Neglect the standard crypto hype. The dialog round Chainlink (LINK) hitting $150 isn’t simply wishful pondering anymore. This daring prediction comes from a mixture of arduous information – Huge-money gamers are shopping for up LINK, the mission is changing into the spine for tokenizing real-world property (RWA), and its personal financial design is constructed to reward development.

A glance underneath the hood reveals a community buzzing with new customers and heavyweight traders quietly including to their positions. Because the strains blur between Wall Road and crypto, Chainlink is positioning itself because the bridge, forcing a significant rethink of its worth.

Actual-world asset gold rush – Chainlink is the important plumbing!

Everybody agrees the subsequent gold rush in crypto is bringing real-world issues—like actual property, shares, and bonds—onto the blockchain. Boston Consulting Group sees this market ballooning to $16 trillion by 2030, whereas the World Financial Discussion board thinks almost $870 trillion in property may someday get the token remedy.

Chainlink is constructing the important infrastructure for this shift. For a tokenized asset to work, it wants dependable, real-world information—like its present worth or authorized standing. That’s precisely what Chainlink’s oracles present. This has led to game-changing work with the largest names in finance.

- SWIFT – They proved that the world’s greatest banks, over 11,500 of them, can use the techniques they already need to work together with numerous blockchains via Chainlink’s CCIP know-how. This isn’t a small check; it’s cracking the code for mass adoption.

- DTCC – The group that settles almost all U.S. inventory trades, the DTCC, used Chainlink’s tech to tug mutual fund information onto a blockchain, with main American banks becoming a member of the pilot.

- Intercontinental Trade (ICE) – Even the New York Inventory Trade’s dad or mum firm, ICE, is tapping Chainlink to feed forex and treasured steel costs to decentralized apps.

One notably optimistic mannequin calculates that if Chainlink grabs an honest chunk of a $19 trillion tokenized market, its yearly income may soar into the tens of billions. This may make its press time worth look minimal.

