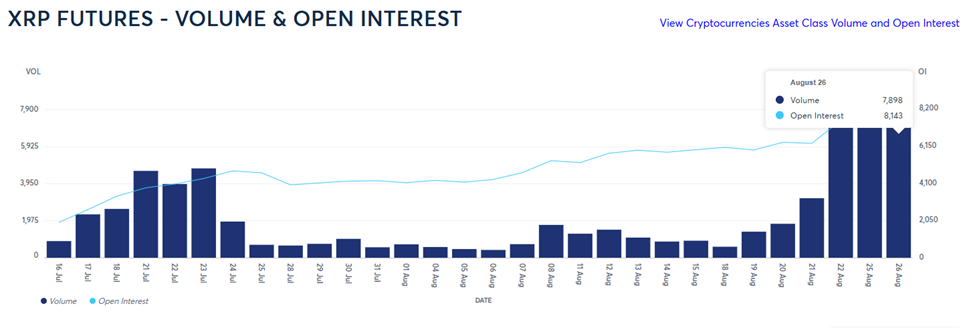

XRP set a brand new benchmark on Wall Avenue’s largest crypto buying and selling venue, the Chicago Mercantile Change (CME). Ripple’s powering token grew to become the quickest CME contract in historical past to surpass $1 billion in open curiosity (OI).

The token crossed this milestone in simply over three months since launching in Could 2025.

File Futures Progress Sparks Contemporary Hypothesis Over Spot XRP ETF Approval

The CME Group confirmed the achievement in an replace on August 26, describing it as an indication of accelerating maturity in crypto derivatives markets.

“Our Crypto futures suite simply surpassed $30 billion in notional open curiosity for the primary time ever. Our SOL and XRP futures, together with ETH choices, every crossed $1 billion in OI, with XRP being the fastest-ever contract to take action, hitting the mark in simply over 3 months. This can be a enormous signal of market maturity, with new capital getting into the market,” CME wrote.

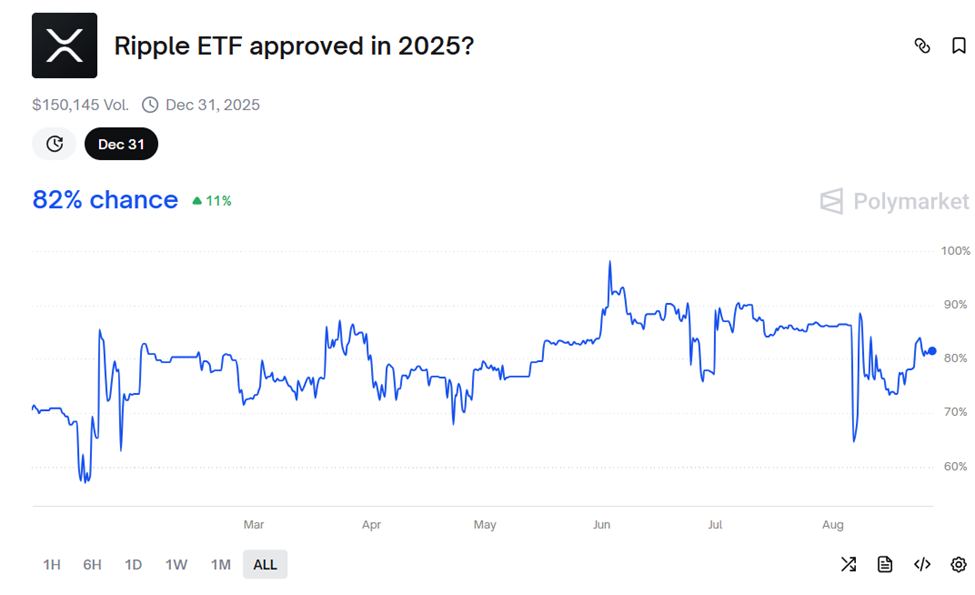

The pace of XRP’s rise on CME has fueled a contemporary spherical of hypothesis concerning the potential for a spot XRP ETF.

Nate Geraci, president of the ETF Retailer, famous that XRP already has over $800 million in futures-based ETFs. In his opinion, the demand for spot merchandise is being underestimated.

“CME Group says XRP futures contracts have crossed over $1B in open curiosity… fastest-ever contract to take action. There’s already $800+ million in futures-based XRP ETFs. Suppose individuals is likely to be underestimating demand for spot XRP ETFs,” he stated.

Prediction markets seem to agree, at the moment assigning an 82% probability {that a} Ripple-backed ETF will likely be permitted earlier than the tip of 2025.

The milestone comes in opposition to the backdrop of XRP’s paradoxical market place. With a market capitalization of round $178 billion, XRP is the world’s third-largest cryptocurrency.

On paper, it’s greater than asset administration big BlackRock, whose market capitalization was $176 billion as of this writing.

But, in response to Nate Geraci, it stays amongst professionals’ most disparaged belongings. Professional-XRP legal professional John E. Deaton strengthened that view.

“XRP is the only most hated crypto by institutional {and professional} merchants/holders. XRP is probably the most liked crypto by retail traders/holders,” wrote Deaton.

This rigidity between institutional skepticism and grassroots loyalty has outlined XRP’s trajectory for a very long time.

Retail holders have embraced it as a token with utility-driven potential, therefore the “XRP has cult-like following” adage.

In the meantime, establishments stay cautious attributable to Ripple’s not too long ago concluded however longstanding authorized battles with US regulators.

Futures Momentum Meets Skepticism Over XRP’s Lengthy-Time period Worth

Nevertheless, not everyone seems to be satisfied that XRP’s futures success will translate into long-term worth.

Some critics argue that stablecoins, good contracts, and oracle options like Chainlink have eclipsed the asset’s authentic perform as a bridge foreign money.

They contend that bridge tokens face structural limitations, since each buy for transaction functions is matched by an instantaneous sale, producing impartial demand stress.

The XRP Ledger itself has additionally been criticized for restricted adoption and performance in comparison with extra feature-rich networks.

Whereas the momentum on CME speaks for itself, traders are impatient concerning the XRP value.

As of this writing, XRP was buying and selling for $3.00, up by over 3% within the final 24 hours.

XRP’s surge to $1 billion in open curiosity means that capital flows into the asset at scale. This can be towards speculating, hedging, or gaining publicity to potential regulatory breakthroughs.

If regulators approve a spot ETF, it could mark a crucial take a look at of whether or not XRP’s loyal retail base. It might additionally reveal whether or not a rising futures market can translate into sustained institutional adoption.

The put up XRP Futures ETF Turns into Quickest CME Contract to Hit $1 Billion Open Curiosity appeared first on BeInCrypto.