When markets get shaky, traders scramble for a port within the storm. For generations, that secure harbour was virtually at all times gold. As we speak, two digital newcomers are vying for that title – Gold that’s been transformed into tradable tokens, and the unique cryptocurrency – Bitcoin.

Analyzing what makes an asset really secure exhibits how these new choices each match and break the previous mildew.

An actual secure haven is meant to zig when the remainder of the market zags. As traders panic-sell their shares, they need to have the ability to pile into these property to guard their cash and even see it develop. To earn that belief, an asset wants a number of key qualities. You will need to have the ability to promote it rapidly with out crashing the value.

Its provide can’t be one thing that may be inflated into worthlessness in a single day. There must be a gradual, broad base of people that need it, and it shouldn’t be one thing that may rot, rust, or change into out of date. Having a protracted observe document of being helpful and accepted definitely helps construct its case.

All that glitters could also be gold…

Gold’s resume for this job is lengthy and storied.

Throughout the 2008 monetary meltdown, for instance, gold costs climbed because the S&P 500 cratered, exhibiting that excellent inverse relationship. We noticed an analogous flight to security throughout the preliminary chaos of the COVID-19 pandemic. Its fame is constructed on stable floor – It’s liquid, with a worth acknowledged worldwide, new provide is proscribed and costly to mine, demand is fixed from jewelry to trade to central banks, and it’s virtually indestructible.

Nonetheless, some latest evaluation suggests its function may be shifting. Particularly because it has generally moved in lockstep with shares throughout more moderen scares.

Tokenized gold tries to present the traditional metallic a contemporary digital makeover. It really works by creating digital claims on a blockchain that correspond to actual, bodily gold held in a safe vault. This method immediately tackles a few of bodily gold’s drawbacks. By digitizing it, you may commerce tiny fractions of a bar, 24/7, from wherever, which may make it even simpler to purchase and promote.

It might probably additionally slash the prices of storage, insurance coverage, and transactions by chopping out intermediaries. The blockchain may also present a clear, unchangeable document of who owns what. The trade-off, nonetheless, is a brand new class of worries. The principles for these digital property are nonetheless being written and may differ wildly from place to put.

You’re additionally utterly depending on the honesty and competence of the corporate issuing the token and guarding the precise gold. And, in fact, the digital platforms themselves will be hacked.

Is Bitcoin a legit competitor?

Bitcoin doesn’t simply need to enhance on gold. In reality, it presents a totally completely different philosophy of security. Followers see it as the final word retailer of worth for a digital world.

