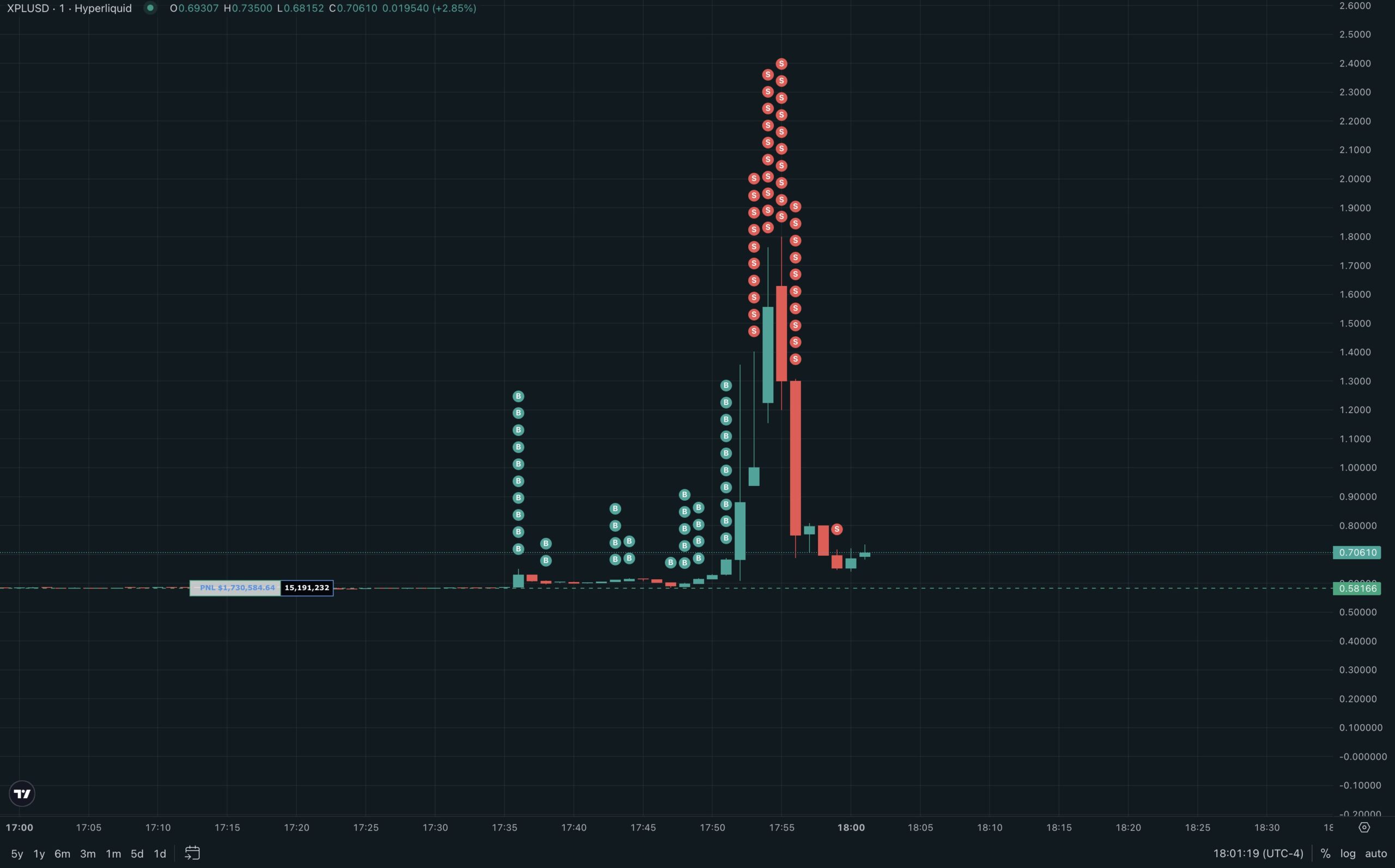

A big pockets rocked the Hyperliquid market when it deposited 16 million USDC and opened hundreds of thousands of XPL lengthy positions in just some minutes.

This transfer immediately “swept clear” the order guide, liquidating all brief positions and driving XPL’s value to soar over 200% from the $0.58 vary to a peak of $1.80.

Liquidity Shock

Based on information from Lookonchain, this pockets partially closed its place inside lower than a minute and secured a $16 million revenue. Some merchants speculate that this pockets belongs to Justin Solar, the mastermind behind the Tron (TRX) community.

“Justin Solar simply locked in $16M revenue in underneath 60 seconds. He longed hundreds of thousands of $XPL, nuking all the order guide and wiping merchants immediately. Despatched $XPL hovering to $1.80 (+200% in 2 minutes). And he’s STILL holding 15.2M $XPL ($10.2M) lengthy. Simply one of many craziest liquidation cascades ever seen on Hyperliquid,” an X consumer commented.

