On this planet of company crypto, two names stand out, they usually couldn’t be extra totally different. One firm is a fanatic, leveraging every little thing to purchase extra Bitcoin. The opposite dabbled, acquired spooked, and now sits on the sidelines.

The final quarter of the 12 months is about to place each playbooks to the final word check, and the outcomes may sway how different firms resolve to dip their toes within the water.

MicroStrategy – The all-in Bitcoin whale

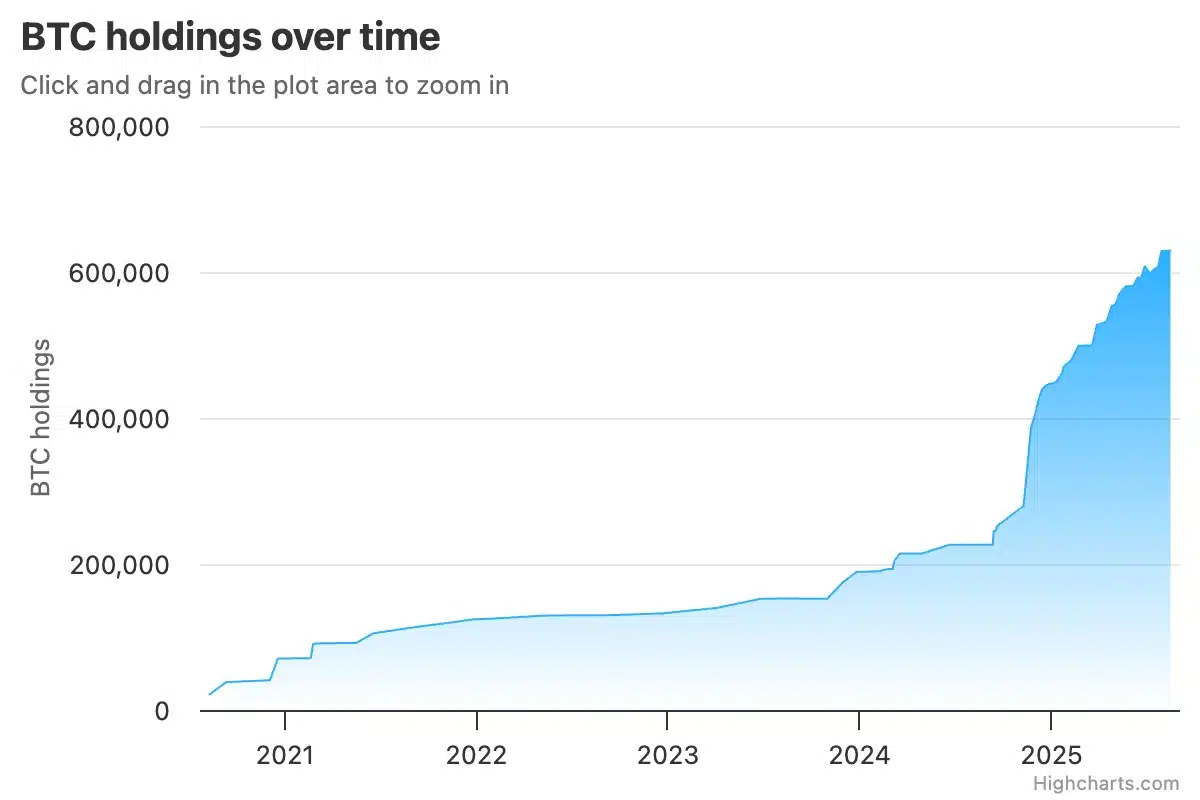

Michael Saylor’s MicroStrategy isn’t only a firm that owns Bitcoin; it is a Bitcoin firm now. His obsession has made it the most important company whale on the market. The agency’s playbook is easy – Purchase Bitcoin and by no means, ever promote. By its final depend in August 2025, the stash had ballooned to a mind-boggling 629,376 BTC.

Supply: MicroStrategy’s BTC holdings/BitBo

This mountain of crypto wasn’t constructed with spare money. MicroStrategy constructed a cash machine, issuing billions in debt and new inventory particularly to vacuum up extra cash, particularly when costs dip.

It’s a suggestions loop – they purchase BTC, the value motion helps their inventory, they usually use their pricier inventory to boost more cash to purchase extra BTC.