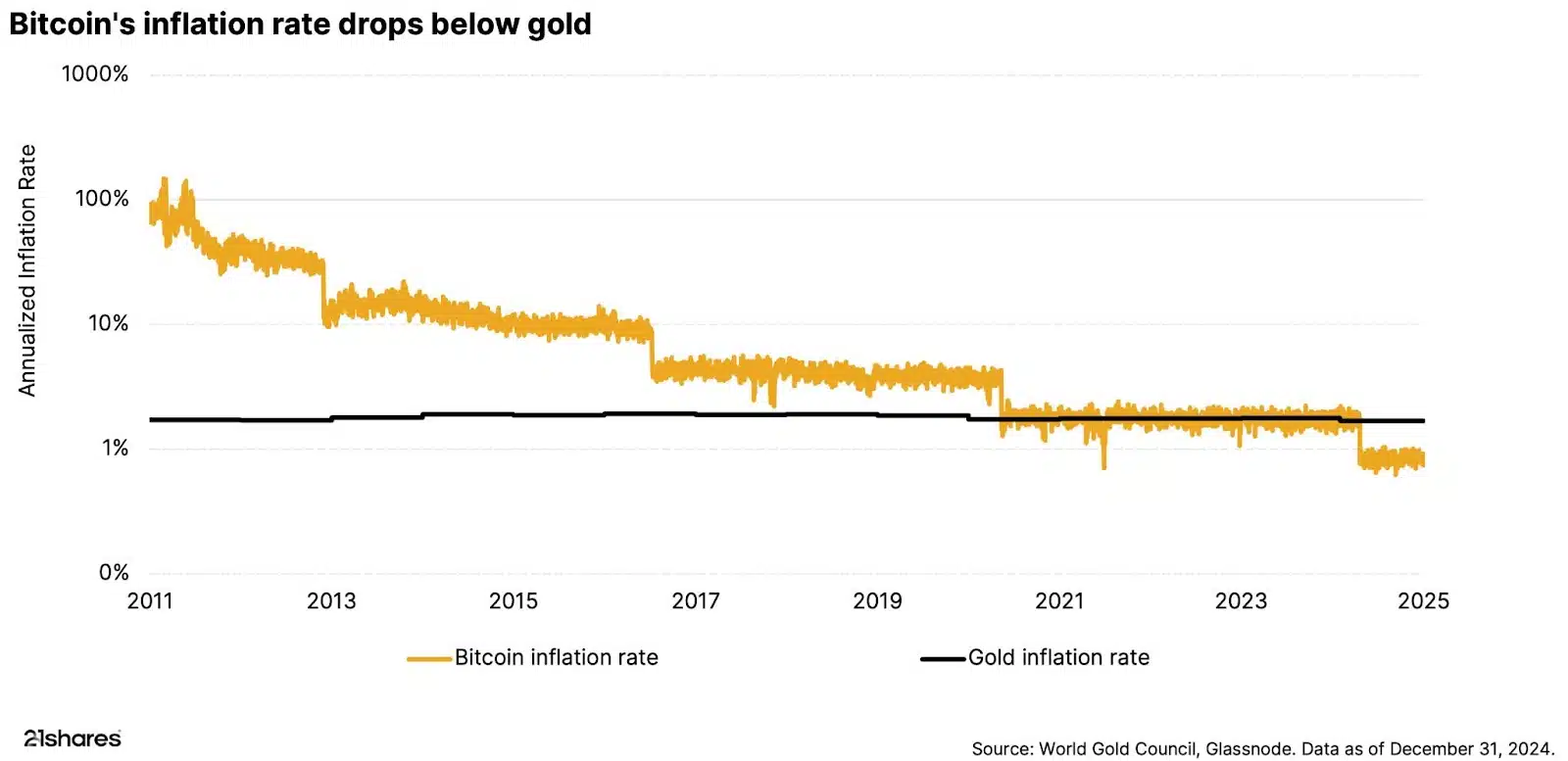

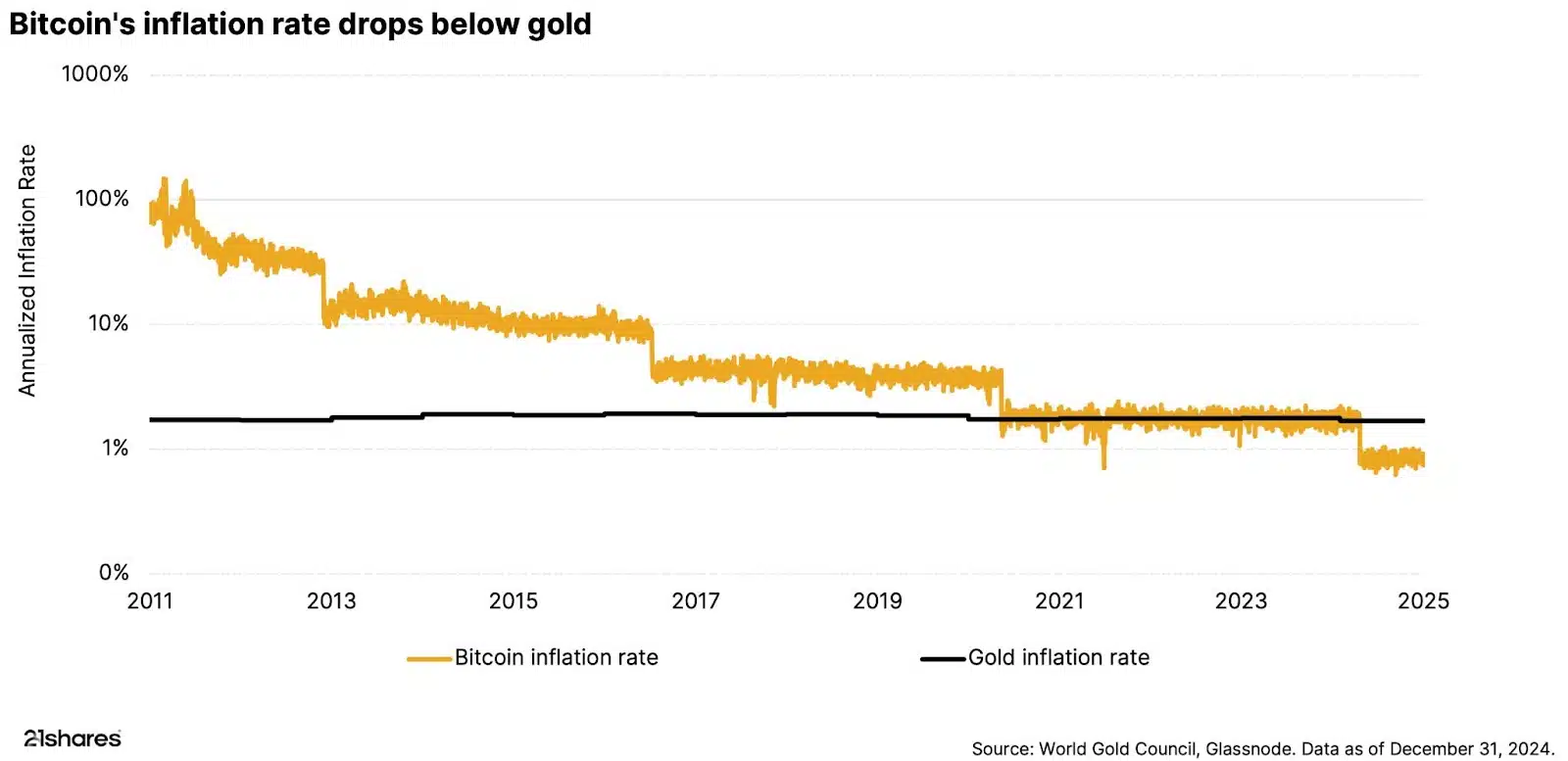

Supply: 21Shares

The argument for Bitcoin rests on a number of highly effective concepts. It’s decentralized, so no single authorities or company can management or censor it. Its provide is mathematically mounted and predictable, with a tough cap of 21 million cash that may by no means be modified. It’s additionally borderless, transferrable to anybody with an web connection.

Alas, Bitcoin’s path to changing into a secure harbour is blocked by a large impediment – Its personal wild worth swings. Its worth is known for large, sudden strikes that undermine any declare to being a secure place to park wealth. In a number of latest downturns, Bitcoin has really fallen more durable than the inventory market, performing extra like a dangerous tech inventory than a monetary lifeboat. Its historical past is a blink of a watch in comparison with gold’s millennia, and its habits in a deep, extended world recession is a totally unknown.

Supply: Blackrock Investments

The very which means of monetary security is up for grabs.

Gold is the time-tested normal, although its excellent document is now being questioned. Tokenized gold smooths out the bodily commodity’s tough edges, however introduces a special set of trust-based and technological dangers.

Bitcoin stands as a revolutionary however unproven various, whose excessive worth swings make it a questionable shelter from a monetary storm. Whereas it might need a spot in a diversified portfolio, its efficiency throughout market panic suggests it’s removed from being a real secure haven.