Pi Community (PI) is getting into a pivotal stage with the discharge of Pi Node Linux and preparations for the upcoming protocol improve to model 23.

But, paradoxically, Pi Coin is buying and selling only a few share factors above its all-time low, leaving traders each fearful and looking forward to a pointy rebound.

Infrastructure Model Upgrades

Pi Community has formally launched a Linux Node and plans to improve the protocol from model 19 to 23.

“There may also be an upcoming rollout of protocol upgrades that begins with Testnet1 this week, and proceed with Testnet2 and Mainnet upgrades into the subsequent few weeks, which can probably require deliberate outages of the blockchain providers.” The announcement said.

The Pi Node Linux allows operators—particularly service suppliers and exchanges that depend on Linux environments—to run standardized node software program. This replaces the necessity for personalized builds. Operators can handle protocol updates or allow Pi’s auto-update function, lowering node configuration discrepancies and strengthening community stability.

For the group, whereas Linux help doesn’t immediately translate into fast Node rewards, it lowers entry boundaries. This allows builders and technically expert customers to contribute to the ecosystem.

In parallel, Pi introduced a multi-phase protocol improve, beginning with Testnet1 within the coming weeks. Testnet2 will observe. Then, Mainnet will transfer all the ecosystem to model 23—a Pi-modified variant of Stellar Protocol v23. Pi plans to embed KYC authority on the protocol layer, step by step delegating verification authority to trusted organizations.

The crew stated greater than 14.82 million customers have accomplished KYC and migrated to Mainnet. This can be a crucial milestone to unlock integrations requiring id verification.

Worth Goes Down In Blended Alerts

From a market standpoint, macro pressures and Bitcoin’s volatility drag PI right into a dangerous zone.

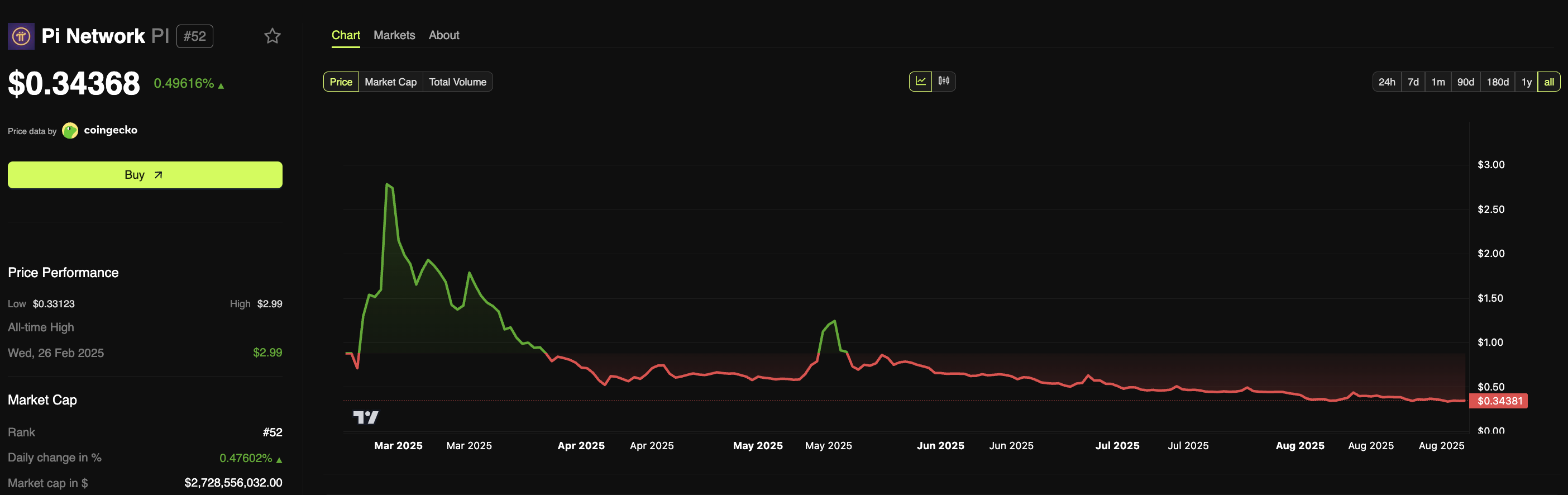

Actual-time knowledge reveals PI buying and selling round $0.34 available on the market facet, simply above the all-time low of $0.3312 (August 26, 2025). This skinny margin may simply break if bearish sentiment intensifies. Contemplating that the newest all-time excessive was recorded at $2.99 final February, this reveals how months of regular decline have erased most of this yr’s earlier positive aspects.

Technical alerts stay blended. Some analyses spotlight bullish divergence on momentum indicators, suggesting a possible 40% rebound if PI can reclaim resistance zones. Nonetheless, this state of affairs relies upon closely on contemporary shopping for curiosity and broader market situations. On the flip facet, one other report warns that Bitcoin may drive PI to new lows because of the more and more tight correlation with BTC. If Bitcoin weakens, the danger of PI breaking under its historic help turns into very actual.

In abstract, Pi is concurrently strengthening its infrastructure and testing worth bottoms. Ranges close to ATL are at all times tempting for risk-seeking traders, however strict danger administration—clear stop-losses, place sizing, and ready for pattern affirmation—is important.

For builders, the discharge of Pi Node Linux and the v23 improve marks a well timed alternative to experiment with early integrations, particularly as KYC strikes to the protocol layer. This differentiator could grow to be a bonus as soon as institutional capital returns.

The publish Pi Community Upgrades: Can They Lead Worth Restoration? appeared first on BeInCrypto.