A recent golden cross on Bitcoin’s weekly chart has set off hypothesis that the cryptocurrency could possibly be coming into its strongest rally thus far.

The sign, which happens when a shorter-term shifting common crosses above a longer-term one, has traditionally marked the start of large bull markets.

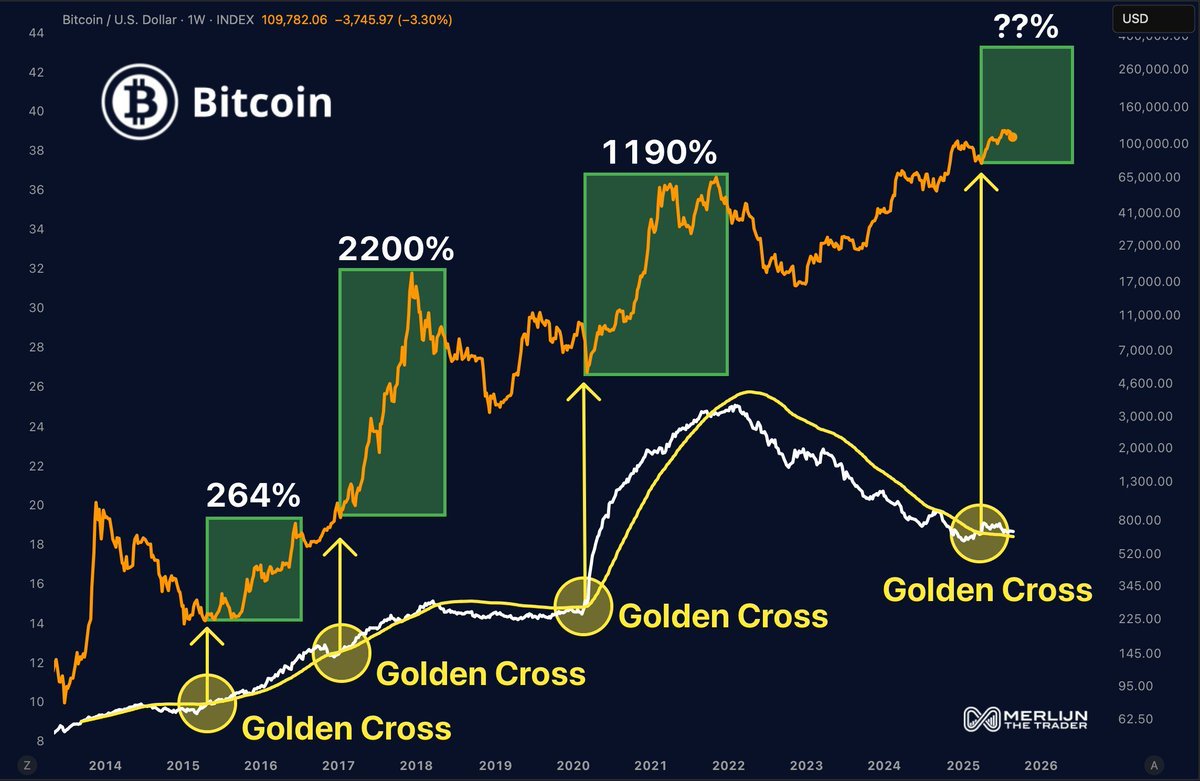

As Whale.Guru highlighted, previous golden crosses have been extremely dependable precursors to Bitcoin surges. In 2015, Bitcoin climbed 264% after the crossover. The 2016 sign ignited a unprecedented 2,200% rally, whereas the 2019 occasion was adopted by a acquire of 1,190% that drove Bitcoin to recent document highs.

Now, with Bitcoin buying and selling round $109,000, the most recent golden cross has triggered expectations {that a} new parabolic transfer could possibly be underway. The chart reveals an open-ended inexperienced field, leaving merchants to debate simply how excessive the following cycle might carry costs.

Skeptics word that previous efficiency doesn’t assure future outcomes, and macroeconomic pressures might nonetheless impression Bitcoin’s trajectory.

Nevertheless, historical past reveals that every golden cross has aligned with a cycle-defining uptrend. If the sample holds, Bitcoin could also be on the cusp of rewriting its all-time highs and setting new benchmarks for digital belongings.

For long-term buyers, the golden cross stays one of the crucial watched indicators—and this time, the hype is louder than ever.