A brand new tracker of Solana DAT (digital asset treasury) corporations exhibits a startling information level. These company holders are barely staking any SOL. The 13 corporations that management over $1.73 billion in tokens are solely staking round 7% of it.

ETH treasuries present that staking can present much-needed options and new dangers. Solely two SOL corporations are staking vital holdings, so their efficiency might be a helpful market barometer.

Most DATs Received’t Stake Solana

Solana DATs are very stylish proper now; within the final week, three corporations introduced plans to purchase $1 billion SOL, and one other firm’s inventory jumped after a $400 million treasury funding plan.

With this type of acquisition, Strategic SOL Reserve has been constructing a tracker to evaluate these firms’ holdings and behaviors:

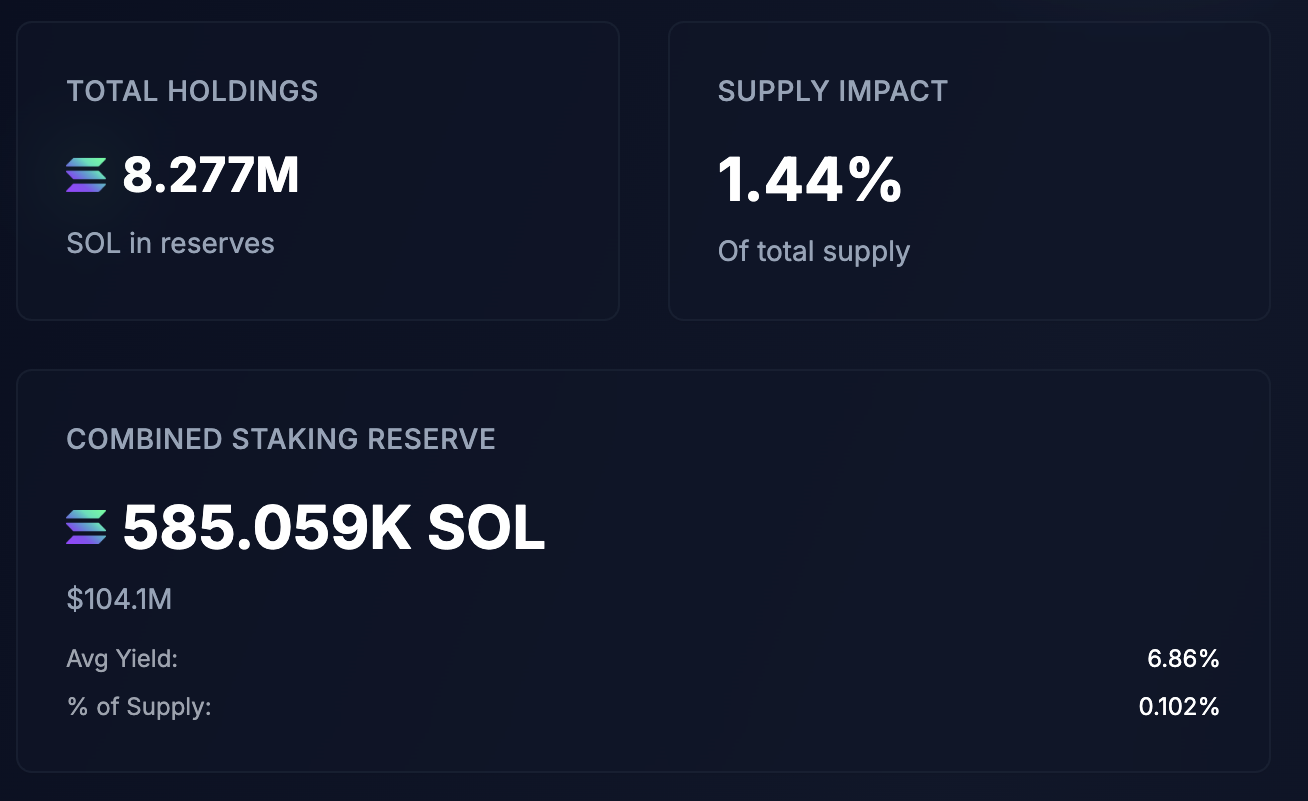

This software isn’t exhaustive, but it surely’s presently observing 13 personal SOL holders that collectively symbolize 1.44% of all the token provide.

In gathering this information, the challenge found an attention-grabbing information level: these DATs are barely staking any of their Solana. Regardless of holding $1.73 billion in SOL, lower than 7% of that’s presently being staked.

Furthermore, solely 2 of the 13 tracked DATs are staking any Solana in any respect. Each these firms, DeFi Growth and SOL Methods, started buying Solana nicely earlier than company acquisition grew to become a development.

SOL Methods started making purchases over a 12 months in the past, and it’s staking an enormous share of its holdings.

So, why aren’t the opposite 9 corporations staking any Solana? Are they lacking an enormous alternative, or is that this a wise marketing strategy?

Comparisons With Ethereum

To assemble extra information, it may be helpful to check the token with Ethereum, which is seeing an enormous inflow of DAT staking.

On one hand, staking can alleviate a number of the elementary issues with a DAT technique. An asset treasury wants fixed money inflows to purchase extra tokens, however they incessantly fundraise completely through inventory choices.

Too many rounds of this could trigger shareholder dilution worries, and this just lately triggered issues for ETHZilla. Staking generates passive earnings, which may ease this concern.

If DATs can increase funds by way of different strategies, it’d give them extra leeway to behave freely. However this isn’t a risk-free proposition. Over the previous couple of months, minor worth adjustments have triggered main unstaking surges that ETH couldn’t deal with.

Its blockchain wasn’t constructed for this corporate-level staking motion, so technical congestion can combine with promote stress and create a harmful scenario.

So, if token staking has professionals and cons, what can Solana DATs study from this? For the second, the 2 greatest DAT stakers can function vital bellwethers.

Nevertheless, these firms’ dealings with shareholder dilution or worth downturns can inform the remainder of the market.

That second challenge, not less than, ought to present numerous information. Simply yesterday, large DAT acquisitions didn’t cease SOL from sliding 10%. Cryptoassets are very unstable, and Solana treasuries might want to tailor their staking plans accordingly.

For now, observers have developments to check earlier than they resolve if this plan is worth it.

The submit Solana Treasuries Are Rising—However They’re Hardly Staking Any SOL appeared first on BeInCrypto.

MAJOR UPDATE: 3 new institutional listings = 2.18M+ SOL tracked!

MAJOR UPDATE: 3 new institutional listings = 2.18M+ SOL tracked!  New verification sources⁰

New verification sources⁰ Full inventory worth historical past & charts⁰

Full inventory worth historical past & charts⁰ Management profiles w/ profession backgrounds⁰

Management profiles w/ profession backgrounds⁰ Historic SOL buy information

Historic SOL buy information