Tesla – As soon as bitten, twice shy HODLer

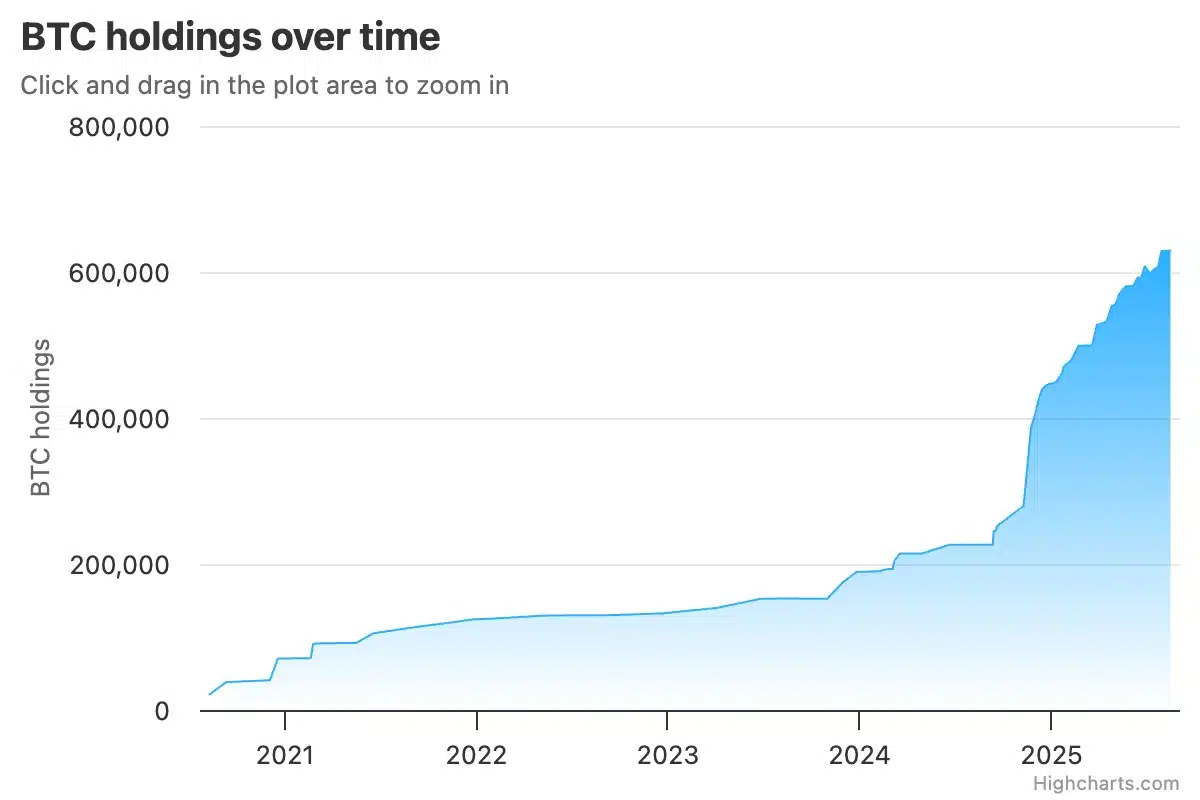

Then, there’s Tesla, whose Bitcoin journey has been as erratic as an Elon Musk tweet. The carmaker cannonballed into the market in 2021 with a $1.5 billion purchase, briefly let clients pay with it. Nevertheless, it then yanked the plug, blaming a responsible conscience over mining’s power use. That one transfer despatched the market right into a tailspin.

In contrast to Saylor’s diamond-hand strategy, Tesla cashed out large, promoting off about 75% of its stack for practically a billion {dollars} in mid-2022. Musk mentioned it was about shoring up money, not a judgment on Bitcoin itself.

Supply: Bitcoin Treasuries

Now, they only sit on what’s left – An estimated 11,509 BTC.

An accounting rule that modifications every little thing

The whole lot modified in This fall final 12 months because of a monster new accounting rule. Earlier than, the bean counters had a bizarre system – Firms may report when their crypto misplaced worth, however by no means when it gained worth till they bought. It was all ache, no paper achieve.

Since 15 December 2024, that’s over. The Monetary Accounting Requirements Board’s new rule (ASU 2023-08) forces firms to mark their crypto holdings to their actual, present market worth each quarter.

These swings, up or down, will move immediately into the online earnings line on their earnings experiences. A Bitcoin rally may make their earnings look gigantic. A crash may make them look disastrous, even when they didn’t promote a single coin.

How does Wall Avenue see these shares?

This new accounting actuality will mess with investor heads, however the market already treats these two shares very in a different way.

- MicroStrategy (MSTR) – This inventory is principally a Bitcoin ETF with a CEO. Its worth is welded to Bitcoin’s, transferring in lockstep however with far more volatility. If you wish to wager on Bitcoin with out opening a crypto account, you purchase MSTR. That leverage cuts each methods, although; when Bitcoin sneezes, MSTR will get the flu.

- Tesla (TSLA) – This can be a complete different story. The preliminary Bitcoin purchase briefly tied the inventory to crypto, however not anymore. Buyers care about automotive deliveries, battery tech, and AI guarantees. Musk can nonetheless jolt the crypto market with a tweet, however his firm’s inventory now marches to the beat of its personal drum.

Financial crosscurrents and crypto wildcards

After all, none of that is occurring in a bubble. The broader financial system can have its say in This fall. All eyes are on the Federal Reserve. If they begin chopping rates of interest, buyers may really feel courageous sufficient to pour cash into riskier issues like Bitcoin. In the event that they keep hawkish to battle inflation, that might kill the temper. The spiraling U.S. finances deficit can be lurking within the background, pushing some to see Bitcoin as a protected harbor from a devaluing greenback.

Contained in the crypto world itself, the massive drama is the SEC. The company has a stack of purposes for brand new crypto ETFs—for cash like Solana, XRP, and Litecoin—with deadlines hitting in October. A wave of approvals may open the floodgates for giant cash. A string of rejections may ship the market packing.

So, the stage is about for a captivating closing quarter.

You’ve MicroStrategy, the loud and proud accumulator, doubling down repeatedly.

And, you’ve got Tesla, the quiet large, sitting on its stack with an unreadable poker face.

Their clashing philosophies present simply how messy and unsure the company path into digital cash actually is.