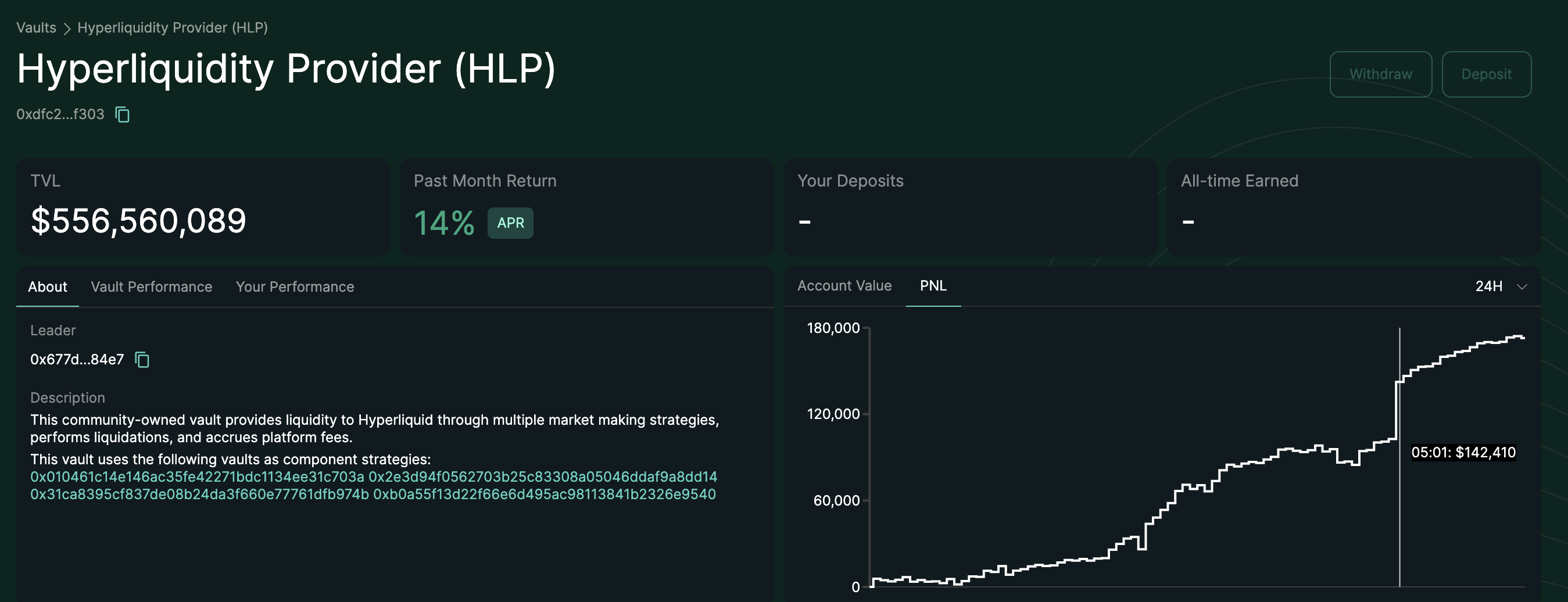

Not solely did whales profit, however Hyperliquid’s HLP vault additionally earned roughly $47,000 from this volatility. Regardless of this, the vault suffered an almost $12 million loss in the same occasion. This displays the dual-risk nature of liquidity suppliers: they’ll earn charges whereas dealing with important losses when volatility strikes.

Earlier than XPL, Hyperliquid witnessed the same occasion with the JELLY token. At the moment, uncommon value swings brought on the HLP vault to incur an almost $12 million loss. This loss occurred as a result of the vault was caught up in liquidity provision amid an order guide “wipeout.”

HyperLiquid responded to the JELLY squeeze by refunding affected merchants and implementing stricter safety measures to stop future incidents. The commonality lies in each instances originating from a mighty whale transfer in a thinly liquidated market, triggering widespread brief squeezes.

Dangers for Retail Merchants

The XPL value explosion is proof of the “order guide sweep” mechanism on decentralized derivatives exchanges. When liquidity is reasonably skinny, a sufficiently giant order can pierce by means of a number of value ranges, triggering a sequence of liquidations. This motion causes excessive volatility straight away. On this case, Hyperliquid’s order guide was nearly fully “devoured,” leaving retail merchants unable to react and dealing with mass liquidations.

This sample reveals the dangers of buying and selling in markets with restricted liquidity. Whales can manipulate short-term developments, turning earnings into large losses for many different traders.

For particular person traders, the XPL occasion on Hyperliquid highlights three key takeaways. First, traders ought to keep away from excessive leverage when market liquidity is proscribed, as a “squeeze” can wipe out accounts in seconds.

Second, monitoring order guide depth and on-chain money flows is crucial earlier than coming into a place to keep away from zones exploited by whales.

Lastly, for these collaborating in liquidity vaults like HLP, it’s essential to acknowledge that short-term earnings might include important loss dangers throughout sudden volatility.

The submit Was It Justin? XPL Soars 200% on Hyperliquid as Whale Wipes Out Order E-book appeared first on BeInCrypto.