Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin would be the subsequent decade’s best-performing asset by a landslide, with the crypto doubtlessly hovering to just about $3 million by 2035, says $5 billion asset supervisor Bitwise.

In its newest analysis paper, Bitwise outlined three eventualities for Bitcoin’s value trajectory by means of 2035.

Even its most conservative base case sees BTC hitting $1.3 million in a decade with a 28.3% compound annual progress charge, demolishing the projected returns for shares (6.2%), bonds (4%), and gold (3.8%) over the identical interval.

And in its bullish situation, Bitwise sees Bitcoin hovering to a mind-blowing $2.97 million by 2035, a compound annual progress charge of just about 40%.

Bitcoin’s turbocharged progress will probably be powered by inflows from institutional adoption, rising demand for inflation hedges, and its restricted provide, the asset supervisor stated.

This chart from @BitboBTC… pic.twitter.com/OyfSKUr3zs

— Matt Hougan (@Matt_Hougan) August 28, 2025

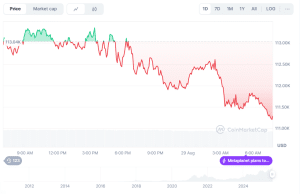

These predictions come after BTC tumbled greater than 5% prior to now month. The crypto king additionally slid 1% prior to now 24 hours to commerce at $111,285.66 as of 1:48 a.m. EST.

BTC value chart (Supply: CoinMarketCap)

Hovering US Debt, Central Financial institution Purchases, And Altering International World Order Might Affect BTC’s Worth

The asset supervisor highlighted rising debt ranges, deficits, fiat foreign money debasement, and questions across the position of the US greenback within the world financial system as elements that may possible affect BTC’s value over the subsequent decade.

It famous that US debt has ballooned from $650 billion to over $36 trillion in simply fifty years, with half of the entire accrued prior to now ten years.

“These tendencies are more likely to improve demand for non-fiat hedges like gold and Bitcoin,” Bitwise stated. “The current efficiency of those hedges—each of which have outperformed all different main belongings since 2020—means that traders are already positioned for this altering world.”

Institutional Embrace Of Bitcoin Helps The Lengthy-Time period Bullish Outlook

“Lately, Bitcoin has emerged as a bona fide institutional asset,” Bitwise stated. “What was as soon as a distinct segment different asset owned principally by retail traders is now broadly mentioned and analyzed by the biggest monetary companies on this planet, and more and more held by hedge funds, pensions, household workplaces, monetary advisors, firms, and sovereign wealth funds,”

The institutional adoption of BTC was enabled by the approval of US spot Bitcoin ETFs (exchange-trade funds) in January 2024, which the agency says “made accessing Bitcoin secure, simple, and cheap for conventional traders.”

Since their launch, these merchandise have recorded billions of {dollars} in cumulative inflows, with the product provided by Wall Road big BlackRock pulling in probably the most capital.

Knowledge from Farside Traders reveals BlackRock’s IBIT BTC ETF has seen greater than $58.28 billion in cumulative inflows to date.

The rising institutional adoption can be evident by the rising variety of public corporations which can be including Bitcoin to their stability sheet, a pattern that Technique (previously MicroStrategy) began again in 2020.

Since then, Technique has regularly accrued the biggest crypto by market cap to change into the main Bitcoin treasury firm globally with its holdings of 632,457 BTC, knowledge from Bitcoin Treasuries reveals.

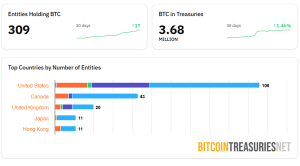

A number of different corporations have since adopted in Technique’s footsteps, with 309 BTC treasury corporations now out there. Collectively, these corporations maintain 3.68 million BTC of their reserves.

The US leads when it comes to the variety of nations that maintain Bitcoin, with 106 such entities. Canada, the UK, Japan, and Hong Kong make up the remainder of the highest 5 on this regard.

BTC treasury market overview (Supply: Bitcoin Treasuries)

Whereas the approval of spot BTC ETFs was the “main catalyst” for the institutional adoption, Bitwise stated that “the transformation has accelerated due to a number of elements, together with the pro-crypto regulatory shift within the US following the 2024 election.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection