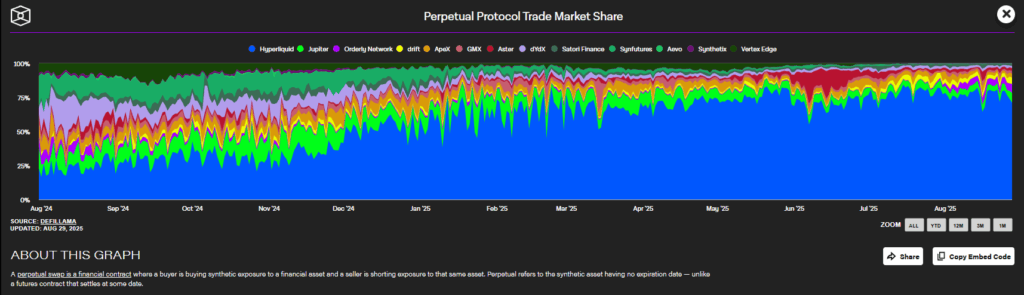

- Hyperliquid (HYPE) now holds practically 80% of decentralized derivatives market share, with over $200B in current buying and selling quantity.

- Its daring tokenomics skipped enterprise capital, launching $HYPE on to public markets to make sure truthful entry and natural development.

- Cross-chain deposits, together with Bitcoin, and powerful liquidity are fueling adoption as Hyperliquid chips away at Binance’s dominance.

Hyperliquid has shortly change into one of many greatest tales of this crypto cycle, reshaping the decentralized derivatives market in methods few anticipated. The platform now instructions practically 80% of all perpetual protocol market share, inserting it firmly within the highlight because the decentralized rival merchants are taking severely towards centralized heavyweights.

What makes Hyperliquid stand out is its tokenomics. As an alternative of leaning on enterprise capital, like most DeFi protocols do, the group launched the $HYPE token straight into public markets. No early VC reductions, no personal rounds — everybody needed to get in at market costs. It was a daring transfer that screamed confidence, whereas additionally holding issues truthful for the neighborhood and proving the protocol was betting on natural development quite than institutional handouts.

Hyperliquid Chips Away at Binance’s Grip

The shift is already exhibiting up in information. The Hyperliquid-to-Binance quantity ratio climbed to 13.6% in current months, up from simply 8% initially of the yr. For context, Binance has lengthy dominated the derivatives market, however this sort of development suggests merchants are greater than prepared to discover decentralized options in the event that they ship comparable pace, reliability, and liquidity.

And Hyperliquid hasn’t been taking part in small ball — the protocol has processed greater than $200 billion in buying and selling quantity in simply the previous few months. That’s the form of quantity that normally belongs to centralized exchanges, making it clear the hole between CEX and DEX choices is narrowing quick.

Liquidity, Cross-Chain Entry, and The Highway Forward

A part of this success comes from Hyperliquid fixing ache factors different decentralized protocols have struggled with. The platform’s cross-chain performance lets customers deposit property from a number of chains — even Bitcoin — one thing that’s traditionally been a roadblock for different DEXs. That further flexibility has made it simpler for merchants to stay round and shift extra of their exercise into decentralized markets.

Nonetheless, the massive query now’s sustainability. Can Hyperliquid maintain its technical benefit as consumer demand scales up? Development is nice, however efficiency is what made merchants go away centralized platforms within the first place. If Hyperliquid can maintain that line whereas persevering with to develop, it might simply show that decentralized derivatives aren’t a distinct segment anymore — they’re the longer term.