- SUI trades at $3.45, displaying modest positive aspects, however community progress is lopsided—smaller DEXs booming whereas Cetus stagnates.

- Value motion is below stress, with $3.50 appearing as the important thing degree to look at earlier than both a restoration or deeper pullback.

- Derivatives markets stay combined, with falling quantity however rising open curiosity, hinting at indecision amongst merchants.

Sui managed to put up some modest positive aspects immediately, although a deeper take a look at its community exercise tells a extra sophisticated story. Whereas a handful of smaller decentralized exchanges (DEXs) on the chain are seeing wild progress, the community’s greatest participant has been kind of standing nonetheless.

On the time of writing, SUI trades at $3.45, with 24-hour buying and selling quantity hitting $2.24 billion and a market cap of about $8.06 billion. That’s a 3.25% bump within the final day, however the alerts coming in from each technicals and on-chain knowledge counsel issues aren’t as simple as the worth chart reveals.

On-Chain Development Break up Between Large and Small Gamers

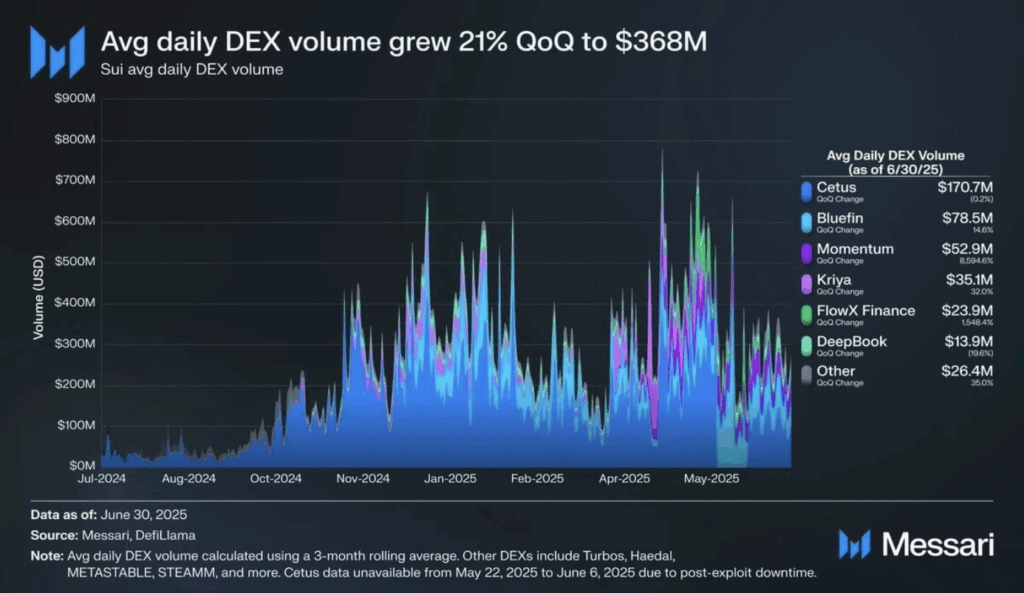

Messari’s knowledge highlights how Sui’s DEX exercise has grown 21% quarter-over-quarter, reaching a mean every day quantity of $368 million. However this progress hasn’t been unfold evenly.

Smaller protocols have seen their numbers completely explode—Momentum, for instance, jumped an insane 8,594%, whereas FlowX Finance climbed greater than 1,500%. In distinction, Cetus, the dominant DEX on the community, barely moved in any respect, sitting flat with about $170.7 million in every day exercise.

The development appears to indicate that whereas new platforms are drawing in curious customers, the most important DEX is consolidating its spot, virtually appearing like an anchor on the community’s exercise.

Technical Stress Nonetheless Lingers

From a buying and selling standpoint, SUI is in a fragile place. The token slipped below its 50-day shifting common at $3.69and even dropped under the $3.46 pivot level, signaling warning. The MACD histogram at -0.0293 remains to be flashing bearish vibes, hinting that draw back momentum hasn’t fairly pale.

For now, analysts are watching $3.50 as a key short-term degree. Reclaiming it convincingly may push SUI again into the $3.70–$4.00 zone, whereas continued weak spot would probably take a look at decrease helps round $3.20.

Derivatives Market Sends Combined Indicators

The derivatives aspect of SUI additionally paints a cut up image. Quantity fell 14% to $5.21B, however on the similar time, open curiosity rose 3.66% to $1.88B. That combo normally alerts that merchants are cooling off on exercise whereas nonetheless protecting capital locked in—mainly a “wait and see” mode.

Funding charges hover round 0.0089%, suggesting longs nonetheless barely outnumber shorts, although not by a lot. Total, the derivatives market feels balanced, with nobody aspect betting too closely in both route.