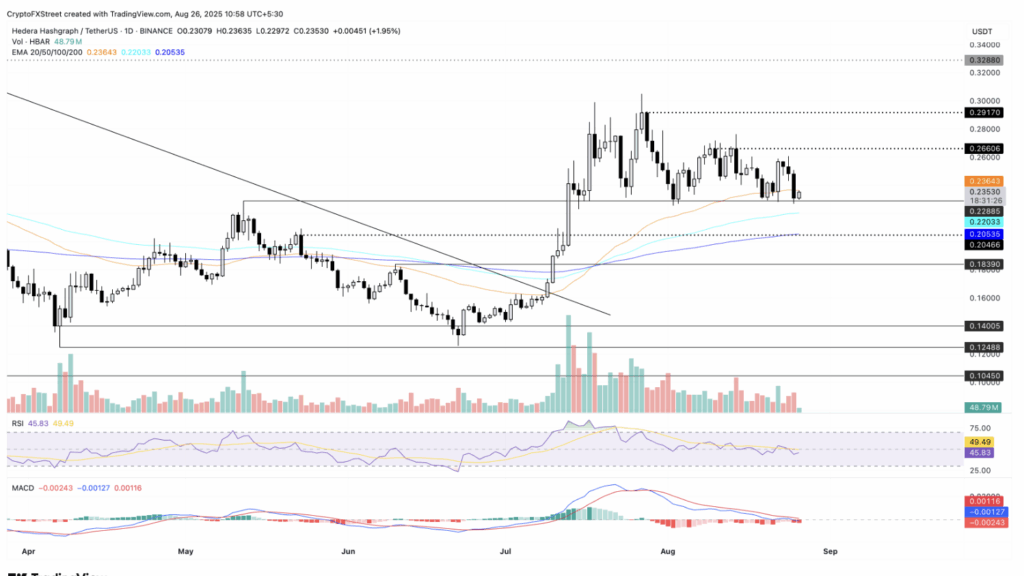

- A detailed above the 50-day EMA might ship HBAR towards $0.2660, whereas shedding help dangers a slide to $0.2203.

Hedera (HBAR) managed to tick greater by almost 2% on Tuesday, snapping a tough three-day shedding streak. The token rebounded from an important help degree, giving bulls a little bit of respiratory room at the same time as open curiosity retains slipping. For now, although, the charts look slightly indecisive, leaving room for each consolidation and one other transfer decrease.

Derivatives Present Conflicting Indicators

Contemporary numbers from CoinGlass reveal that Hedera’s open curiosity (OI) slid again underneath the $400 million mark, settling round $391.8M in comparison with $409M simply the day earlier than. That dip factors to merchants pulling cash out of HBAR derivatives, seemingly tied to current liquidations.

Even so, sentiment isn’t utterly within the gutter. Taker purchase quantity climbed to 48.55% from 47.63% the day earlier than, and the long-to-short ratio inched as much as 0.9436. Principally, some merchants are leaning again towards the bullish facet, at the same time as general positioning appears to be like lighter than final week.

Worth Motion Fights to Reclaim EMA

On the spot facet, HBAR bounced cleanly off $0.2288 help, marking a close to 2% elevate on the day. That transfer lower quick the current shedding streak and put eyes again on the 50-day EMA at $0.2364. A strong shut above there might open the door for a run towards $0.2660, final seen in mid-August.

Nonetheless, momentum is shaky. The MACD and sign line are hovering dangerously near flipping underneath the zero line, which might flash a promote sign and trace at additional bearish momentum. In the meantime, the RSI sits at 45, hovering just below impartial — not precisely a screaming purchase sign.

What’s Subsequent for HBAR?

If consumers can maintain defending the $0.2288 degree, Hedera has a shot at reclaiming misplaced floor. But when that line offers manner, draw back stress might drag it again to the 100-day EMA at $0.2203. Merchants watching the charts are caught between a hopeful bounce and the chance of one other breakdown — the subsequent few periods ought to make the path lots clearer.