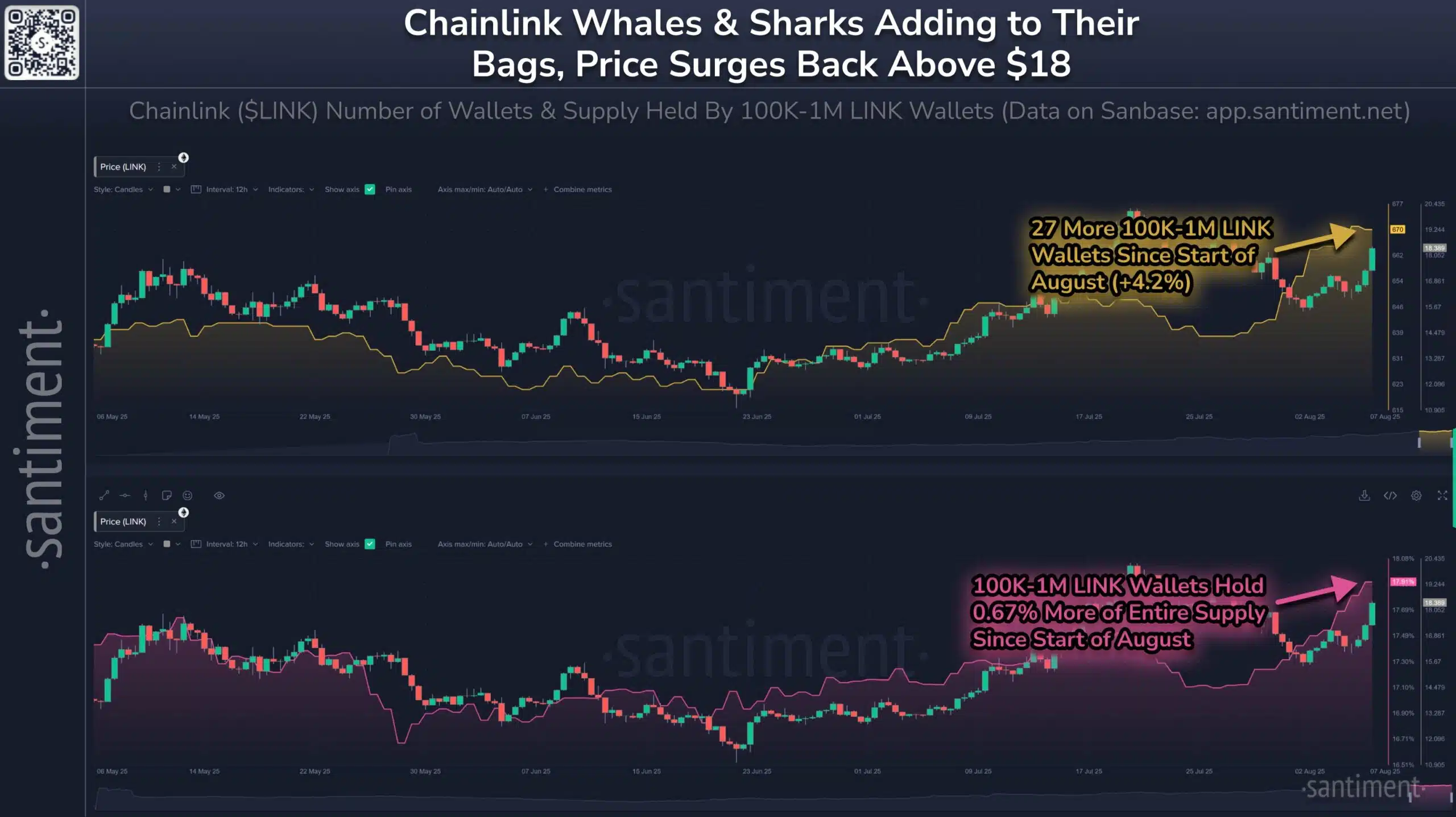

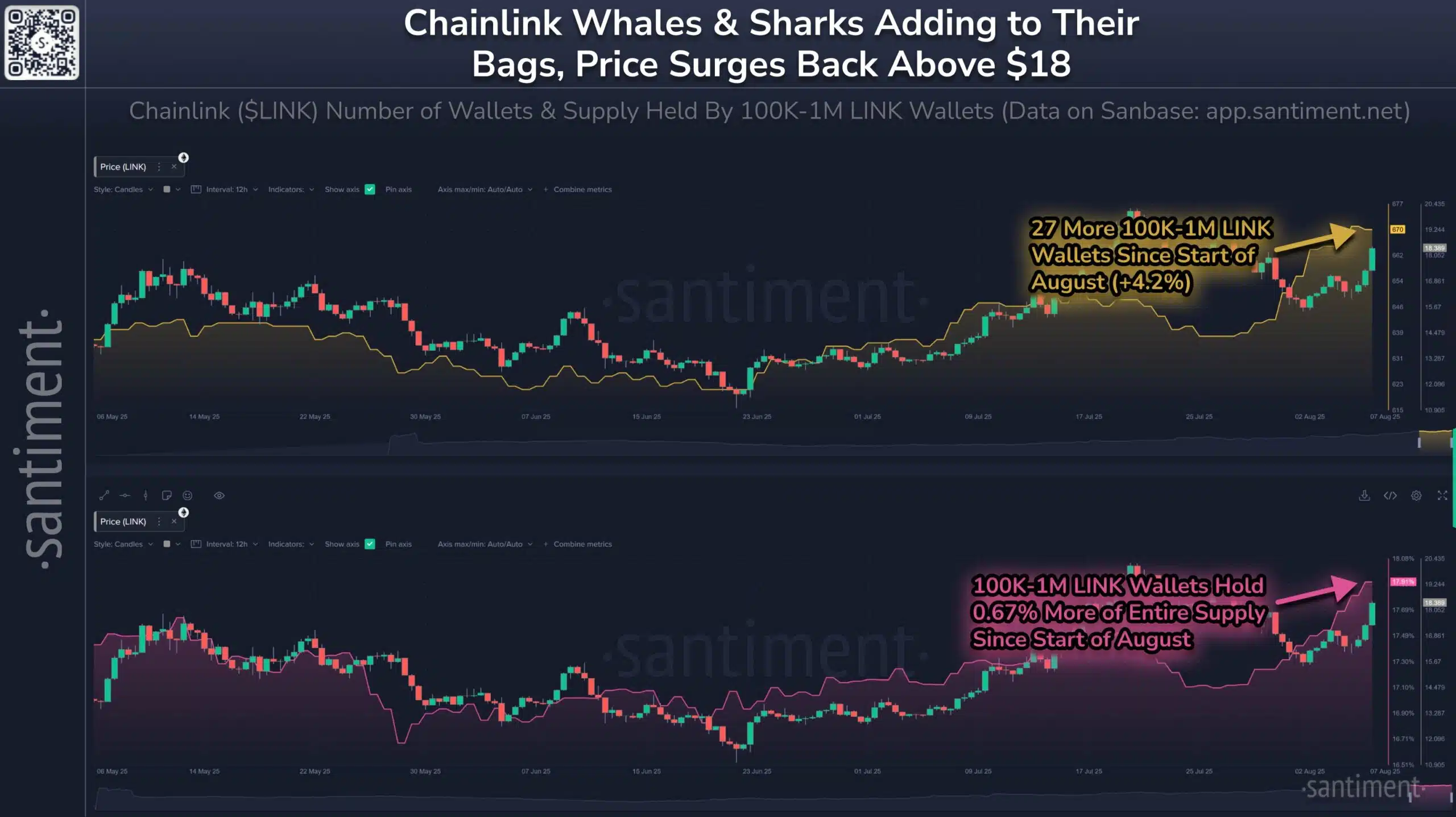

Blockchain information is flashing inexperienced as whales fill their baggage

The blockchain information itself is telling a narrative of rising confidence. Chainlink noticed its busiest day of the 12 months in mid-August, with almost 10,000 completely different wallets transferring LINK round and virtually as many new ones being created the very subsequent day. This isn’t simply bots; it’s a surge in precise person curiosity.

What’s actually turning heads is the whale exercise. Deep-pocketed traders have scooped up over 1.1 million LINK, about $27 million value, in simply the previous few weeks.

Supply: Santiment

On the similar time, LINK is disappearing from exchanges, hitting the bottom ranges seen all 12 months. That’s a basic signal that patrons are stashing their tokens away for the lengthy haul, tightening the out there provide and setting the stage for a worth bounce if demand retains up.

Is LINK primed for a breakout?

The value chart for LINK is beginning to look simply as promising. Chart watchers are pointing to an enormous, four-year-long ceiling that the worth is lastly attempting to interrupt via. If LINK can punch via this barrier, historical past reveals {that a} main, sustained rally typically follows, with some merchants eyeing $30 as the primary cease.

Supply: LINK/USD, TradingView

On prime of that, followers of Elliott Wave idea imagine LINK has completed an extended, painful correction and is simply beginning a robust new climb. In the event that they’re proper, the upside from right here may very well be huge.

Financial engine – Staking and a built-in purchase button

Past the charts and partnerships, Chainlink’s personal financial engine is designed to create a suggestions loop the place success fuels extra success. This technique rests on two key pillars –

