- Whale exercise is shrinking, with PEPE’s worthwhile provide hitting a two-month low of 37.6%.

- Derivatives market information exhibits capital outflows, damaging funding charges, and a rising brief bias.

- Technicals stay bearish, with dangers of a drop towards $0.00000900 except bulls reclaim resistance.

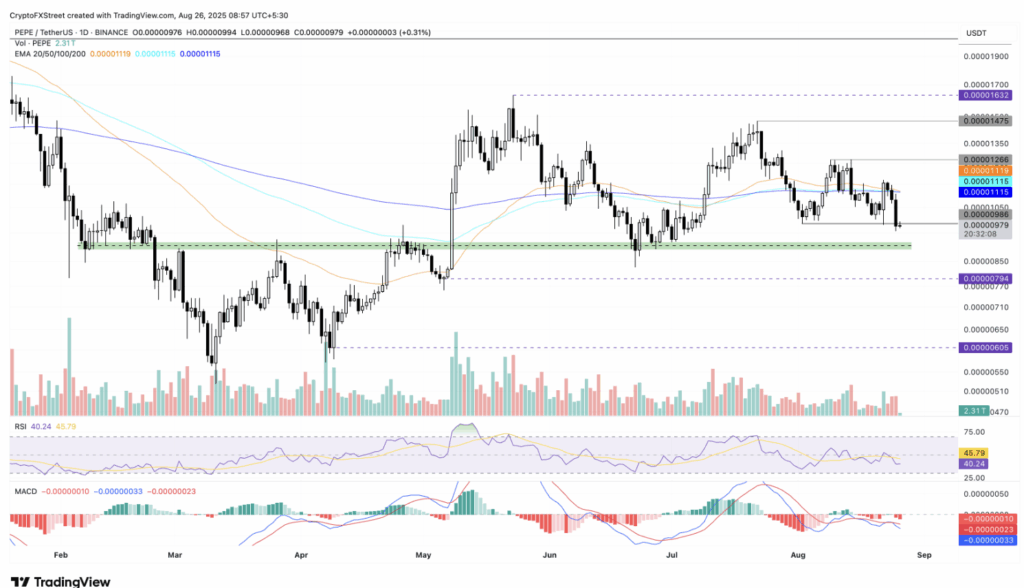

Pepe (PEPE) managed a slight 1% restoration Tuesday after tumbling practically 10% the day earlier than, slipping beneath the important thing $0.00001000 stage. Regardless of the bounce, on-chain and derivatives information proceed flashing weak spot, leaving room for extra draw back.

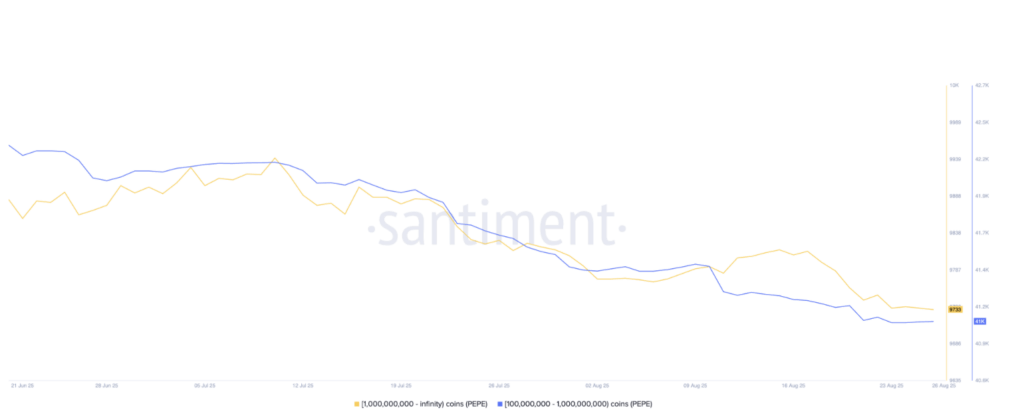

Whale Exit Provides Stress

Santiment information exhibits giant pockets holders are steadily exiting. Buyers with 100M–1B PEPE dropped to 41,058, down from 41,506 earlier this month, whereas wallets holding over 1B cash slipped to 9,725 from a 9,815 peak. As these whales step away, the entire provide in revenue has fallen to only 37.6%, its lowest in two months—signaling extra overhead strain.

Derivatives Market Turns Threat-Off

CoinGlass information paints an identical image. Open curiosity in PEPE fell 8% in 24 hours to $556.9M, with damaging funding charges (-0.0168%) exhibiting merchants paying to remain brief. The lengthy/brief ratio has slid to 0.89, which means shorts dominate. Collectively, this highlights waning confidence and a stronger bearish tilt.

Technicals Level to Deeper Decline

After briefly retesting $0.00000986 as resistance, PEPE dangers dropping additional to the $0.00000900 demand zone. A looming demise cross, with the 50 and 100-day EMAs closing in on the 200-day EMA, provides to bearish fears. MACD stays damaging, RSI hovers at 40 close to oversold, and momentum clearly favors sellers.

For any actual revival, PEPE wants a powerful day by day shut above resistance, doubtlessly focusing on the 200-day EMA at $0.00001115. Till then, the draw back case dominates.