Binance founder Changpeng Zhao (CZ) joined the BNB Chain this week because it marked its fifth anniversary in Tokyo.

In the meantime, Japan Submit Financial institution plans to activate its ¥190 trillion ($1.29 trillion) in deposits, issuing a digital foreign money for buying and selling of blockchain-based monetary merchandise.

Binance’s CZ Says DeFi Will Outpace Centralized Buying and selling Amid Japan’s Web3 Rise

In his hearth chat, Changpeng Zhao emphasised that BNB Chain’s success has been pushed by its group slightly than any single particular person.

“The chain has a small tech crew and is rather more community-driven. I don’t do this a lot; I publish tweets and encourage individuals to construct. I’m a cheerleader,” he mentioned.

With greater than 4,000 decentralized functions now energetic, together with PancakeSwap and Aster, BNB Chain has develop into one of many largest ecosystems within the business.

CZ famous that stablecoin utilization has practically doubled this yr. In the meantime, real-world belongings (RWAs) are starting to take form regardless of regulatory and liquidity challenges.

Whereas he acknowledged that he holds many BNB tokens, which account for a good portion of his value, CZ acknowledged that he sees decentralized finance (DeFi) overtaking centralized exchanges.

“DEX volumes are very more likely to exceed CEX sooner or later. DeFi is the longer term. And regular buying and selling needs to be privacy-preserving,” he mentioned.

If ranging from scratch immediately, CZ mentioned he would give attention to constructing an AI-powered buying and selling agent and a privacy-preserving perpetual DEX. He additionally pointed to RWAs and stablecoins as areas of huge alternative.

“Securities, treasuries, and commodities have big potential. However regulation, KYC, and liquidity are main challenges,” he acknowledged.

Towards this backdrop, the Binance govt highlighted BNB Chain’s investments into partnerships with issuers corresponding to Securitize and Backed.

Japan, he argued, is well-positioned to play a number one position on this subsequent chapter of Web3.

“I’d like to see a devoted BNB Chain crew right here, and extra tasks that deliver collectively robotics, AI, and Web3,” CZ shared.

Japan Submit Financial institution’s Digital Foreign money Push

Whereas CZ checked out the way forward for world DeFi, Japan’s monetary sector is making ready for a leap of its personal.

Japan Submit Financial institution introduced it can challenge the DCJPY digital foreign money in fiscal 2026. The transfer would allow depositors to immediately convert financial savings into digital cash for buying and selling blockchain-based belongings.

Native media studies that the financial institution manages ¥190 trillion ($1.29 trillion) in deposits throughout 120 million accounts. By integrating blockchain rails into its core companies, it hopes to revitalize dormant balances and entice youthful prospects.

DCJPY, developed by DeCurret DCP, might be pegged 1:1 to the yen and usable for buying safety tokens and NFTs (non-fungible tokens).

The transfer may considerably enhance buying and selling effectivity by enabling instantaneous settlement of tokenized securities. Japan Submit Financial institution additionally envisions authorities subsidies and grants distributed through DCJPY, additional embedding digital cash into every day life.

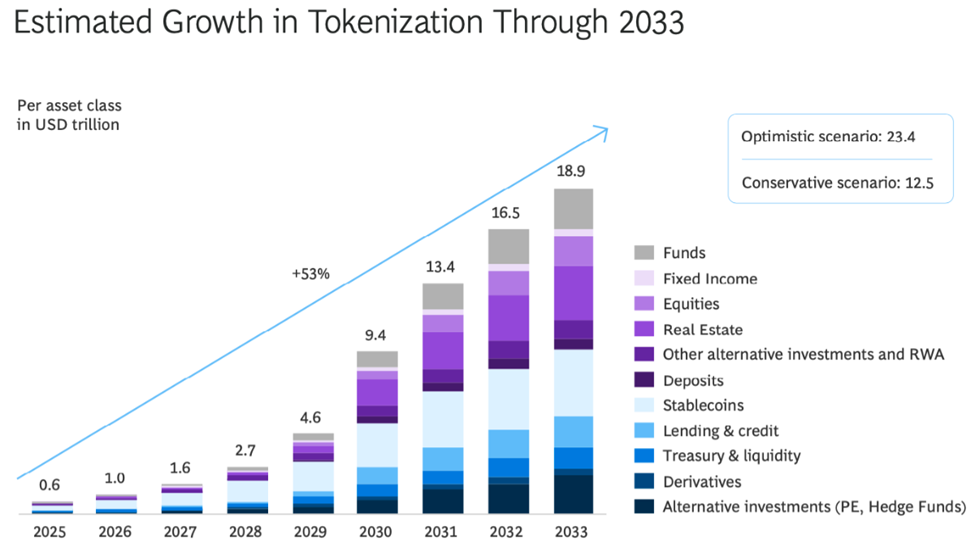

In the meantime, the Boston Consulting Group and Ripple say the tokenized RWA market may increase from $600 billion in 2025 to $18.9 trillion by 2033.

Primarily based on these studies, each CZ and Japan Submit Financial institution purpose to seize this chance.

From BNB Chain’s decentralized group to Japan’s state-backed digital foreign money, Tokyo is rising as a hub the place Web3 beliefs and institutional innovation converge.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.