- Chainlink Staking v0.2 – The brand new staking system acts like a sponge for the token provide. It lets individuals lock up their LINK to assist safe the community—45 million tokens are already within the pool—and earn a strong 4.3%-4.5% return for doing so. This encourages holding, not promoting.

- LINK Reserve – The community additionally has a sensible mechanism that takes the charges it earns from companions and mechanically makes use of that cash to purchase LINK available on the market. This creates a relentless, built-in demand that grows proper alongside the community’s use.

The numbers already present the community’s immense scale, with over $93 billion being secured by its oracles and greater than $25 trillion in transactions enabled up to now.

What are the roadblocks forward?

After all, it’s not a straight shot to the moon. The oracle sport isn’t a one-horse race anymore. Opponents like Pyth Community, with its speedy “pull” mannequin, are carving out a distinct segment, particularly in high-frequency buying and selling.

Chainlink nonetheless wears the crown with 46% of the market, however it could’t afford to get complacent. And, like every crypto mission, the shadow of potential sensible contract bugs and unpredictable regulators all the time looms.

Right here’s the decision…

So, can Chainlink actually hit $150? The argument for it’s highly effective, coming from each angle – Its essential position within the RWA increase, the seal of approval from Wall Road giants, and the story the on-chain information is telling.

The street will undoubtedly be rocky, and competitors is heating up. Nonetheless, for these holding LINK, all of the indicators are pointing in the direction of a launchpad being constructed for what may very well be a spectacular rise.