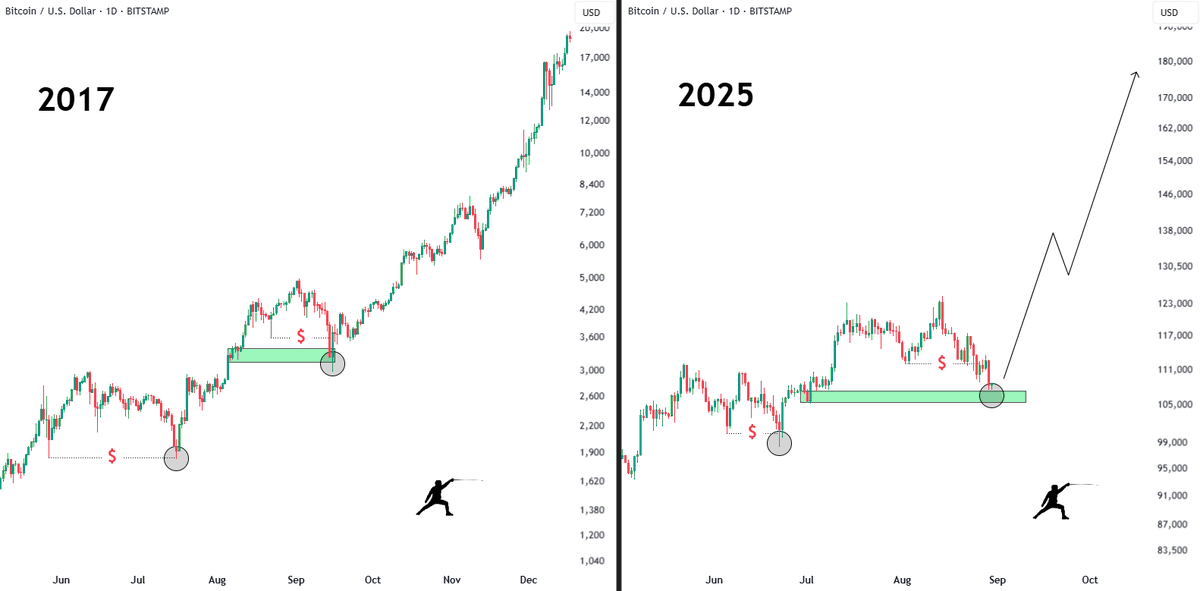

Bitcoin’s value motion is echoing the 2017 bull run, with analysts arguing that the anticipated “September dump” could not materialize this yr.

In accordance with dealer Rekt Fencer, Bitcoin already front-ran the seasonal sell-off in June and August, forming a powerful help base round $105,000–$110,000.

In 2017, the same sample unfolded. Bitcoin dipped in August, sparking fears of a September crash, solely to rebound sharply and launch right into a parabolic rally that pushed costs near $20,000 by December.

Fencer suggests the 2025 setup is strikingly related, noting that bears ready for additional draw back danger lacking the subsequent leg of the bull run.

The newest chart comparability highlights how Bitcoin tends to lure late sellers earlier than igniting its strongest uptrend part. If the cycle continues to observe the 2017 blueprint, Bitcoin may quickly break increased, concentrating on ranges between $160,000 and $180,000.

Whereas September has traditionally been a weak month for crypto, present situations recommend the correction part is already full. For traders, this raises the likelihood that Bitcoin is coming into its vertical development stage, leaving cautious merchants behind as bullish momentum takes over.