Ethereum staking retains rising quickly. By August 2025, greater than 36 million ETH had been staked, which is roughly 30% of the overall provide. This can be a important milestone and price noting as a result of it displays broad confidence within the community.

Individuals’s confidence in Ethereum’s Proof-of-Stake mannequin appears to be rising. It isn’t nearly buying and selling anymore. Many holders are maintaining their cash for the long run, partly to earn yield and partly to help the community.

Staking rewards individuals in two methods. First, you assist safe the community. Second, you accumulate common payouts. Given these advantages, it’s comprehensible why traders are asking the place to stake their ETH safely at the moment.

A Billion-Greenback Vote of Confidence

Some of the notable strikes this 12 months got here from a well known Bitcoin holder who shifted a part of their portfolio into Ethereum. They staked 269,485 ETH on the Beacon Chain, a place valued at round $1.25 billion on the time. That’s an attention-grabbing quantity by any measure.

Company gamers are additionally getting concerned. SharpLink Gaming, for instance, reported whole ETH holdings of 797,704, with rewards of practically 1,800 ETH already gathered.

The takeaway appears clear, although it’s at all times doable circumstances may change. Staking is now not restricted to retail traders. Giant holders and establishments view it as a severe earnings technique reasonably than a distinct segment experiment. That is value noting as a result of it might affect how smaller traders strategy staking.

Regulators Weigh In

Regulation has lengthy been unsure in crypto. Just lately, the U.S. Securities and Alternate Fee (SEC) clarified that sure staking actions, together with liquid staking tokens, are usually not thought-about securities.

This steerage gives some reassurance for each particular person holders and bigger funds who wish to take part with out authorized threat.

The SEC can also be reviewing proposals for Ethereum ETFs that would embrace staked ETH. If permitted, such merchandise would possibly convey staking nearer to mainstream monetary markets. Notably, this might encourage extra traders to discover staking as a technique.

Why Staking Appeals Regardless of Market Swings

Ethereum is presently buying and selling at roughly $4,440. Costs fluctuate from week to week, typically sharply. Staking gives rewards in ETH that accumulate over time, no matter short-term volatility. In apply, this usually implies that holders can earn even when costs aren’t transferring a lot.

One other issue to contemplate is provide. ETH that’s staked is successfully faraway from circulation, decreasing liquidity on exchanges. If demand continues, this smaller float may apply upward stress on the value.

Some analysts recommend that by 2026, over 40% of Ethereum’s provide could also be staked. If that happens, it may symbolize a significant shift in how liquid the asset is. In apply, predictions needs to be taken with warning, however the development is obvious.

Protected Staking Choices in 2025

None of this eliminates the necessity for warning. Staking by centralized exchanges is handy, however it requires trusting a 3rd celebration with custody of your ETH. If the platform experiences issues, your belongings may very well be in danger.

Coinbase, for example, is fashionable because of its ease of use. Nevertheless, yields there are sometimes decrease than these out there by different strategies.

Extra skilled traders are exploring options, similar to decentralized protocols and non-custodial wallets. These choices provide greater rewards whereas letting customers retain management of their funds, which is usually most well-liked by long-term holders.

$ETH Staking Alternate options

As ETH traders hunt for non-custodial wallets that enable them to maximise staking rewards with out shedding full management of their belongings, one identify that continues to earn their consideration is none apart from Greatest Pockets.

This non-custodial pockets, which emerged late final 12 months, has shortly turn out to be a favourite amongst crypto customers, all due to its no-KYC mannequin, ease-of-use, security-focused design, and big selection of options.

Not solely does it enable customers to purchase Ethereum with fiat or different tokens, it additionally connects them to ETH staking swimming pools like Lido and Rocket Pool, permitting them to place their tokens into greatest use and optimize returns with out leaving the app.

Not like centralized platforms, staking on Greatest Pockets is automated and versatile, guaranteeing that customers can get entry to their earnings anytime that they need. It shows real-time efficiency metrics similar to reward charges, validator standing, withdrawal timelines, including a layer of transparency to the general ETH staking expertise.

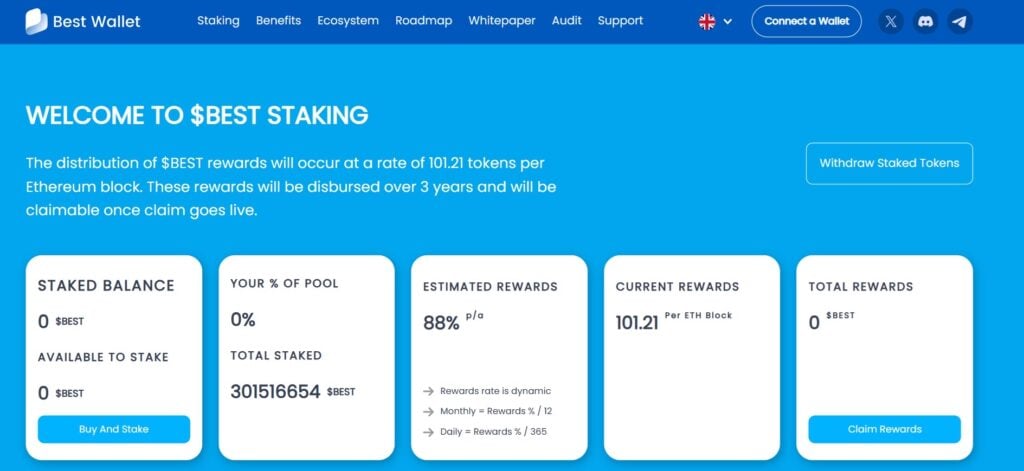

Past ETH, Greatest Pockets additionally provides high-yield staking choices for different crypto belongings. The truth is, its native token BEST, which is presently in a pre-launch stage, provides a considerably greater staking APY than ETH and different supported altcoins, amplifying early traders’ total returns, even earlier than it arrives on exchanges.

And for ETH traders trying to diversify into new, high-potential launches with out the effort of navigating a number of interfaces, Greatest Pockets delivers by its Upcoming Tokens characteristic.

Mainly, Greatest Pockets is a multichain pockets, supporting a number of the largest blockchain networks already. The entire concept is so as to add help for over 60 blockchains, and it has already hit the bottom operating by integrating fashionable networks like Bitcoin, Ethereum, Base, Polygon, Binance Good Chain, and Solana.

Swap charges are actually extra clear, due to its newest v2.10 replace, which additionally included help for Bitcoin swaps, the Korean language, and gamified rewards for lively customers.

Safety shouldn’t be left to likelihood, because it has already collaborated with cutting-edge instruments like Fireblocks to guard customers’ funds from malicious assaults. This, coupled with its non-custodial mannequin, has made it a go-to hub for each investor scouting for the perfect $ETH staking options in 2025.

Go to Greatest Pockets

This text has been supplied by one among our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please remember our industrial companions might use affiliate packages to generate revenues by the hyperlinks on this text.