Hedera (HBAR) has been up greater than 40% over the previous three months. Nonetheless, its latest efficiency means that these positive aspects are in danger.

Within the final 24 hours, HBAR’s value dropped by over 4%, and its one-month shedding streak has now prolonged to greater than 11%. With sellers in management, HBAR is in a key zone. The one potential help comes from a impossible supply.

Fading Curiosity Fuels Sellers’ Management

A take a look at on-chain knowledge exhibits why consumers have stepped again. Hedera’s social dominance, which tracks how a lot dialogue it generates throughout crypto platforms, has collapsed.

On July 13, it stood at 2.417%, however by late August, it had fallen to simply 0.515% — a decline of just about 80%. This drop in consideration has been mirrored by weak shopping for flows.

For instance, web flows to exchanges elevated sharply over the previous month. On July 21, shopping for strain was measured at -46.48 million tokens, whereas by August 25, it had solely improved to -12.24 million.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

That represents a 73% discount in shopping for strain, signalling that sellers stay forward. The shortage of purchaser conviction explains why each small bounce has been bought into, conserving the HBAR value on a gradual downward path.

Derivatives Positioning Is Bearish, However Additionally the Solely Ally

The weak spot shouldn’t be restricted to identify buying and selling. Derivatives markets inform the identical story. On platforms like Bitget, open positions are closely skewed towards shorts.

Quick leverage stands at $103.97 million, in contrast with simply $34.78 million in lengthy positions — almost 200% extra shorts than longs.

This lopsided positioning is clearly bearish. Nonetheless, it additionally creates an unlikely ally.

If the HBAR value positive aspects upward momentum from broader market strikes, the heavy focus of shorts between $0.23 and $0.26 could possibly be liquidated.

In easy phrases, merchants betting towards HBAR may be pressured to purchase again their positions shortly, pushing the worth increased in a brief squeeze. Whereas the core sentiment stays adverse, this imbalance supplies the one seen catalyst for a rebound.

Nonetheless, if the worth corrects additional, the small but important lengthy positions may additionally face liquidation dangers, pushing the HBAR value decrease.

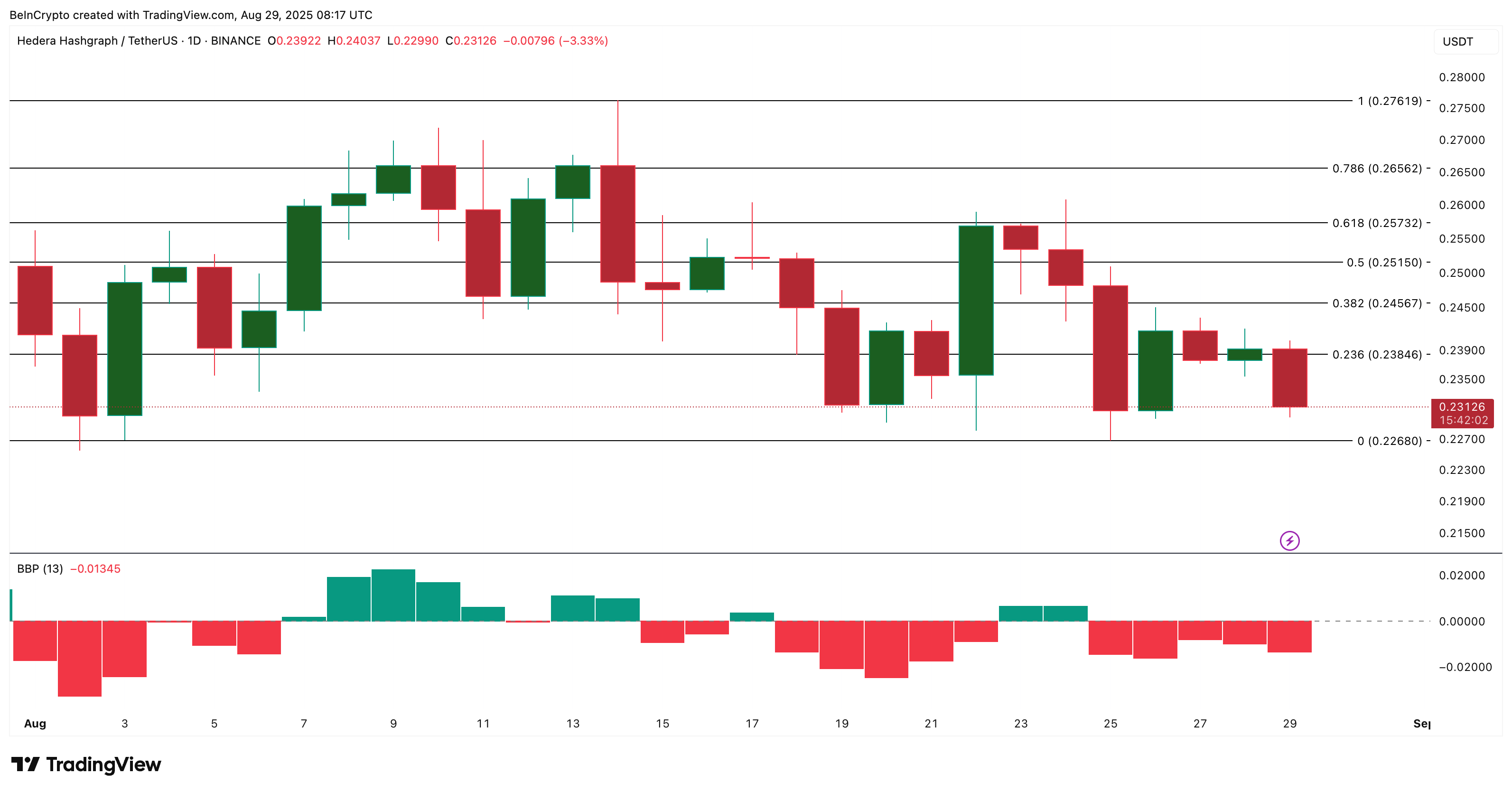

Hedera (HBAR) Value Hangs by a Thread

At press time, HBAR value trades round $0.231. Lose $0.23, and the subsequent slide towards $0.22 turns into probably, extra so with the Bull-Bear Energy (BBP) indicator flipping strongly into the adverse zone.

The Bull-Bear Energy indicator measures the stability between consumers and sellers. It compares the best value a token reaches in a given interval with its common value. If the worth is optimistic, it suggests consumers are pushing costs increased. Whether it is adverse, it exhibits sellers have extra management.

If $0.226 breaks, new native lows may await the HBAR value. But, if a squeeze begins, the primary rebound zone is simply above $0.26. Clearing that space would open room to construct a bigger transfer, however till then, sellers stay in management.

With out assist from a brief squeeze, HBAR value dangers printing new native lows regardless of its stable three-month achieve.

The submit Why HBAR’s Bearish Sentiment May Be Its Set off for a Value Rebound appeared first on BeInCrypto.