Bitcoin is buying and selling at a essential stage after efficiently holding above $110,000 as help, however market sentiment stays on edge. The latest protection of this zone has given bulls a brief cushion, but promoting strain is mounting as volatility continues to drive uncertainty. Some analysts warn that additional declines could comply with if consumers fail to regain momentum, placing Bitcoin’s resilience to the take a look at.

Associated Studying

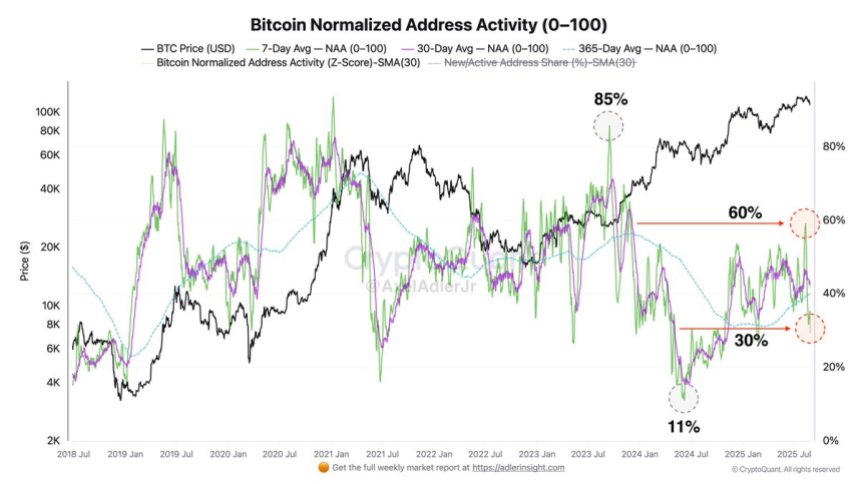

High analyst Axel Adler highlights a key onchain sign that sheds gentle on the present market construction. In line with Adler, Bitcoin’s Normalized Handle Exercise (NAA) dropped sharply from 60% — the extent at which the $124,000 all-time excessive was shaped — down to simply 30%. This decline displays a transparent cooling in transactional depth, with fewer cash shifting on-chain. Whereas this indicators that short-term provide is weakening and speedy promoting strain has eased, it additionally raises questions on whether or not there may be sufficient demand to gas one other rally.

The steadiness between cooling exercise and sustained help might be decisive. If Bitcoin holds $110K and demand reemerges, the market might stabilize. But when volatility retains pressuring consumers, the danger of deeper corrections stays firmly on the desk.

Bitcoin Lengthy-Time period Vendor Base Expands

In line with Adler, whereas Bitcoin’s short-term provide exercise has cooled, long-term dynamics reveal a special story. The annual Normalized Handle Exercise (NAA) has climbed from 30% — recorded when Bitcoin was buying and selling close to $80,000 — to 40% in the present day. This regular enhance reveals that extra holders are keen to appreciate earnings at larger ranges, regularly broadening the vendor base.

For context, the height of promoting exercise on this cycle occurred in September 2023, when the annual NAA hit 85% with Bitcoin priced round $37,000. That marked a interval of heavy distribution at decrease valuations. In contrast, the present part displays a extra balanced setting, the place promoting strain is elevated in comparison with earlier this 12 months however nonetheless far beneath peak cycle extremes. Adler suggests this positioning signifies Bitcoin has entered a “mid-stage” part of distribution, the place profit-taking grows however the structural development stays intact.

Regardless of this, value motion underscores hesitation. Bitcoin is holding above essential help at $110,000, however has to date did not reclaim larger provide zones that will verify bullish continuation. The market now sits at a crossroads, with hypothesis rising in regards to the subsequent main transfer. Whether or not consumers can overcome increasing long-term promoting strain will seemingly resolve if Bitcoin stabilizes for one more rally or faces a deeper corrective wave.

Associated Studying

Bulls Push To Check Key Ranges

Bitcoin is buying and selling close to $112,900 after a sequence of unstable swings that pushed the worth down from latest highs above $123,000. The chart highlights how BTC has struggled to reclaim misplaced floor, with short-term momentum nonetheless capped by resistance ranges. After defending the $110,000 zone, consumers are trying a restoration, however the construction suggests {that a} extra decisive transfer is required to shift sentiment.

At the moment, BTC stays beneath the 50-day and 100-day shifting averages, which hover between $113,000 and $115,000. These ranges kind the speedy barrier for bulls, and breaking above them could be essential to altering momentum in favor of an upside push. A profitable retest and maintain of $115,000 might sign the beginning of renewed power, setting the stage for one more try on the $120,000–$123,000 resistance zone.

Associated Studying

On the draw back, failure to interrupt larger retains BTC susceptible. A rejection close to present ranges might open the door to a different retest of $110,000 help, with deeper dangers extending towards $108,000. Market sentiment stays cautious, and the following few classes will seemingly decide whether or not Bitcoin can reclaim bullish momentum or stay caught underneath strain. For now, $115,000 stands because the essential line within the sand.

Featured picture from Dall-E, chart from TradingView