Be part of Our Telegram channel to remain updated on breaking information protection

Fundstrat International Advisors managing companion Tom Lee says Ethereum bottomed at round $4,300, whereas his ETH treasury agency Bitmine Immersion Applied sciences snapped up one other $21 million of the altcoin chief.

“Calling ETH backside to occur in subsequent few hours,” Lee stated in an X submit earlier at present simply after 8 p.m. EST.

Lee shared a screenshot of a message he obtained from Fundstrat’s managing director of technical technique, Mark Newton.

Newton stated that ETH presents “an excellent danger/reward” at its present ranges. He added that he was “extremely skeptical” that the biggest altcoin by market cap would get away of the bullish development it has been in not too long ago or that it might fall under final week’s lows.

Mark @MarkNewtonCMT once more at it.

➡️Calling ETH backside to occur in subsequent few hours

Tickers: $BMNR $GRNY pic.twitter.com/038efU7cZH

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) August 26, 2025

“Ideally, this could backside out someday within the subsequent 12 hours close to $4,300 and begin to push again as much as new highs and get above $5,100 and as much as close to $5,400 to $5,450,” Newton went on to say.

BitMine Buys ETH At A Low cost

Whereas many merchants offered through the current mark dip, BitMine Immersion Applied sciences took the correction as a possibility to purchase ETH at a reduction.

In accordance with on-chain information by Arkham Intelligence, the corporate has purchased one other 4,871 ETH for $21.3 million.

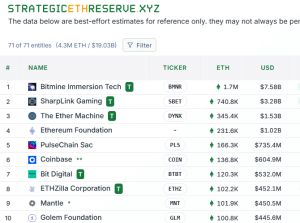

BitMine is presently the biggest Ethereum treasury firm globally, with 1.7 million ETH on its stability sheet valued at over $7.5 billion at present costs, in accordance with information from StrategicETHReserve.

The following largest company ETH holder is SharpLink Gaming, with its reserves of 740.8K ETH price $3.2 billion.

Each BitMine and SharpLink maintain extra ETH than the Ethereum Basis, which solely has 231.6K tokens in its reserves.

BitMine’s holdings additionally symbolize a 40% share of the entire 4.3 million ETH presently held by public corporations.

High 10 largest ETH treasury corporations (Supply: StrategicETHReserve)

BitMine disclosed yesterday that it elevated its crypto and money holdings by $2.2 billion to $8.8 billion, including over 190,500 tokens over the previous week.

The mixed internet asset worth of the corporate’s money and crypto per share has subsequently climbed to $39.84, which is a rise from $22.84 in July.

BitMine Shares Proceed To Drop

Whereas BitMine retains including to its huge ETH stockpile, the corporate’s share value has been in a adverse development over the previous week.

Information from Yahoo Finance reveals BitMine’s value surged greater than 584% within the final 6 months. Its share value over 3% within the final 24 hours and 9% previously week.

It’s up 2% in pre-market buying and selling at present.

Crypto Market Hit With Over $800M Liquidations

Lee’s ETH value prediction was made amid a broader crypto market downturn.

Within the final 24 hours, the crypto market noticed its capitalization slide over 1% to under $3.8 trillion, in accordance with CoinMarketCap.

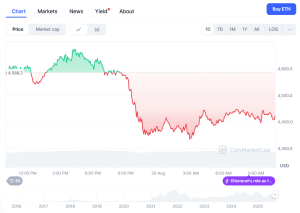

Market chief Bitcoin (BTC) briefly dipped under $110K, whereas all different crypto majors have been caught within the selloff. ETH itself dropped all the best way right down to $4,316.30 within the final 24 hours after reaching an intraday excessive of $4,678.99. The altcoin has since recovered to commerce at $4,420.65 as of 4:45 a.m. EST.

Regardless of rebounding, the Ethereum value remains to be down greater than 3% on the 24-hour timeframe. It is a adverse pivot from the longer-term bullish development that noticed ETH surge over 4% and greater than 17% on the weekly and month-to-month time frames, respectively.

Ethereum value chart (Supply: CoinMarketCap)

Throughout the current crypto correction, round $812 million received liquidated from the market.

GoinGlass information reveals that lengthy positions took the largest hit, accounting for $700.36 million of the quantity that was wiped off the market.

Merchants who positioned bets that BTC and ETH would rise took the largest hits. Bullish BTC merchants misplaced $269.94 million, whereas ETH longs took a $266.8 million knock.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection